The yield curve is widening today, which is providing succor to the banks. Remember, they’ve been surviving off saltine crackers and repurposed salt water for the past 5 years. Should rates go up, their margins will expand. Should H. Clinton get elected, their clout will spread like the mist in the movie The Fog.

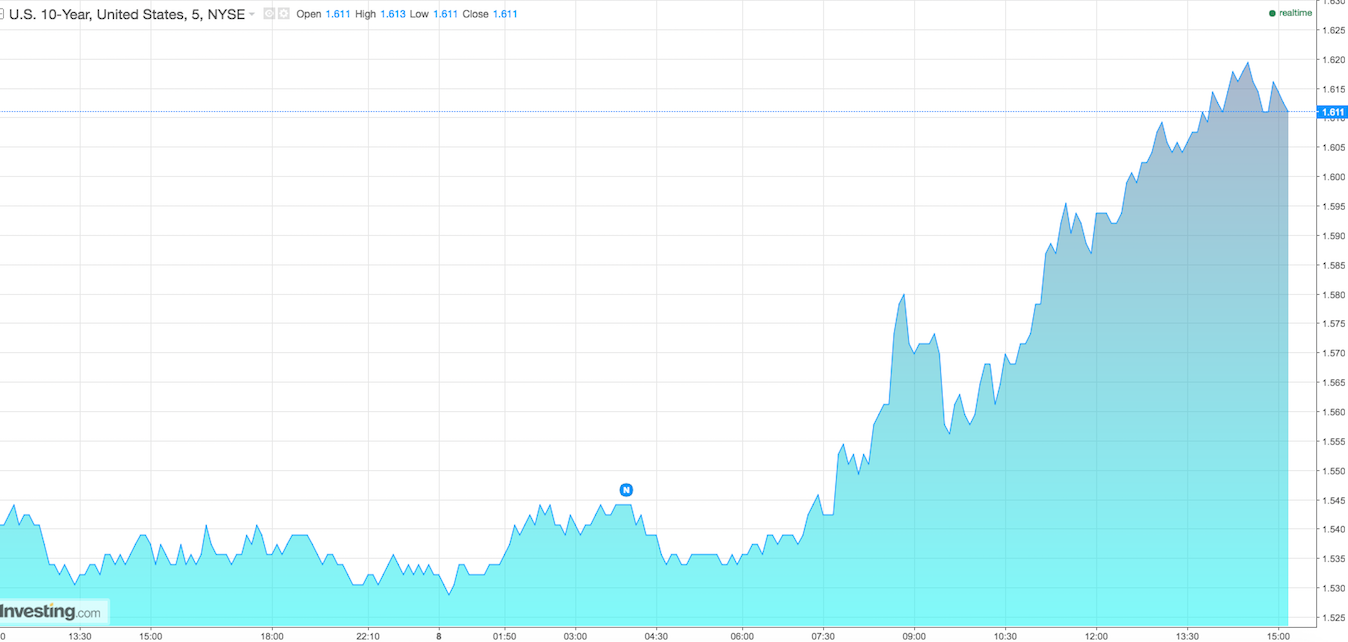

As a result of both Draghi declining to extend the ECB’s QE, and hawkish comments out of Fed’s Rosenberg, bonds are getting hit, globally. I believe this was coordinated to get Europe out of the negative rate mud hole they were stomped into.

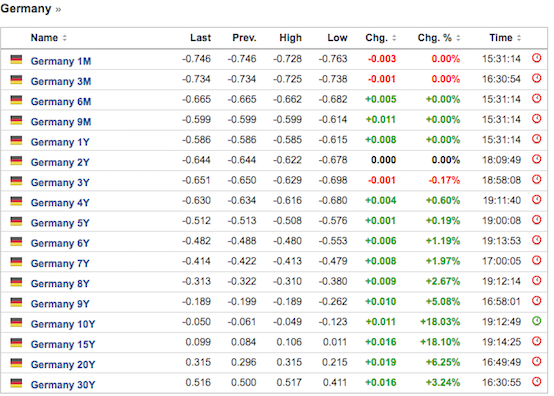

German bunds are now positive yielding, miraculously.

