Try to fucking stop me.

Comments »Speculation in Biotech Hits a Feverish Pitch

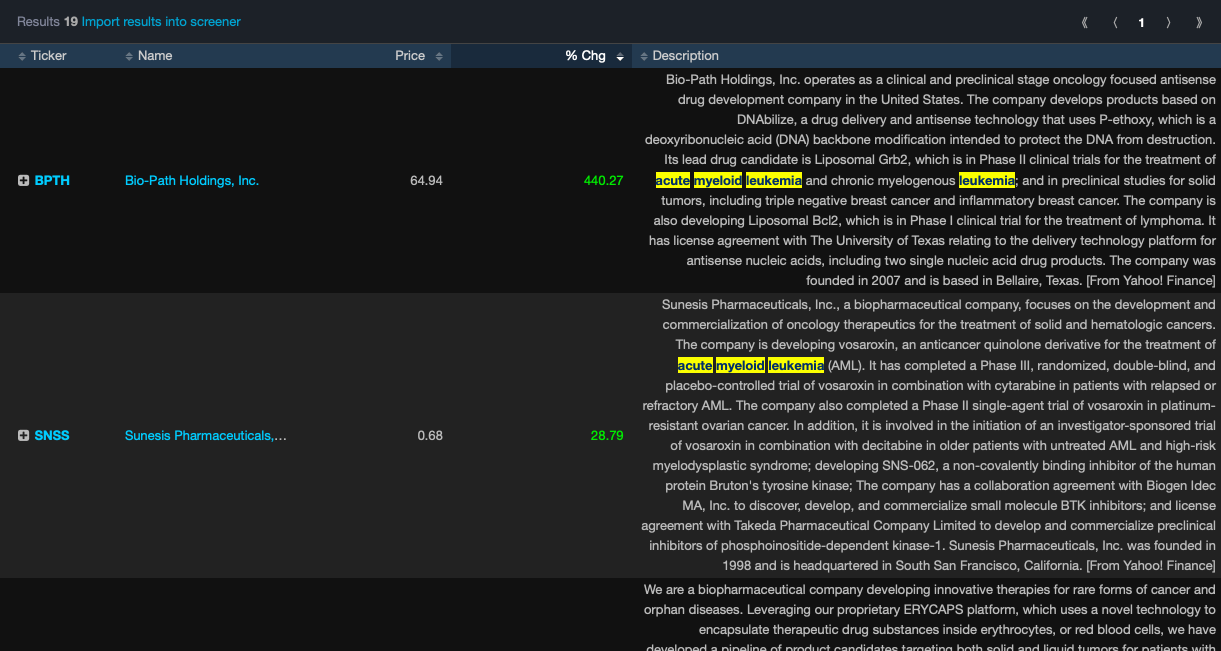

Take a look at shares of BPTH, higher by 400%+ today.

Within the sector, there are about a dozen stocks running double digits, such as ALT, SEEL, and ARQL. When stocks run like this, I like to do keyword searches to find companies in the same field, for sympathy runs.

Based on this simple ideology, I bought SNSS. Why the fuck not?

Markets are still weak, but moderating. They think they’re going to make it.

Comments »BULLS ON SUICIDE WATCH; ALL EYES ON $AAPL

Tim Apple is in trouble here. The fate of western finance might depend on his words. I suggest he choose them very carefully.

We’re in March now — ’tis the time for earnings warnings. Will Tim warn or say everything is great? Time will tell.

Here we are now, barely off recent highs. Sure, trannies have rolled over and the VIX is beginning to spike. But the FANG paradigm is still intact.

This is how it started heading lower last time, quietly.

It should be noted, small caps are doing well today and SAAS stocks are +0.58%, so there is an undercurrent of strength in the tape. But I think it’s fair to say we overshot to the upside and now we’re digesting some of the more zealous types.

In other words, the shorts you have on now are trades and not idealogical positions that will preside over an end of days scenario. It’s fun to become hyperbolic and see bulls twisting in the wind — because they’re simple people who respond to base instincts. But don’t let a good trade turn sour, just because you have a feeling about something that has yet to materialize.

What I want to see to confirm this downturn is weakness in WTI and HYG.

Comments »DOW THEORY ALERT: TRANNIES SMASHED TO PIECES, NEW ROLLOVER IN EQUITIES INITIATED

Dump it.

Dump it again.

I spent the morning cleaning out my trading account of the refuse, selling RENN for an 11% loss, GPRE for -3%, and NTLA -9%. Given my recent winners, this is nothing but a mere paint chip on the side of my gigantic warship.

It’s evident to anyone paying close attention, we have Dow Theory distribution taking place in the trannies, an economically sensitive sector that bodes miserably for ze bulls.

Observe.

Over the past 2 weeks, truckers are off by 10%. Bet most of you didn’t know that.

Today’s exuberance is in the biotech sector, so I faded it and bought LABD.

For now, the trend is, inexorably, lower. A behavioral shift has been noted and logged.

The only true way to partake in the downside is to strip account barren and to the bones of the longs and overweight shorts. Should stocks belly flop off the bottom and bounce, this stratagem will ruefully scorn you. However, in the event this rollover is legit, you will forever be in my debt. Watch the tape carefully and be sure not to overstay your welcome.

