__________________

You know in this job, its hard not to become incredibly cynical and even (dare I say it?) “conspiracy minded.” But when you see some of the actions of the people in power, both at the political and financial levers (Congress/POTUS and the Fed, along with the NY Banking Axis), one wants to cry out in frustration.

It’s a helpless feeling, like being a powerful swimmer encumbered by a straight jacket. Let me tell you this straight — anyone in business, no matter their political distinction, can tell you what makes businesses work and what encumbers them.

What makes businesses work, what makes businesses hire is the ability to plan. It’s a simple as that. Successful people in business are both smart and economically (not necessarily politically) conservative. If they are given a set of parameters to work with, no matter how onerous — they will eventually figure out a way to make money around them.

It’s only when the parameters are largely unknown — thanks to a tidal wave of government interference like we’ve seen in succession with Obamacare and the Dodd-Frank “reforms” recently enacted– that business people are left without the ability to plan for the future, and are thus frozen. Stephen L. Carter wrote a great article about this in Bloomberg recently, you should read it.

So now we are reaping the result of a frozen private sector and a gradually starving public sector (there will be no new government jobs out of the states, either, now that Stimulus is done). So what’s the answer from Ben & Co?

Destroy the Dollar, one more time.

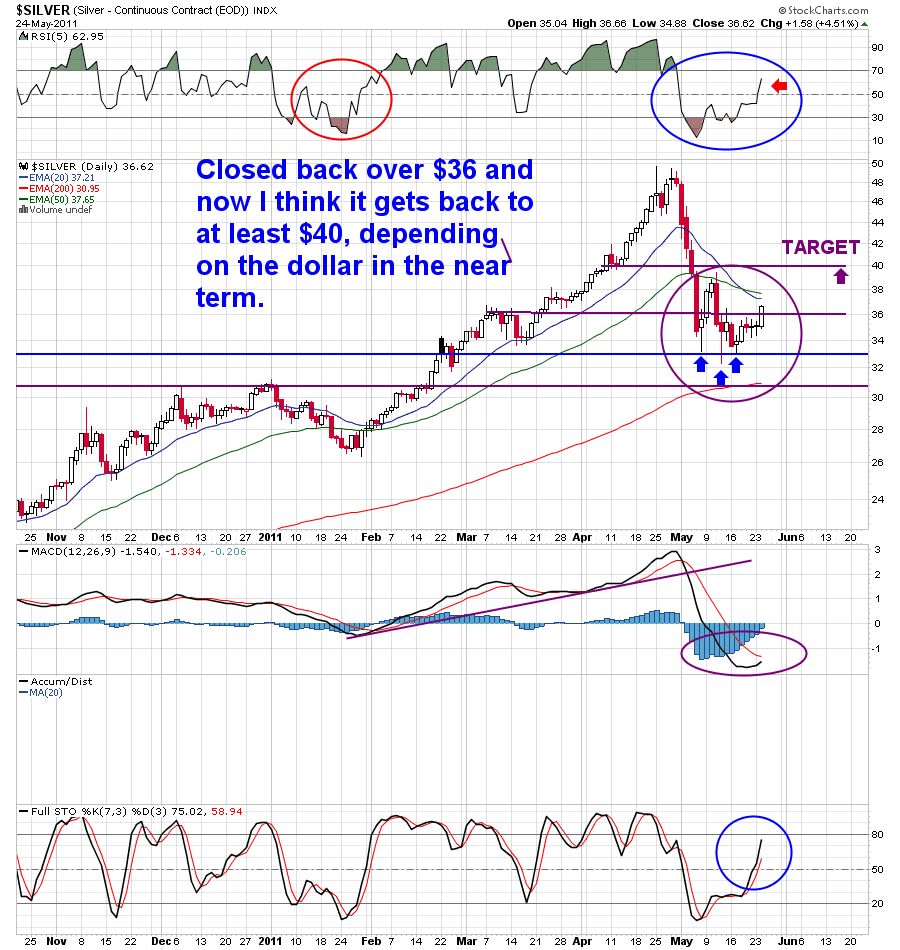

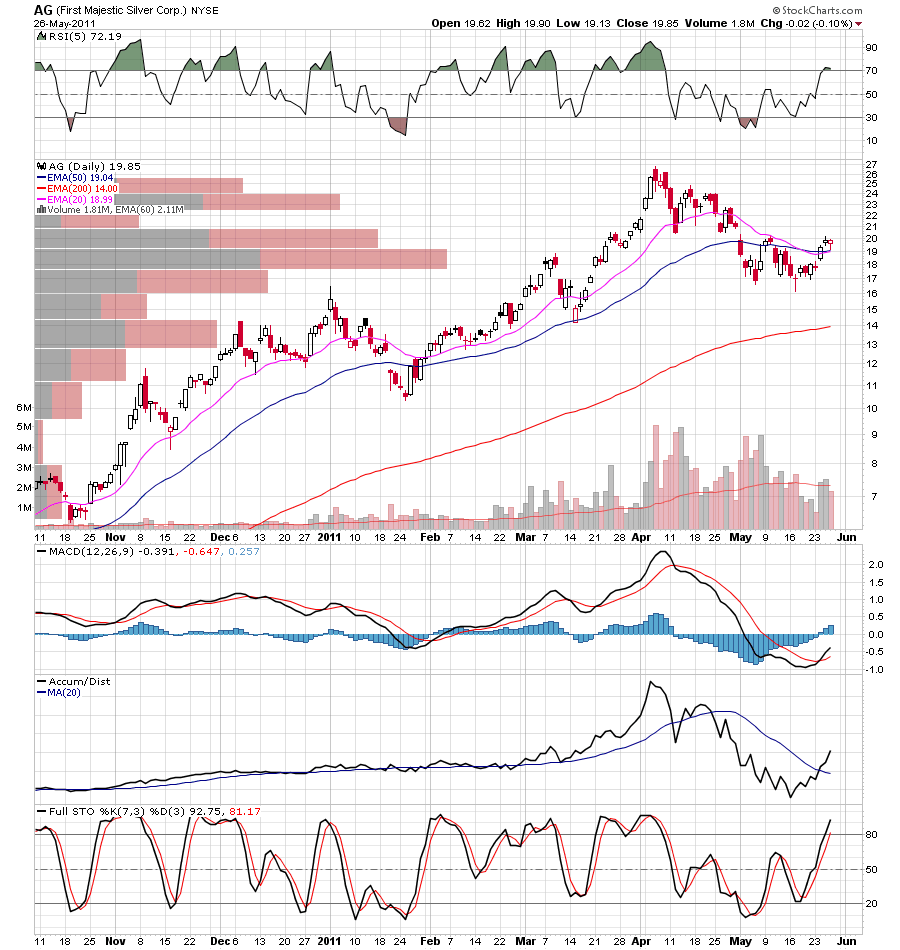

This is why I’m still in PM’s despite their hinky motions over the last couple of days. Maybe we get a dollar bounce at the lows again, I don’t know. But they are killing it today, and who can blame them?

What choice have they, under current circumstances?

My best to you all — and please, don’t just give up… Get involved! You may not like Paul Ryan’s “Path to Prosperity,” but dammit all, at least he’s offering solutions.

C’mon intelligent people of the world, we need to put our heads together now, our countr(ies) need us.

Best to you all.

_____________________________