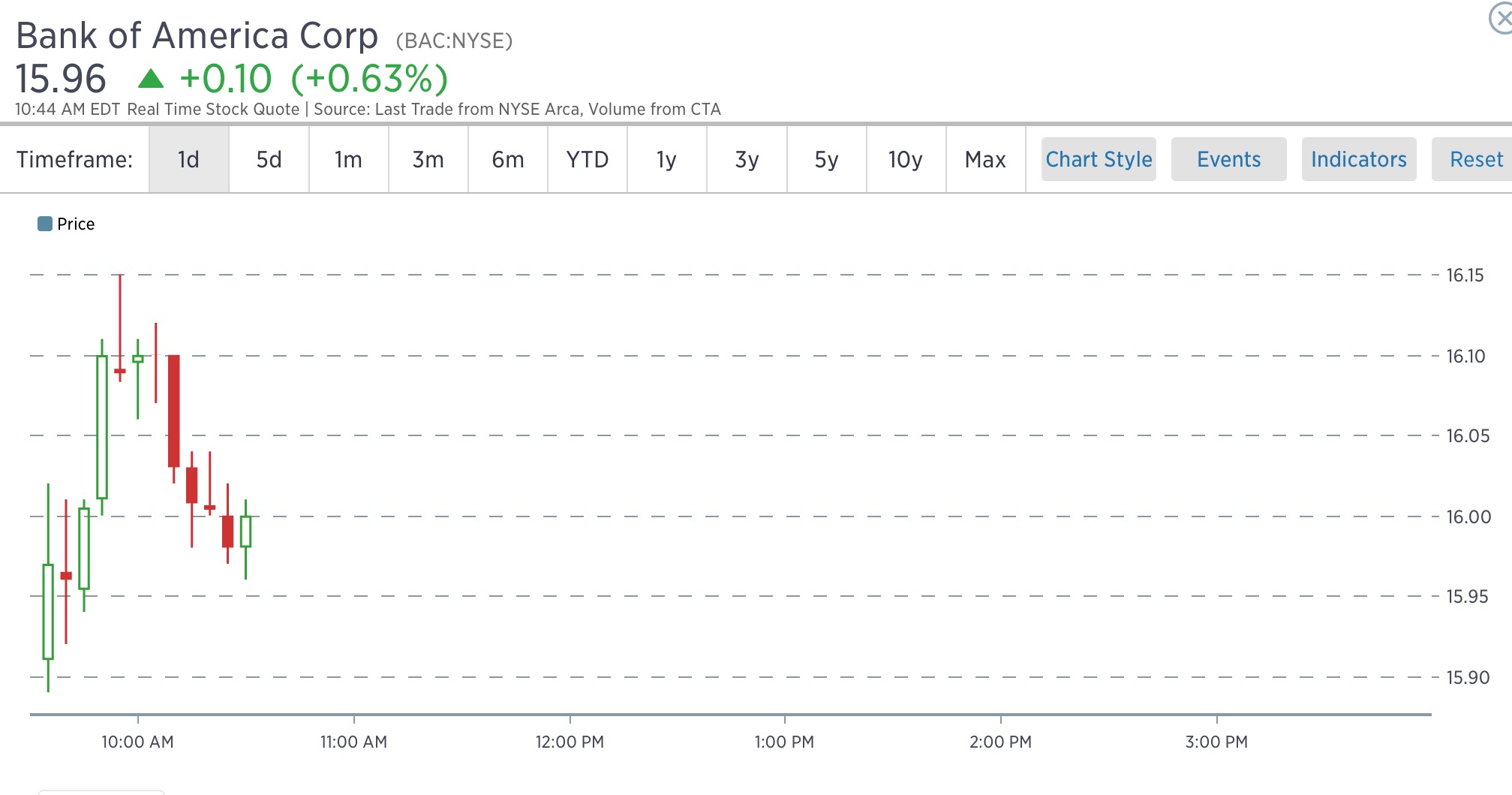

Also, in spite of the fact that the Dow is off by almost 200, most banks are outperforming.

We can make a few deductions from this price action.

1. This sell off is controlled and within the realms of reason.

2. Banks are in a position, both here and in Europe, to make more money with higher yields.

3. Markets aren’t forecasting an economic slowdown, otherwise the banks would be diving.

4. Traditional safe havens, like bonds and gold, aren’t safe today. As a matter of fact, BAC is safer.

5. The primary driver for lower treasuries is lower bunds. The two are intermingled. The bond sell off started yesterday, following Draghi’s comments, not today.

It’s a slow Friday afternoon, so I won’t read too much into it. Just keep your eye on the dollar, for it possesses the power to single handedly make a giant mess out of global trade and FOREX markets. Should you start to see buying enter the bond and gold markets, at the same time markets dive lower, then we have a real problem. Unless otherwise, this is a standard milling about the edges of the market sell off that is more likely to be viewed as constructive than destructive, even though I’d greatly prefer the latter.

Comments »