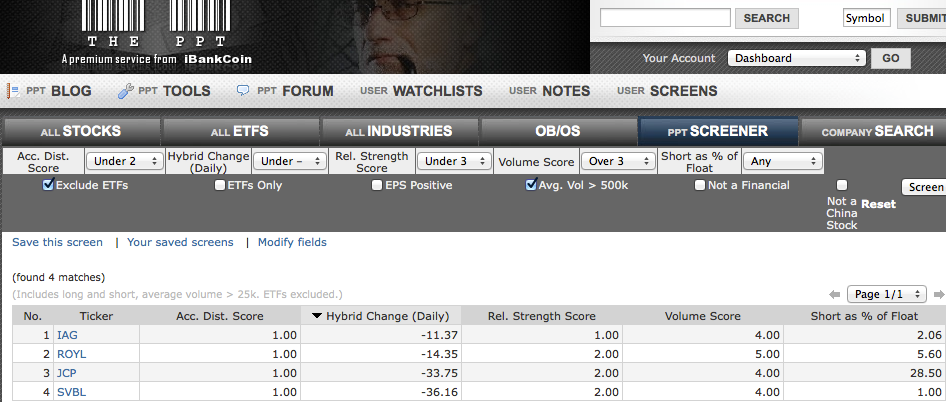

Short-Term Oversold; Cover Shorts Into Any Weakness Early This Week and Reevaluate

According to a variety of indicators, the broad market is now oversold after the abrupt sell-off we saw late-last week. In support of that statement, let us look at two indicators.

First, all major averages closed the week out below their respective lower daily chart Bollinger Bands.

For reference, Bollinger Bands are useful technical indicators for measuring relative short-term tops and bottoms, among other aspects, including volatility compression and explosion.

Here, the Dow Jones Industrial Average saw price slice down through and close below the lower Bollinger Band, typically a sign of short-term oversold conditions. It is therefore likely that a temporary bounce can ensue this week.

In addition, the NYSE McClellan Oscillator (“NYMO”), which is a simple market breadth indicator tool, finished last week at -89.39.

Generally speaking, when NYMO is above zero it tends to indicate bullishness for stocks, and below zero, bearishness. However, extreme readings can indicate overbought or oversold conditions. Above 50 is considered to be overbought, while below -50 is considered oversold.

Here, you can see NYMO closing in deeply oversold territory by the end of last week.

As a result, the market is plainly oversold on daily timeframes headed into next week. Of course, oversold can certainly become more oversold in corrective markets (e.g. summer 2011), particularly corrective markets which reek of complacency and a general lack of panic.

So, the issue then becomes what this oversold condition means to us given the current backdrop of this particular market.

In prior instances during this bull market, abruptly oversold conditions presented an excellent buying opportunity to spring price back to fresh highs in a V-shaped manner.

Nonetheless, the argument in these Strategy Sessions is that we are dealing with a…