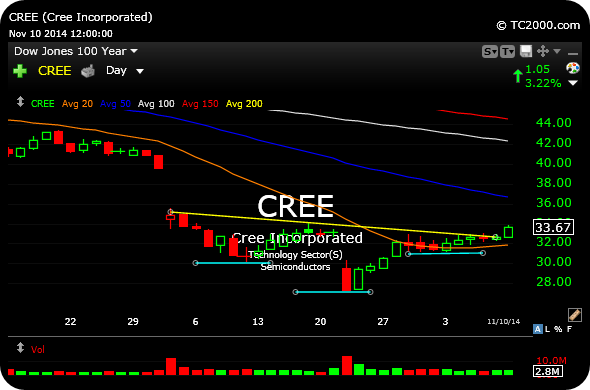

It sure looks like the weakness in the U.S. Dollar today is giving precious metals and miners a shot at bouncing back yesterday’s apparently rollover. And, yet, even if this is a bottom for the metals and miners you can expect sharp shakeouts like yesterday.

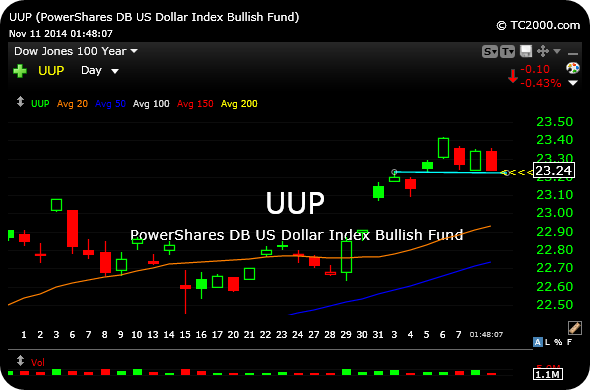

I am keying off the UUP, Dollar ETF daily chart, below, to see if it loses $23.23 to the downside (just below).

If it does, I suspect metals and miners can sustain another move higher.

Also note top shelf miners like RGLD SLW are acting quite well today–Perhaps even like leaders.

_____________________________________________________

Comments »