Thus far, just 7 out of the 21 companies that have reported earnings have exceeded the mean estimate. For the first time in well over a decade, the median price to sales ratio of the tech sector is trading at a discount to the overall market. Either sales are about to get hammered, or the tech sector is a ridiculous bargain down here. Judging by the after hours pin action in GPRO, I’d say the former is likely.

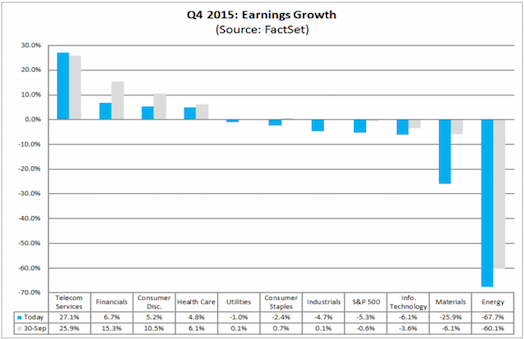

The Q4/2015 revenues growth results were not good.

Year to date, global equity losses have topped $3 trillion.

The oil and gas capital structure is a horror show, with over $300 billion in very distressed debt, and another $600 billion looming behind it.

All commodities are in a deflationary vortex, yet the Fed heads keep popping up on the teevee as if nothing happened.

How the fuck can the Fed still say 3-4 rate hikes are in the cards for 2016?

If you enjoy the content at iBankCoin, please follow us on Twitter

That bitch needs to grow a beard asap

Heil Fly.. What can they do? On one hand they’ll be admitting the s&p price dictates policy = lose credibility. On the other hand, let capitalism prevail, leads to recession = lose credibility.

Wth would YOU do?

america took a BiG step toward socialism or abatement and castration of capitalism when it desired the comfort of a controlled stock level. cant-have-it-both-ways

[i still believe controlled-stocks were only a front in a predetermined gap of time]

Keep in mind, they have to tread carefully in front of an election!!

Dyer

They cannot take the 25bps back, but they can easily send one of their morons out to say Fed hikes are OFF THE TABLE until normal market conditions persist.

They’ve done this many times. The Fed likes to make believe the market doesn’t dictate policy; but it always has.

The major difference here is the Fed only hiked so they could lower later. None of the data suggested they should raise. They could have done it last year, but not now under these circumstances. They should be focused on creating inflation, not deflation.

I agree. Won’t surprise me if we get one of those Cramer goes crazy moments, then a FedHead comes out to ease fears.

Your M.O. assumptions are still too innately implanted. Just because their motivation seemed in line with what you thought it should be for healing an economy doesnt mean that motivation doesnt change (or as some of us think programmed to change at some point) their – actions – are – they – are – not – helping – the – market right now and thats that. done. over. get over it

“How the fuck can the Fed still say 3-4 rate hikes are in the cards for 2016?”

Here are the multiple choice test answers to choose from:

A) Gross incompentence

B) The Fed thinks stocks are in a bubble and wants to pop said bubble.

C) The folks at the Fed– or their friends and relatives– are short the market out the wazoo.

D) The Fed knows something we don’t know e.g. they have inside info that indicates that this deflationary vortex is temporary and that commodities have bottomed, or will bottom some time later this year.

either answer A or E

E) The Fed’s friends on Wall Street asked them to “reset” the market at a lower entry price, so they could sell it short, buy it back, and then buy it low and hold for some higher target price. Wall Street asked their Fed friends “Can you please find a way to drop the market really quickly, so I can make a ton of money on puts?”

Milton Friedman believed the Fed was at the root of many economic evils…causing the Great Depression and the inflation of the late 1970s. He’s probably right. Another policy mistake here wouldn’t exactly be a shocker. They fucked up and kept rates too low for too long during the R/E bubble and then following the Great Recession it created. Now the shift gears into a shitty economy (which they probably believe is sound based on the phony data they kid themselves with).

As we used to say in the Navy…Stand The Fuck By…

Fed pumps these bubbles then people cry when they remove the punch-bowl.

toad beat frog

>They fucked up and kept rates too low for too long during the R/E bubble and then following the Great Recession it created.

Solid comment

I don’t believe in conspiracies. And it does feel like they are trying to knock the slats out from under equities. Why else would they be doing all the jawboning

I don’t think the world markets are going to collapse, and I don’t think the Fed wants them to. But it’s anybody’s guess as to how low a price the Fed wants to reset the markets at.

Define collapse. OA has a chart showing S&P 1600 on the downside if we break the current range, which we’re threatening to do. Is that a collapse or just a healthy pullback? I think most would see it as the former.

you’re forgetting the wealth effect. what they explained/admitted very recently was a primary aim. explaining/admitting at the same time it didnt work. So not only did it not work but falling equities and the continued deathly deterioration of formerly qe pumped commodities will feedback double negative in relation to the ‘wealth’ ‘effect’

markets

dont

need

to

collapse

to

foment

structural

distress

Showtime. Frog is worried about all the douche bag pet projects that progressive retards need to exist. A market collapse most likely would make frog homeless. Really. In a tent on the side of the fucking road style. Like any parasite they need a host. Seriously.

It’s like Nero fiddling while Rome burned.

Le Fly

Have you not read William Cooper’s Behold a Pale Horse?

nope. Any good?

#1 underground best seller

Cooper was shot in the head

Real good

Explains economics as electrical circuits

Correct a bit ( bunch) and add some juice. 15%-25% now, or 50% later? Mid 1500’s-1700’s probably the most bullish thing that could happen correction wise. Get plenty of bear juice on a move like that, because in their mind “this is the one” and it always is. Trading sideways until the end of time is not gonna help investors. Although, you’d likely clean house with exodus again in that type of market.