God only knows why people are scared of a December Fed hike. I mean, doesn’t anyone have a fucking brain inside their skulls? That didn’t sound too cerebral. I get it. But I have a cussing problem online. In person, it’s a true rarity to hear me tell you to ‘fuck off.’

They aren’t going to hike. After holiday retail sales miss targets, the Fed will bend the knee to the markets caprices.

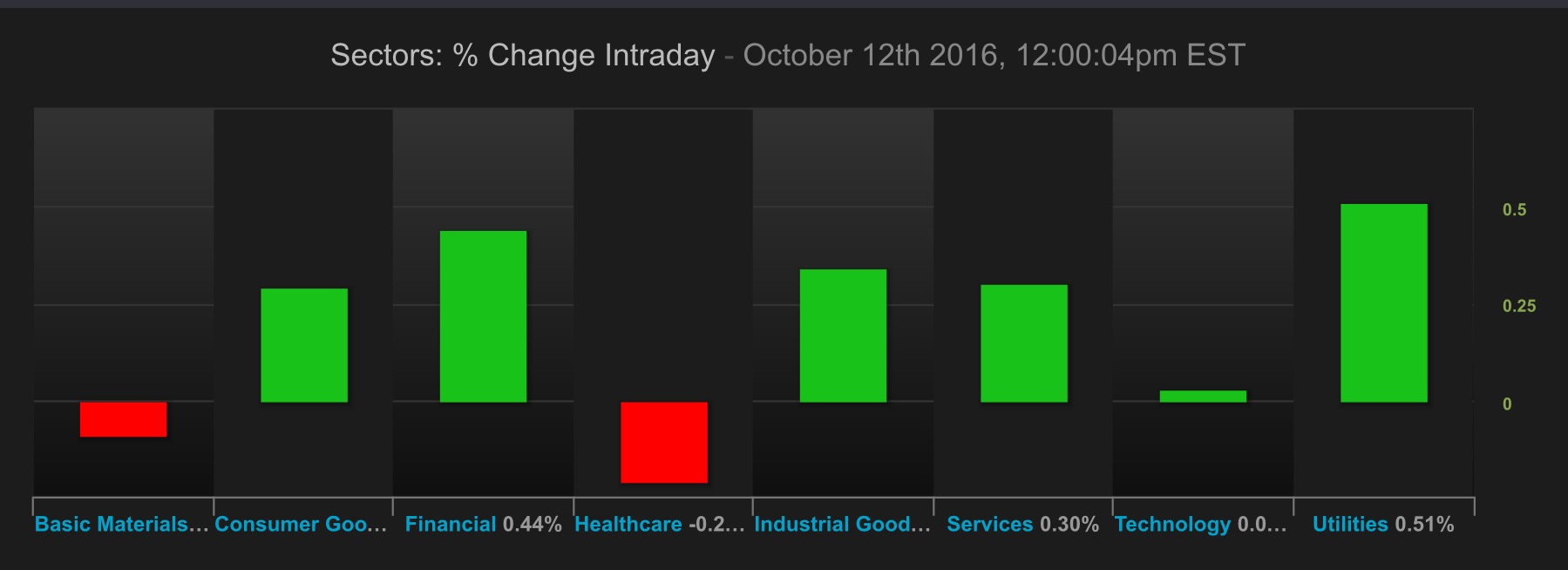

Following yesterday’s rout, stocks are on edge today, with investors crowding into utilities and gold stocks, while running for the hills in healthcare. I think the ILMN miss and surge in the polls for Clinton is starting to truly worry degenerate biotech traders.

Let’s face it, biotech traders are low people. They don’t have medical degrees and often mispronounce the names of drugs — because they don’t care about the companies themselves. Biotech traders only care about stock prices and wouldn’t have an issue with an outbreak of the bubonic plague, as long as they were smartly positioned in a company in phase 3 trials to cure it. Better yet, they’d rather contain it. Cures are bad for stock prices. See GILD.

Anyway, it’s a slow Wikileaks drip of a day. Here are the out and underperformers in the market today, courtesy of the all glorious Exodus. Try it, you’re gonna like it (extra yo gabba gabba).

If you enjoy the content at iBankCoin, please follow us on Twitter

TLT is down 8 points in the last month and you don’t think they’re going to hike?….tisk tisk. 100% chance they will move in December, but at that point it will be fully priced in which has mostly already happened. The 10yr is up 40 basis points in the last month.

This is all very wonderful. Nobody escapes unscathed the next few years, however. Cash yields zero and isn’t sexy but it will trump (no pun) a 50% beat down coming your way.

say they raise the rate from 0.25 to 0.50%

what does that ultimately do? We are in the midst of a 7 year bull run with markets at all time historic highs. the entire thing crumbles because the fed funds rate is 0.50%?

Truth. It’s bullshit that the market is fading because the prospect of a 25bps move. The raise is happening in December, but the talk of moving to inflationary plays is way overblown.

What fundamentals have changed since DB went down?

Per Fed minutes today, via marketwatch.com:

“the Fed staff said that it expects inflation to remain below the Fed’s roughly 2% target until 2019”

Umm, 2019? Anyone? This was supposed to happen this year, then next year, now 2019? This is a real problem.

So, the Fed target rate is 2% inflation, yet they’re hiking interest rates more than 2 years in advance? Does anyone see the discord in what their stated goals are and what they’re actually doing?

We are fully valued right here.

Jittery is the word for what I’m feeling here. Historically that has been a buy signal for me. It’s really hard though when the moment comes.

I expect a bleak holiday season. Although Hillary will be shopping for new drapes for the White House. What color and pattern will she pick?

The drapes will be made of dollar bills fresh off the press of the mint. Dollars will be like paper towels.

Maybe we should be buying up cotton ETFs…

Deflation is the biggest risk to the financial system. It always is at the end of a massive debt cycle like the one we’re seeing. This is what the Fed and CB’s are trying to avoid—Judgement Day. That’s why they don’t want to raise rates. All talk of raising rates. Sounds good, but no action.