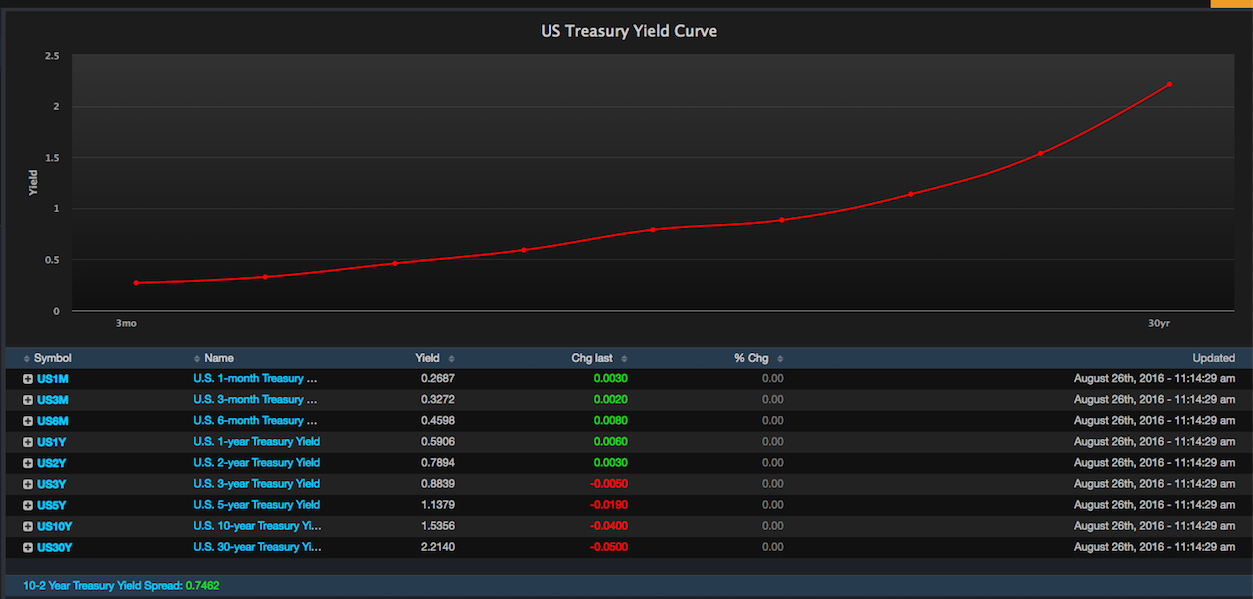

The 2yr yield isn’t dropping as fast as the 10. Typically, this is an indicator of a weakening economy, which could be construed by this morning’s revised GDP data. Also, it could mean the Fed might hike rates within the next 6 months. If the Fed hikes, it will affect shorter duration bonds much more than longer. As such, the yield curve is flattening.

I’ve been tracking the curve in Exodus for a while now and haven’t seen it this low ever. With just 74bps between the 2 and 10 year, someone, somewhere, is betting on a deleterious turn in economic activity.

Bear in mind, TLT is moving sharply higher today, +0.9% to $140.36. My entire thesis for TLT is that I will only sell it when the yield curve inverts. So, the tighter that spread gets, the more likely I am to take profits on treasuries. Also, because the Yellen speech was pretty much as expected, lacking any substance or teeth, I added the second tranche of my gold positions. It is now a full position, a little more than 25% of assets.

If you enjoy the content at iBankCoin, please follow us on Twitter