Last I saw him he was running around, all ass & tail, gunning down shots of Don Julio and screaming “New Lows in July, damnit!!”

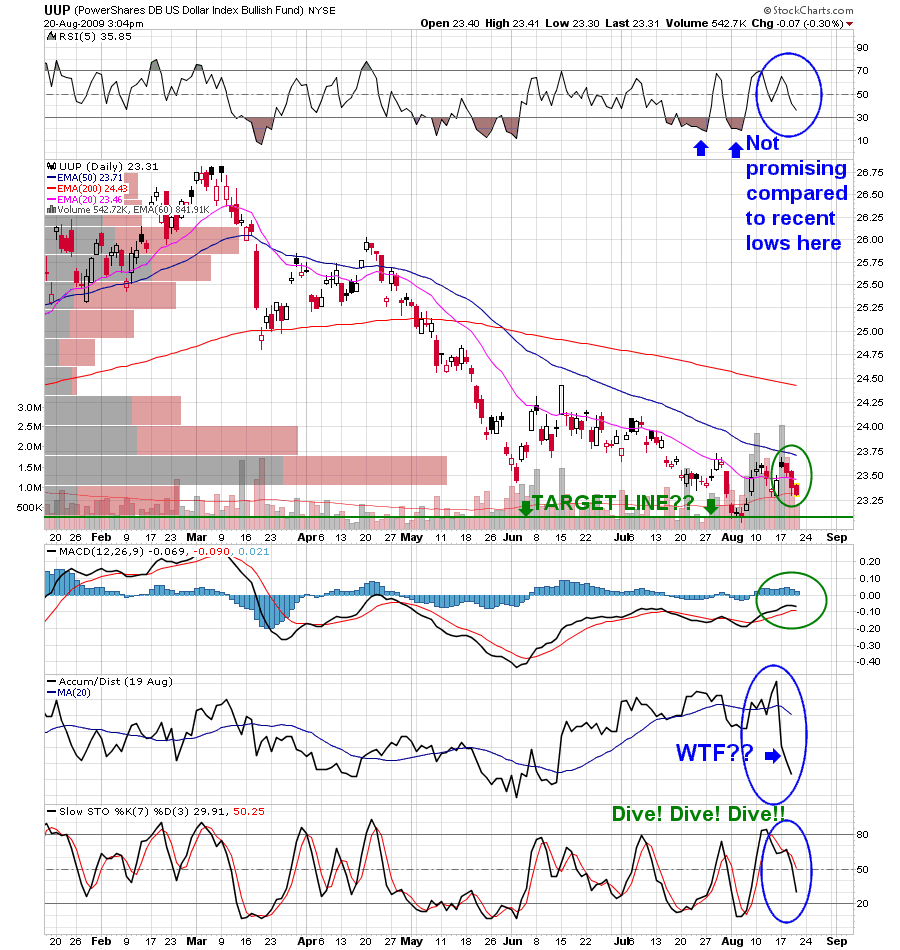

But here it is August, and the only lows I’m seeing are the catatonic stair steps of [[UUP]] as it heads to its crypt in the basement. Remember my post about the “noise zone” from the other day? Here’s our result:

Looks like $23 is the make or break area, here. If we get there, I think we get at least a bounce. Would not shock me to see further deterioration after that.

Again, that means good things for our PM and Jacksonian buddies, and they all rallied today, with the overall portfolio up 3.23% today and now breaking to new highs since our May 1st inception, with a return to date of 26.62%. My only regret is that I didn’t put more cash to work last week when I upped my Monsanto Company [[MON]] and Thompson Creek Metals Company, Inc. [[TC]] holdings back to their former strengths.

Another interesting note — while Mr. Anderson — The Andersons, Inc. [[ANDE]] remains my top performer with a 92.81% return since May 1st launch, my second chasing close on his heels is also my newest pick Teck Cominco Limited (USA) [[TCK]] which is up an astonishing 88.76% since first purchase back on June 16th at $15.04. Most of the PM’s are in the 20’s percentile range (still off their June highs, mind you) with IAMGOLD Corporation (USA) [[IAG]] leading that pack, up 32.06%.

The one Jacksonian clunker (for which I receive a large “cash” dividend) is Natural Resource Partners LP [[NRP]] , at a negative (4.11%). I will consider NRP’s inclusion in the ongoing list, unless it’s laggard status improves.

As for the best of the Jackson’s currently, the silvers seem to be standing out nicely, with my favourite (sic) Silver Wheaton Corp. (USA) [[SLW]] breaking out past it’s 61.8% fib, and looking to continue here to resistance in the near term at $11.00 or so. I of course will hold onto it until the bonds of time are loosed. Silver Standard Resources Inc. (USA) [[SSRI]] also looks extremely strong here, with another breakaway gap, up over 6% today like SLW. [[PAAS]] was only up over 5% today, but is exhibiting the same tendencies.

Last, non-Jackson junior silver [[EXK]] was also very strong today, with a nice volume spike and also gapping up over resistance. levels. It seems to be heading to it’s recent highs ($2.40) , and I’d say that’s going to come quickly. My analysis is that the Central banks were so busy suppressing gold today that they forgot about her little brother, and the beach ball popped above the water for all to see….

Onto the non-Jackson golds– I still like Allied Nevada Gold Corp. [[ANV]] , which is becoming almost Jacksonian in its stately and dignified rise here. Take a look at it’s weekly chart when you get a chance — it’s a thing of beauty. As mentioned in my comments section, [[BAA]] broke da Flummox out today over the $2.14 barrier I had mentioned in my chart the other day, and Ivanhoe Mines Ltd. (USA) [[IVN]] is looking to move higher. I also still like Golden Star Resources Ltd. (USA) [[GSS]], even though it’s rise was crippled by the Curse of DMG early this morning.

On the non PM front, I still very much like Mirant Corporation [[MIR]] — which also has A and B warrants, if you are interested in that type of thing. I also applaud any of you that took my [[CNXT]] breakout signal chart from the other day to heart. I think they’ll be more there, btw.

That should be enough for you to digest for now, but check in my comments section tomorrow for trading updates. Best to you all.

Comments »