October is often regaled as an ominous time for stocks, when in fact on the whole it’s a net net winning month. The few true market collapses have occurred in the month of October, harkening back to the glory days of 1929 and 1987 when all appeared to be lost forever.

In recent history, 2008 stands out as this generation’s truest financial collapse. Sure the dot com bubble was bad — but it didn’t possess the same panache as 2008, featuring banks dancing for dollars in an attempt to stave off permanent collapse.

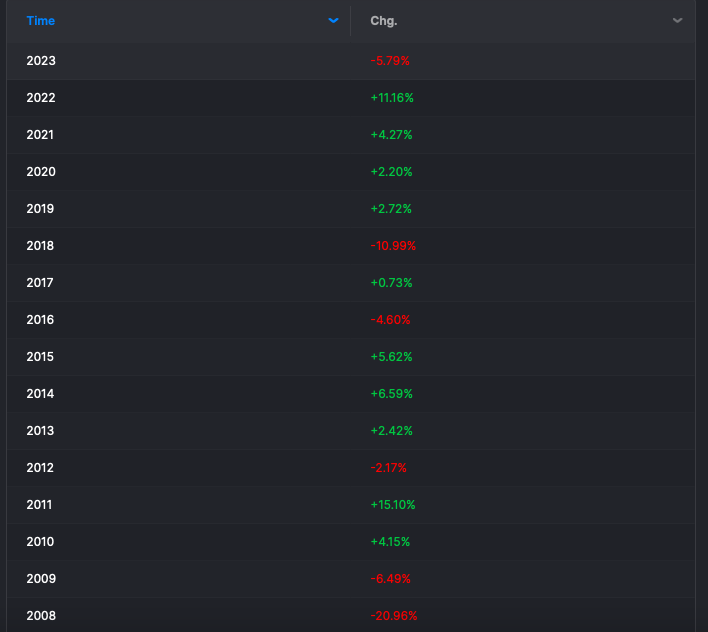

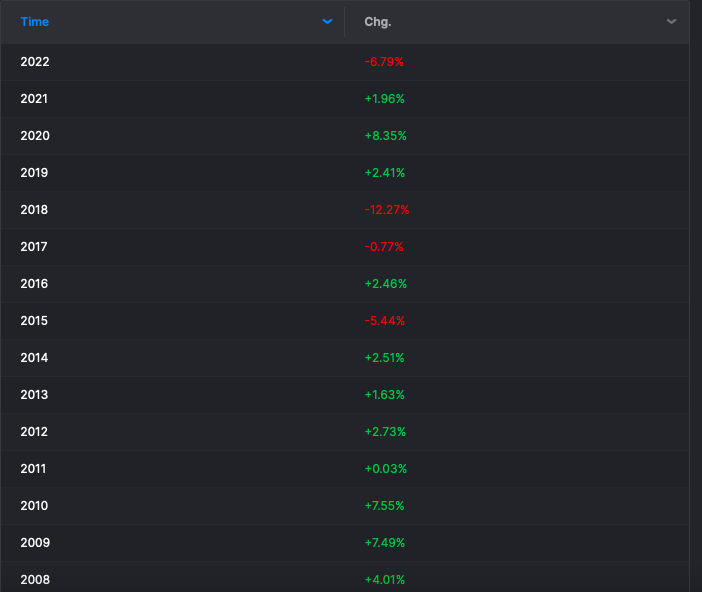

And her we are today, staring down the barrel of the $IWM down 6% for October following a 6% drubbing in September; noteworthy because it’s the worst month of month Autumn decline for small caps since 2008. The only other year that enters the conversation is 2018, accompanied by losses of 2.6% in September, -11% in October, +1.7% reprieve in November and topped off with extreme Xmas collapse of -12.3% for December.

Here is the raw data, courtesy of Stocklabs.

Analysis: I place seasonal trends in high regards. Humans are creatures of habit with emotions that can be measured and often used to predict the future. When fear is at its apex, time to buy and vice versa. One thing is abundantly clear: this sell off isn’t ordinary. There is a unique character to it and we shouldn’t dismiss it as some random ship passing in the night. Based upon the previous two occurrences of Autumn collapses in stocks, we have more downside left in this tape.

Since we are not in a fundamentally driven decline like we were in 2008, I’d opt to use 2018 as a guide of what to expect. Lower prices for October, followed by reprieve in November — capped off with extreme cataclysm in December — starring Krampus and his evil habits.

If you enjoy the content at iBankCoin, please follow us on Twitter