_________

I suppose I could post a slew of daily charts of the major indices, but they would all show essentially the same thing: A slow drip higher that is becoming laughably predictable.

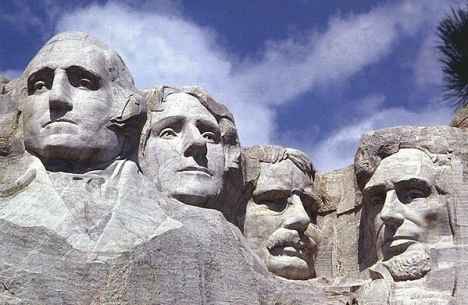

Heading into an OPEX Friday and a long weekend (market closed on Monday for Presidents’ Day), I am curious to know where you think we are going from here. Topping out? Melting up? Blowing off?

Chime in. Vent. Mock…

If you enjoy the content at iBankCoin, please follow us on Twitter

Chess,

Bottom line, as long as the QE2 POMO is still being deployed, I think we buy any dip. We’ll know when it stops working real quickly. We could see a pullback on the order of 3 to 5 or even 10%. That would make me even more bullish. It aint over til the fat lady sings, and I don’t hear nuttin jes yet.

Have a great long weekend my brotha

T_7

PS Why fight the monstah?

Meltdown thanks to domestic protests taking off in the US, shutting down a large part of the economy.

Farfetched perhaps but we’ll see.

melt up, i think, ,,, the path of least resistance, is up. why fight it. and i guess we all just have to not fall asleep and pay attention if any possible cracks show up.

I am sure, the correction, if it does happen,will come whnever it wants too.

SPY goes to 136. LT and ST updates: http://intuitivetrader.wordpress.com/

Blowoff into a March 6th top to mark the 2 year anniversary of the bull run..

I will go with ‘continued melt up’ until the news ‘looks’ good enough that the Fed says they are going to pause the purchasing program. Then we get to see just how strong the buyers are.

Perfect Storm for the upside. No jobs, no one cares; neverending UE, great; food stamps at record highs, they eat; liquidity to no end (no one knows how far); unreal easy money. Anything else?

This market will make heroes, legends, and a ton of blubbering fools by the end.

I have been looking at a peak to trough Fibonacci 78.6% around 1,375 to 1,380 before we have a correction to 1,300. I see 1,325 as a big support level on short term time frame which would break the rising wedge started back in July. The move to 1,380 likely a slow grind and continue to pull back to the 10 day EMA as a buy the dip level. Sell in May and Go Away should be the correction time period as we begin to sell ahead of the end of QE2, and then pick back up in July to start another surge to new highs. I see fair value of this market in the 1,450 to 1,500 range and fully expect us to be there come November.

All of my signals continue to be bullish, large institutional option trades are buying out of the money calls and in size, and large profitable positions are being extended out into later months. The VIX may be seen as “cheap”, yet no one is buying puts for protection, so expect this joy ride to proceed. Until I start to see some real institutional action on the put side, I have every reason to buy the dips this market gives.

I’m a fan of the theory of continued melt up until something happens when the market is closed such as a weekend or holiday. I’m not thinking a war or anything like that as we shrugged off N.Korea/S.Korea bombing and are shrugging of the whole Iran/Israel deal and Egypt seems to be a thing of the past. I’m thinking it comes from what hasn’t been thought of like in Jan 2008 when waking up to see the Dow Futures down -500 points (found to be of the rogue trader at Societe Generale). Yes there was selling before this event, but today with this melt up there are a whole lot of longs and people are more fearful today. I see initial buying off the drop only to sell into the strength.

Meh. 20% correction. Starts some at some random time. Could be today, next week, next month, or whenever. Seriously though, I can’t recall a time when we had a higher level of complacency. It doesn’t show up in any numbers that I see, but in the price action. There’s no euphoria, I would welcome that, it just seems to be a lack of fear. POMO and “the Bernak” have the market’s back. That’s what they believed of “Portfolio Insurance”.

SPY Range bound into June….BTO June PUT 124/STO June PUT 127–STO June Call136BTOJuneCall140 open for 2.35 or better scalp near term monthly on Vol pops…I am way above the site allowed age restriction but thought I would sneak this in. Thanks for your posts btw I enjoy them.