Facebook is down more than 20% in the after-hours, following an atrocious earnings miss. I will not attempt to analyze the numbers or make predictions on the stock, since that feckless narrative has proven to be a waste of time. How many times have people declared NFLX, GOOGL, AAPL, and TSLA dead over the past 5 years?

Stop making predictions.

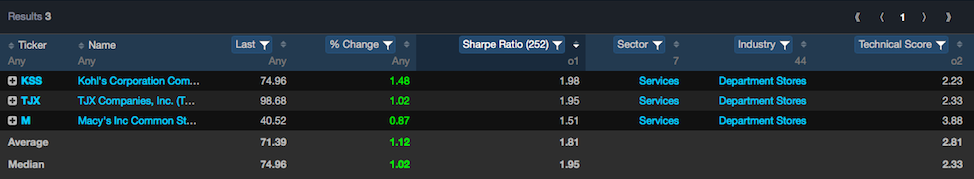

That said, you should know Nasdaq futures are down a harrowing 1.6%, while the Dow is slightly higher. We will have a split market tomorrow, juxtaposed between techFAGS and real economy brick and mortar. I suspect my retail stocks will fair well, while some of my SAAS related names will trade off. Reason being, FB is a major holding for a lot of funds. Said funds will be liquidating tomorrow and lowering their risk profiles, which might mean a broad sell off in a number of names. Bear in mind, the market is based on fundamentals, but the short term swings are largely psychological.

Speaking of which, I found this interview interesting, between Entertainment Weekly and a Facebook executive, addressing the ‘fake news’ scourge. It seems corporate fascism is gaining momentum and even though Zuckerberg has pushed back against government shills who want complete censorship, I suspect resistance is futile. They will have their way, one way of another.

Facebook executives promoting their video-on-demand service got into a combative exchange with reporters while at the Television Critics Association’s press tour in Beverly Hills on Wednesday. The issue: the presence of right-wing conspiracy site Infowars and Fox News on the social network’s platform.

The kerfuffle started when Fidji Simo, Facebook’s vice president of video, was asked about Infowars stories on their platform while touting new Facebook Watch entertainment shows.

“To be totally transparent, I find Infowars to be absolutely atrocious,” Simo replied. “That being said, we have the hard job of balancing freedom of expression and safety. So the way we navigate that is we think there’s a pretty big difference between what is allowed on Facebook and what gets distribution. So what we’re trying to do is make it so that if you are saying something that’s untrue on Facebook — you’re allowed to say it as long as you’re an authentic person and you adhere to our community standards — but we’re trying to make it so it doesn’t get that much distribution .… We don’t always get it right, as you can imagine, it’s very complicated, but that’s sort of our principle for dealing with information.”

Reporter: How do you limit distribution?

“When we have something that we think — that a fact checker has told is probably not true, or a lot of our audience is telling us is not true, we just limit distribution. We tell our algorithms that this is probably not something we want to see distributed widely. So that’s one way. Another way, a lot of how misinformation spreads, is by people sharing the content.… We actually pop up a module that says, ‘Hey you’re about to share something our fact checker thinks is inaccurate, you may not want to do that.’ That decreases distribution very dramatically, north of 80 percent, that’s very effective at reducing the spread of it.”

Reporter: One of the most prominent organizations you’re working with is Fox News, and they’re sort of incorrigible about proliferating a lot of misinformation. Can you speak to your reasoning behind that? Why would you want to work with an organization like that when, as you said, you’re trying to limit the spread of false information?

At this, Rick Van Veen, head of global creative strategy at Facebook, jumped in: “Yeah, well, given that we have limited time. I’d like to keep it — Fidji and I don’t lead the news organization. Campbell Brown leads that…”

Another reporter in the background: Answer the question!

“We have limited time —”

Another reporter: We’ll give you time!

Simo: “We have a range of new shows we’re presenting —”

Reporter: But Fox News is still on every day, including the weekends on this programming list.

Simo: “So is CNN —”

This was met by some chortles in the crowd, presumably because they don’t think CNN and Fox News are remotely compatible when it comes to accuracy.

Simo: “We are really trying to show a range of programming that shows the range of the political spectrum.”

I think it’s all wonderful. Chinese styled propaganda and information control might be nice. Think about it. No more flat- earth retards or people annoying you with conspiracy theories. Moon hoax-homosexuals.

Personally, I like to drown myself inside leather-bounded classics, and have found peace in ignoring the news. I come here and shitpost to my black heart’s delight, bank some coin in stocks, run my software business, and visit the beach whenever I can — drinking gimlets every step of the way.

Comments »