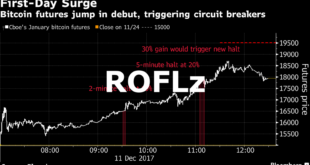

I remember the hubris in the shitcoin community when both the CBOE and CME announced they’d begin trading futures for the cryptocurrency dubbed Bitcoin in 2017. It was the zenith of the mania. Men were throwing away their jobs, cars, homes, and their wives — betting it all on rando ICOs — because ‘it was the way of the future, the way of the future.’

Since that time, those people were wrecked and ransacked, big jowled florid faced bankers took industrial sized vacuums and sucked more than $600 billion in market cap from the ICO world. It has been something to watch and now we all make fun of the shitcoiners — relegating them to the moron circle — subjugating them to a time and a place that will forever be known as a period of unmatched insanity and group think — succumbing to behavioral sink — cannibalizing one another until white bones were bared and nothing at all was left.

Tonight the CBOE closed their trade — announcing a cessation of futures contracts to be traded passed the month of June, 2019.

It’s business as usual for CME Group’s bitcoin futures market, despite a retrenchment by rival derivatives exchange operator Cboe Global Markets.

Contacted by CoinDesk Friday, a spokesperson for CME said the exchange has “no changes to announce re our bitcoin futures contract” and declined to comment on Cboe’s pullback.

The affirmation is notable in light of the news Thursday that Cboe will not add a bitcoin futures contract for trading in March.

This means that after the last currently traded futures expire in June, this market will essentially come to a halt at Cboe Futures Exchange (CFE), at least until new futures get listed.

“CFE is assessing its approach with respect to how it plans to continue to offer digital asset derivatives for trading. While it considers its next steps, CFE does not currently intend to list additional XBT futures contracts for trading,” the company said in its notice to investors.

A spokesperson for Cboe declined to comment beyond Thursday’s product update.

The difference in outcomes isn’t all that surprising since CME’s volumes have been approximately more than double Cboe’s.

As of March 14, for example, the daily trading volume of CME’s bitcoin futures was reported at 4,666 contracts, compared to 2,089 contracts at Cboe.

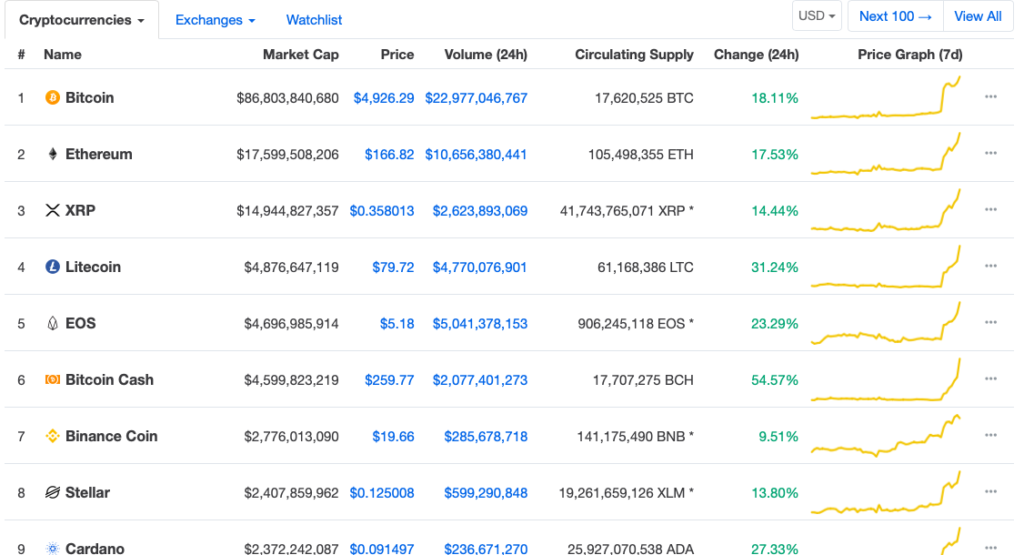

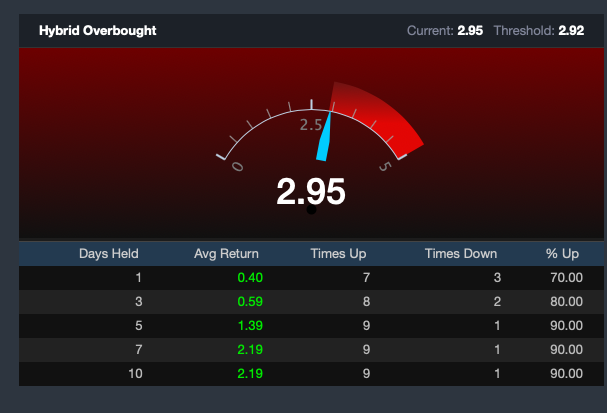

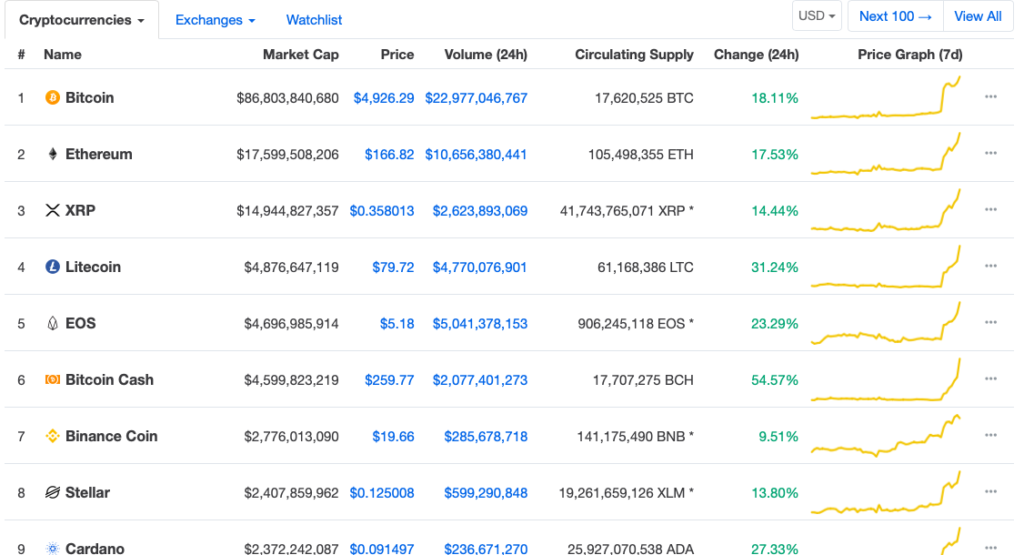

Graphing the chart, one could say it was all a coincidence. But judging by the stiff reaction higher to the shares and overall mood in the crypto space — it appears the speculative fervor is back — if only for a short while.

Comments »