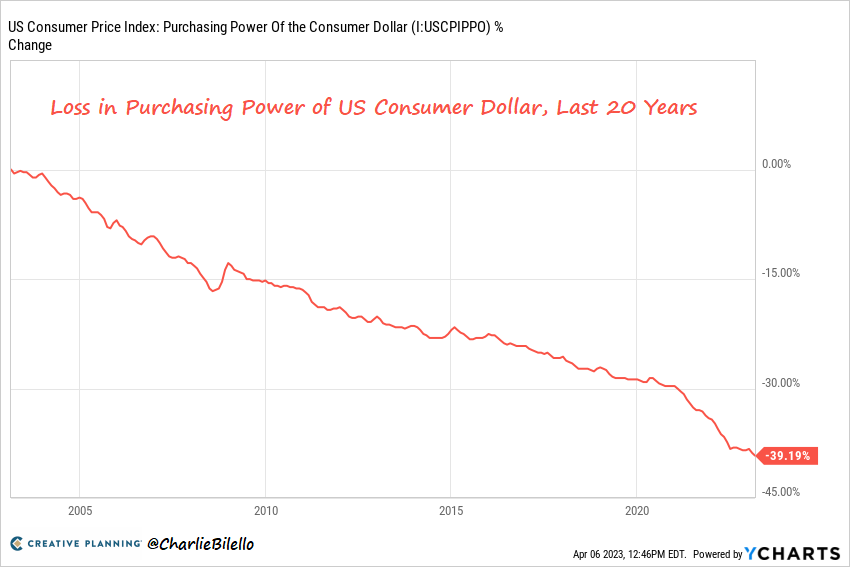

One thing is indelibly clear, whether you’re long or short the market, the overall trend of purchasing power for fiat currencies, specifically dollars, is straight down. We had a brief respite only in 2008-2009, as we descended into a deflationary vortex. But other than that, holding dollars in your account was a detriment to you almost every single day of your lives.

I hear people talk about “King Dollar” often, boastful about how much better our piece of shit currency is versus the next one but at the end of the day — fiat currencies are designed to go lower. Central banks print more and do as they like with it and does not care if the purchasing power of said currencies collapses over time. If you live in America or Europe you are lucky there is a cabal protecting the currencies against the rest of the world’s, otherwise you’d see a Turkey styled rout and subsequent deterioration of public trust in the currency.

You look at $GLD and $BTC now and see they’re both at record highs. Gold is of course the old school hedge against the dollar and $BTC is a newer waive digital currency that can and will be used for purchases — widely adopted by people all over the world. The transfer of fiat to $GLD/$BTC is why they’re at record highs and I’d like to know why anyone should think this dynamic of depreciating fiat/higher $GLD, $BTC will change any time soon?

It’s also worth nothing that stocks is also a great hedge against your dollars losing value, which is the express goal of the FOMC: getting you to sell dollars for stocks to support this fucking house of cards economic system we have today, cobbled together with spit and masking tape.

If you enjoy the content at iBankCoin, please follow us on Twitter