Fuck the Kingdom of Saud. Monarchies are, inherently, the most oppressive and obnoxious form of government ever invented. These mountebanks force an otherwise forlorn populace into a life of repetitive supplication — hoping for scraps to be dropped off their gold mantles to sustain their miserable existences. The great riches of Saudi Arabia, blessed with unlimited amounts of oil, are continuously squandered by a perverted cadre of Princes who levy their positions into hedonistic displays of depravity.

Because they’ve been so very busy trying to foment theocratic barbarism, via the most oppressive religion ever concocted in the history of man, they’ve forgotten to diversify away from their core export: crude.

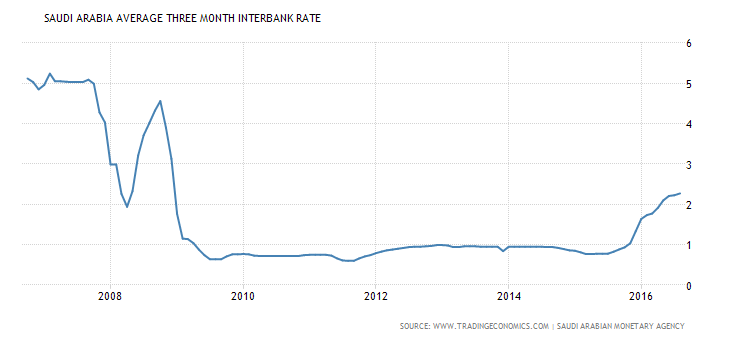

As such, with the drop in Brent and soured loans on the books of many of their banks, we’re entreated to the beginnings of what may become a cauldron of magnanimous fuckery — a SAIBOR driven liquidity crisis.

Interbank rates are on the rise, indicative of stress in the banking system, aka the checking accounts of the Saudi fucking Princes.

Debt has surged! A grande experiment in British banking, designed to enslave borrowers, continues to astound.

For the session, Saudi banks and insurance firms are getting lit.

Via Bloomberg.

Saudi Arabia will post a budget deficit of 13.5 percent of economic output this year, the highest since 1992, declining to 9.6 percent in 2017, according to forecasts from the International Monetary Fund. Amid the shortfall, direct local government debt climbed to $63 billion at the end of August from almost $38 billion at the end of 2015, according to information in the Saudi bond prospectus obtained by Bloomberg.

Rising Saibor rates reflect the “extent of the liquidity challenge in the banking system,” said Raza Agha, the London-based chief economist for the Middle East and Africa at VTB Capital Plc. “The outlook for government borrowing has risen sharply and even if next year’s deficit declines to perhaps 8 percent of gross domestic product, you’re still looking at deficit-financing needs of $56 billion.”

One could only hope for Brent to halve from current levels, in order to make their plight all the more interesting.

If you enjoy the content at iBankCoin, please follow us on Twitter

Didn’t they have some mega IPO coming out?