Once again, the beauty of blogging about the markets or taking private notes on the markets is that when you have a setup that develops, you know what to do and how to trade it. I outlined it here: http://ibankcoin.com/gioblog/?p=2357

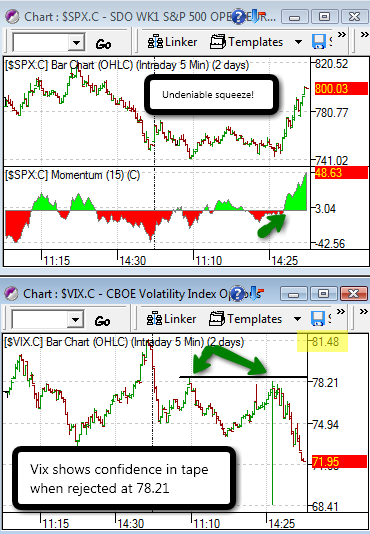

I outlined two days ago on a few blog posts that I would like to see the Vix give me a “double spike” to the mid 80s. Well, I sort of got that… we had Vix at the 80s and SKF trading ridiculously over $200 points (almost hit $300 today). Clearly there was too much fear, and a squeeze was imminent. “Who wants to stay short the weekend”, is what you should have asked yourself. Also in my notes I pointed out that the double inverse ETFs are trading at a high premium, for example EEV is trading at a Dow 7,500. I even noted that a Dow +0 day would send EEV down hard. Look at them now [[eev]] , [[fxp]] , [[skf]] .

Anyway, I waited all day for volume to pick up, and we finally got it… right on the breakout from the inverse HS triangle (thanks Woodshedder), but in reality I was using trader instincts that we would rally into the close.

Anyway, I made a clean trade in shorting [[FXP]] since yesterday (added to current position today. But covered all at the close) and shorting [[eev]] . It is useless to post a day-trade chart in them. There are no technicals to discuss in them. It was simply a matter of using “fear” and the Vix as our only indicator to find an optimal entry point, and therefore you could have got long any stock or shorted any inverse ETF stocks and came out a winner. Shorting the inverse ETFs was the big winner.

Remember, today’s insane 500 point rally on the Dow was simply the undoing of yesterday’s -500 point (yeah, I’m rounding) insanity. Also note, both huge swings occurred because of two news events. One was of Paulson speaking of how bad our economy is, and then there’s today’s news event on an announcement of a new Treasury guy. These are not fundamental changes in our economy, but only news items. Therefore, I still will notch today’s rally as a Sisyphus Rally. If you are going to pick a side, pick the winning side! Lol.

An aloha and a high five to my new twitterfunknastilicous followers! Oh hey there , Andy Swan! Follow that guy if you’re a bull, and if you want to laugh.

| tradejunkie

|

||

| IRON100 / David Buffalo | ||

| StreetRaiders | ||

| ukefuture | ||

| bertram25 | ||

| AndySwan / Andy Swan

|

||

| dariuswei | ||

| cruxmonger

|

Nice win today.

painting the options, monday we crash.

Gio,

great job.

I followed you here from your own blog a few months ago.

Im glad i found this site, its been a great help in my trading.

big thanks and a high 5.

this site is very useful… RC’s swagger and timing, Alpha’s contrarian plays, Danny’s indicators, and Woodshedder’s system trading. Everything you need to get a perspective from every angle. It’s like having ESPN with High Definition.

thanks for being loyal since intuitivetraders.blogspot.com!

Despite being bearish by nature and on the technicals, I thought your comments were sensible, and followed you into SKF, and made a tidy profit yesterday, although it was a hairy ride most of the day.

So, my thanks, first time I’ve gone counter-trend.

NiceCall… you are still on the right side of the trade, being bearish that is.

Here is a post that links to my recent arguments on why the winning side is the bears, and why I still believe they have more power: http://ibankcoin.com/gioblog/?p=2342 , in particular read the post about “Bull Traps” here http://ibankcoin.com/gioblog/?p=2296.

… but for any position there are times when you have to take profits and start hedging, and that is especially pertinent for bears who can get squeezed real fast.

I’m not sure how much further the bulls can push this boulder/stock market up the hill, but when they run out of strength it will roll back down. I’ll be doing some research Sunday evening and I’ll post an opinion.

glad u made $_$

-gio-