Comments »A Decade Later: The ECB is Still in Crisis Mode — New Bank Lending Programmes Revealed

This is getting sort of ridiculous. I think it’s evident to anyone watching Europe that they’re in a permanent state of QE. I recall writing about POMO and how America would be in QE for life, but we ended up half-assing our way out of QE. Look at Europe, just today announcing TLTRO-III — lasting thru 2021.

TLTRO-III is the third European bank lending program, offering bailout styled cheap rates to bedraggled banks living on their continent.

Rates go unchanged at 0% for marginal lending and -0.4% for deposits. European citizens are in a constant state of beatdown by their banks.

Part of this, of course, has to do with Italy entering a recession towards the end of 2018. Had Europe opted to reset their banking system and let them fail — perhaps they’d be healthier now. Alas, living in a world with zombified banks requires constant vigilance.

ECB President Mario Draghi said Thursday that there has been a “sizable moderation in economic expansion that will extend into the current year.”

“While there are signs that some of the idiosyncratic domestic factors dampening growth are starting to fade, the weakening in economic data points to a sizable moderation in the pace of the economic expansion that will extend into the current year.”

The only great market move, based on this news, is the euro sharply lower vs the dollar — now off by 0.5%

Comments »BEIGE BOOK SHOCKER: SEMICONDUCTOR ORDERS COLLAPSE — MOST SINCE 2008

Today’s Beige Book confirmed what I told you FUCKERS weeks ago, when I discussed AMKR.

In their recent call, the chip maker for the iPhone said sales DROPPED OFF A FUCKING CLIFF — off by 30%. But the stock rallied and the market bounced because they said their customers believe Q2 will be better than Q1. Today’s Beige Book numbers confirm that — so it’s not really news, only for absolute retards.

Two [firms] reported substantial drops in sales and two reported significant weakness. The two firms that reported serious issues were a semiconductor manufacturer and a furniture builder…. The semiconductor firm sells mostly to the auto industry and said that a 40 percent drop in new orders from China was the biggest fall in sales since the collapse of Lehman in 2008. Two other firms, both with heavy exposure to semiconductors, said that the market had slowed significantly since earlier in 2018 –

Additionally, Fed’s Williams had all sort of idiotic things to say at an economic forum today, such as considering negative rates here during the next crisis.

The lowlights.

Major risks to U.S. economy are global.

Financial conditions have partially reversed 2018 decline, but a lot of that is due to Fed.

Inflation risks don’t seem to be out there at all right now.

I don’t have a particular lean on where rates should go.

In a downturn we could consider quantitative easing, negative rates.

Cost-benefit tradeoffs of negative rates not as favorable as quantitative easing.

No decisions have been made on inflation framework.

We’re not trying to achieve high inflation.

No answer on when balance sheet normalization will end.

Inflation expecations are well behaved but it’s worth considering consequences if below target for an extended period.

Can’t wait for the next crisis to begin.

Comments »SELL STOCKS TWICE

Only fools think the market is going up now — absolute cave-apes, absolutely.

Data out of China suggests (dot dot dot) LOWER PRICES.

A measure of positive breadth in the Chinese stock market is approaching its mathematical limit pic.twitter.com/BYevID1Wwd

— David Ingles (@DavidInglesTV) March 6, 2019

Nasdaq futures are off by 18. Sure, my longs will shed value tomorrow — some of which are negatively correlated to the market — so I might get lucky. But I’m smartly positioned in SOXS, TVIX and TZA.

What the fuck are you positioned in — bank stock calls?

Why am I short?

Well, because we could not break past $175 on the QQQs and because today was a behavioral shift in stocks — marked and noted by three down days in a row. I suppose some of you have a mind for this sort of thing — but, regrettably, most of you are sub 100 IQers who move on instinct — see shit, break something, fuck something, burp.

I spit in your general direction.

Ladies and gentlemen, the President.

Trump just called Apple CEO Tim Cook “Tim Apple” pic.twitter.com/gTHHtjWvc9

— Sean O'Kane (@sokane1) March 6, 2019

Comments »

If You’re Heavily Long — Be Worried

I ended up taking this day trade RENN into tomorrow — even though I’m 99% sure it will trade lower tomorrow. To pair that, I am long SOXS, TVIX and TZA — with a variety of longs — none of which are meaningful.

If you’re heavily long here and betting on a surge tomorrow — GOOD LUCK. Odds are we’ll trade sharply lower. I’d keep a close eye on WTI in the overnight session and ignore anything you hear or see on CNBC.

Comments »Doubled up on $RENN

I missed the sale at $2.45, would’ve netted me an intra-day gain of 41%. Now that I’m back in the saddle, able to trade, I did something I should never do — buy more of a stock knifing lower after hitting a recent high. The technicals for RENN are now deplorable and I really should be closing out this trade — chalking up to an unfortunate event. There will be many missed calls and unfortunate events; and I’m already numb to the idea that this too could end up going the same way as so many other missed calls during my time in these markets.

But I won’t let it just slip away so easily.

I have a mind for this sort of thing — doing incredulous things — simply because I feel like doing them.

Plainly, you should not follow me into this trade — just wait and see how it works out. Consider it an idle form of passive entertainment.

NOTE: I sold LITB +15.5% one day hold.

Comments »Fly Buy: $RENN

Amidst the carnage, I found time and the bravery to buy some RENN.

Comments »