Every dip is, more or less, an excuse to run higher. Each fade is a head fake to kill or maim shorts.

Markets are off to the races on headlines that convey the US is set to reopen talks with China. It’s nothing, actually, but everything.

Comments »Every dip is, more or less, an excuse to run higher. Each fade is a head fake to kill or maim shorts.

Markets are off to the races on headlines that convey the US is set to reopen talks with China. It’s nothing, actually, but everything.

Comments »This is precisely what you don’t want to see in a market following a big draw down — tepid and weak and very disgusting open. I’d much prefer to see Titanic trading action, followed by hair razing panic, than this.

On a separate note, it appears my storm door detached the trim that it’s attached to and now stands to collapse onto whoever opens the door next. I have a few choices here, one involves saying nothing and letting a household member unknowingly open said door, which will undoubtedly lead to its inexorable collapse, or fix it. I’m debating this topic, and many others, as we speak.

I was at Six Flags the other day and it bemused me to see how incredibly stupid most of the people sharing the earth with me were. You could see it in their eyes, completely devoid of intelligent thinking, unevolved folks in search of quick and cheap thrills. This sense of awareness isn’t a gift, but a curse, as I tend to view things thru a cynical lens by default — which I know is bad. Sometimes I consciously force myself to cast aside aspersions in favor of wanton gluttony or hedonism, in order to meld in with fellow homosapiens.

Time to prepare for markets. In case you’re wondering why the blog is so desolate during the day — it is because we’re all in Exodus chatting away — cavorting mind you, sashaying in a very manly way to the market’s indelible drums.

Comments »***ATTENTION PLEBS: Access the Exodus algos now for free, at FreeStockAlgos.com ***

If you closed out the session very long, you’ll be very sorry tomorrow morning. God knows we deserve a stern talking to, maybe more. I’ve not positioned myself for bearish glory, and also bloodshed, and will be wishing for overnight calamity to hit markets on this evening.

I do not pretend for this to be anything but a revenge trade — for the pangs and the misery I’ve endured in my past 10 trades. Loss upon loss — prick after prick, I am aghast by the wounds brought on by my own hubris. The certitude I had during the ebullience of excess has now transmorphed into a heightened gloom, a rarified grimness that I’ve kept at bay for some time now.

I step into the close a hairy chested man, stronger and fitter than you — long TZA, SQQQ, M and some other shit — mostly cash (70%).

Good day.

Comments »Do I need to review the carnage? Fine, I’ll do it. And, I’ll tell you where the money is flowing and why you’d be an idiot to buy into that gambit.

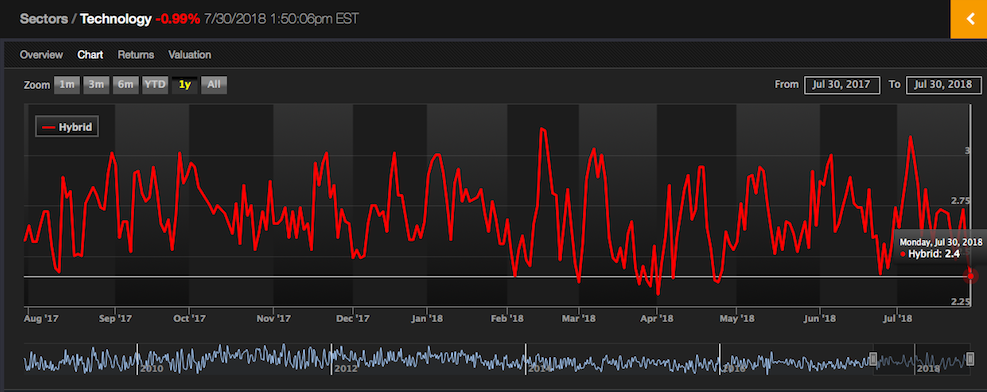

Here are the leaders to the downside in tech. You’ll notice the best and hottest sectors are the one’s doing the worst.

Conventional wisdom might suggest to avoid tech; however, according to our mean reversion algorithms, now might be a good time to step him. Obviously, a “this time is different” mindset often infects the psyche of traders during periods of duress. However, it rarely is any different from previous sell offs. Human behavior repeats itself and history rhymes.

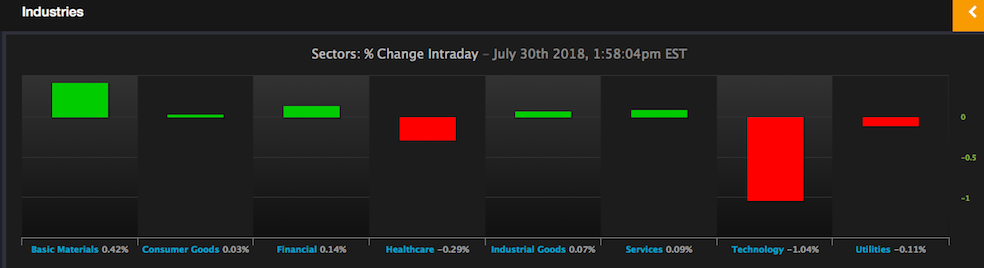

The market breakdown for the day. Losses are contained in tech.

Leaders in tech, specifically FAANG, bearing the brunt of the sell off — now lower by 2.7%.

Most notably, the SAAS sector has been upended and completely wrecked, off by more than 5% today.

One idea worth mentioning, triple upside semis is now OS in Exodus. The track record for this signal is flawless, 10-0, over 10 trading days.

As of now, I am not quick to jump into the market, only because I just took a bunch of losses. I can still feel the knife wounds in my chest. I am long TZA and SQQQ too, which might be a dangerous trade heading into the close. It’s entirely possible that the near term lows are being put in now. Ideally, Exodus can spit out an oversold signal for the overall market and we can mean revert this bitch higher again.

