The recent spike in many commodities has led to countless sensational headlines, including the fact that cotton has seen its highest nominal prices since The Civil War. Indeed, trying to precisely time tops in strong bull markets is as tough as it gets. However, there are certainly times along the way when it is correct to back off the action and wait for better entry points, since even bull market corrections can be fierce and unforgiving to complacent longs.

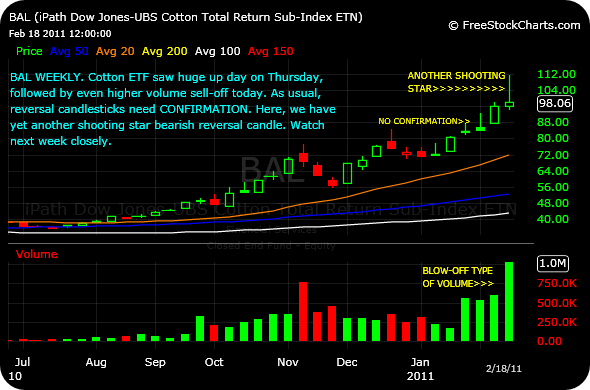

Over the past two months, equity and commodity bulls have aggressively fought off any semblance of a modest pullback. With that said, cotton finished this week with extreme volatility and volume, with a huge gap up on Thursday, followed by an even higher volume selling affair today. The net result is a weekly candle that is often referred to as a bearish shooting star reversal candlestick, where price spikes up only to be aggressively faded to close the given time period of the candle near or at the lows (In this case, a week on the weekly chart). A few weeks ago, I noted that cotton printed a similar candle, albeit not quite the monstrosity of this week’s. However, the bears proved clawless, and cotton promptly ripped higher to negate the candle. As always, the absolute key to acting aggressively on a reversal candlestick is CONFIRMATION–In this case downside follow-through to the bearish shooting star.

In other words, if commodity bears are going to make their move–If only for a few weeks–then they had better make progress next week. If not, then we will know that the commodity inflation genie is so far out of the bottle that he’s already traded it in for a nickel.

_____________

If you enjoy the content at iBankCoin, please follow us on Twitter

chess,those shooting stars remind me of croque mallets, getting ready to kick the next candle up higher. jimmy rodgers certainly is somewhere smiling. the cotton bull has been running for a couple of yrs now,and should stay pretty much that way, according to the bow tie, at least several more yrs. i think that all comods will take center stage for the near and long term,its the only thing left thats a real asset anymore,they have burned every other bridge of investment right down to the homes we live in. so why wouldnt it be the real next bubble going forward.

hah–with more selling next week, watch out.