Comments »Market is fucking toast, with exception to retail and the shopping mall stocks of course. My Macy’s is doing wonderful.

I stepped in with a full heart and bought SQQQ today, not because I’m scared or because stocks look bad, but because I’m angry and want to profit from the demise of western finance.

To access our algos, feel free to use FreeStockAlgos for instant real time grading. We’ll add some new features soon.

Comments »Here’s a very interesting screen that I ran in Exodus. I simply searched for intra-day returns of stocks with Sharpe ratios above 1 and under 1. For those unfamiliar, a Sharpe ratio is the risk adjusted return divided by standard deviation. In the investment advisor world, it is the crown jewel of metrics and many advisors base their entire practice around this singular data point.

Look at the divergence.

The best explanation I can offer is advisors are blowing out of positions and underowned stocks and sectors are being bought. There were a lot of crowded trades and now they’re unwinding. This is the downside to big data and everyone knowing which stocks are the best in seconds. When the trade ends or is paused, everyone tries to exit at the same time. In the past, we’d refer to these stocks as ‘hedge fund hotels’ — but now the field is dominated by series 65 retards and their reverse churning methods.

Comments »Here’s sad boy Cramer, lamenting the recent guidance from $FB, incredulously declaring it is a recipe for a short sale. Lots of classic Cramer drama-queen in that clip.

Cramer on $FB: It's a recipe for a short sale pic.twitter.com/PWaF2yerHd

— The_Real_Fly (@The_Real_Fly) July 30, 2018

Speaking of drama-queens: Conservative folks on Twitter are, ironically, professing to sell and to sell short shares of TWTR, hoping it ‘goes bankrupt’, in order to teach them a lesson for shadow-banning right wingers on the platform. Believe me, I’ve had my fair share of censorship on social media. The iBC Facebook channel was nuked. I was suspended several times on Twitter, once for calling someone ‘a fucking retard’ — and I generally despise Instagram. But that doesn’t mean you should run out there and sell short the stock. These people are fucking retarded, basing their decisions on political hacks. The irony, of course, is that they’re tweeting more to “bring down Twitter.”

Shares of TWTR look like shit and are knifing lower.

Word of advice. Conservatives have little power over social media. That much is certain. But plenty of them own businesses, right? If you want to hurt @Jack — then boycott Square, his other company. Personally, I’m not interested in boycotts and believe it’s a waste of time. Too much negativity. That shit is cancerous.

Comments »I’ve gone from complete and utter genius to reprobate knuckle-dragging moron in a little more than a fortnight. Sure, I still have YTD gains that most would be envious of — but my recent foray into the world of high finance has been met with a swift kick to the nuts and groin.

Let me explain.

Everything that was up is now down, and vice versa. This tape is specifically designed to fuck its participants. Look at what I mean.

If you’re trend following, you’re essentially getting your balls boxed in. Tech is lower, but the Russell is up? Good luck trying to play that.

SAAS stocks hammered, but oil up?

No thanks.

I sold my DRIP ‘hedge’ for a quick 6-7% loss. I’ve been booking a lot of those today. I’m now a complete loser at 75% cash, yelling at children for playing on my lawn. I am an idiot of epic proportions, underserving of a computer. If I was my own cold caller, back in the day, I’d snatch away my computer and replace it with a sticky.

Best thing for me to do now is to eat sandwiches at an industrial rate. If I bargain myself into the tape, I’m liable to screw up again. I might as well wait for worldwide panic to grip markets and play the Exodus OS signals. By the way, have I shilled for me new site enough: FreeStockAlgos.com? It is, essentially, a site for those too lazy to take the free trial, or people who’ve had the trial and only like to freeload. Feel free to use it with my compliments.

Signing off now — Monsieur Moron.

Comments »***ATTENTION PLEBS: Access the Exodus algos now for free, at FreeStockAlgos.com ***

Boy what a tech wreck it is out there. I didn’t want to sell down so much, but what am I supposed to do when these fucking stocks are sticking knives in my chest? Am I supposed to sit there and say ‘please Sir, might I beg your pardon for another?’

No. I removed the knives from my chest and grabbed those stocks by the hair and decapitated them.

I kicked out of PVTL, SMAR, RP, and OSTK — losses ranged between 5-12%.

With the proceeds, I’m doing nothing, other than regretting using DRIP as one of my hedges.

Here’s what I’m seeing in Exodus and why I’m concerned. Leadership in tech is in the wind. My Bubble Basket is sharply lower, as are the FAANG stocks. Additionally, and many aren’t watching this, the highest growth SAAS stocks are getting man-handled. This is, by far, the best performing sector in the market this year. Pay attention to the distribution. Junior at the trading turret is getting nervous and he’s making mistakes. While the PM is in Nantucket doing lines of blow, Junior is busy ruining the business.

Dunkirk soundtrack on loop. Oh and the SAAS stocks are now -2.5%.

Comments »When it comes to trading oil, I always seem to be on the wrong side of the trade. It is my Waterloo. On Friday, I declared I was an ‘Inverse Oil Man’ — betting against the black gold. It seemed like a perfectly reasonable thing to do, considering the circumstances. So I bought DRIP and now it’s lower by 4.5% thanks to WTI running higher by 2%.

Complete idiot.

I’ve been teaching myself how to cook French cuisine, which is great. The only setback to it is my children much prefer to wolf down a pound of drenched fries, rather than sit down to Dad’s “fancy dinners” that take 3 hours to prepare and cook. Life, at times, is an exercise in futility.

Markets are higher thanks to the CAT beat; but the Nasdaq looks like it wants lower. I’m gonna pay close attention to the market now and stop chin-wagging with your faggots.

I’ll update the blog when I’ve made a determination.

Comments »