I get this question all the time during market sell offs: “Is it too late to sell?”

But the question people should be asking is: “do I deserve to hold?”

If you’re investing and still adding to your accounts every month, you can weather through any storm via dollar cost averaging. If, by chance, you made the bulk of your money and no longer contribute to your accounts and simply sit there waiting for a miracle, ask yourself: do you feel in control?

Let me show you two things.

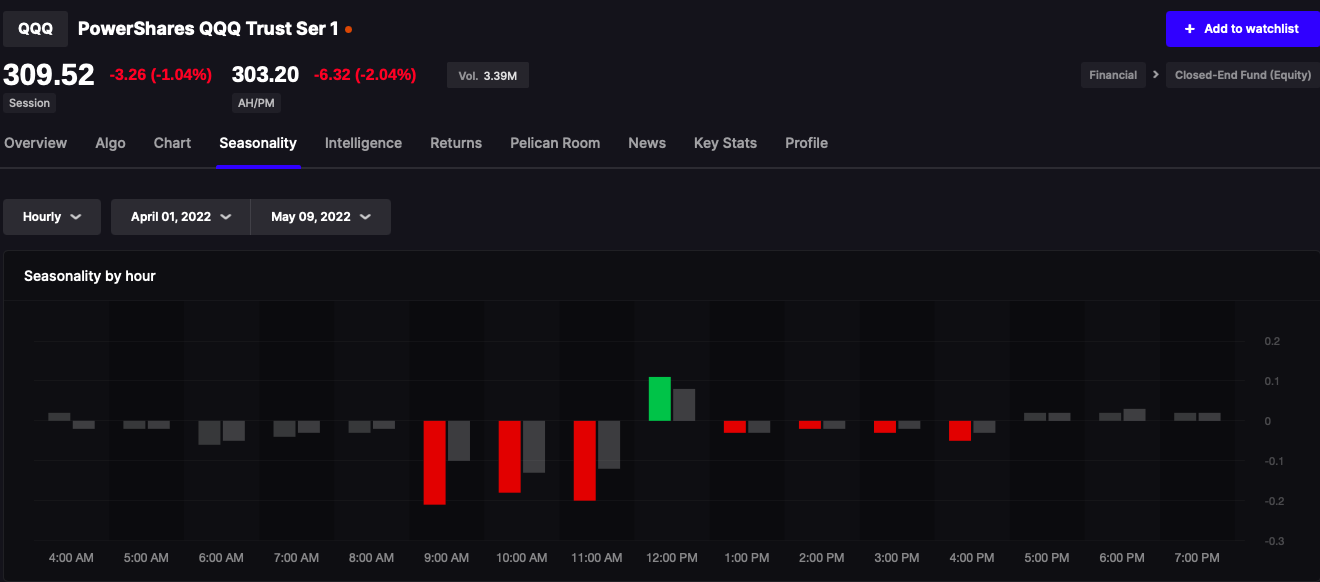

Above are hourly returns of QQQ from April 1st to now. As you can see the bulk of the losses occurs in the morning. This is because markets tend to gap down, attempt to bottom and recover after 11am, and then tank again into the close. What would stop you, for example, from buying an SQQQ hedge into the final hour of trade heading into the next day and closing that hedge each and every morning until markets improved? If you’re frozen from selling, out of stubbornness or fear, why not do something that can reduce the losses?

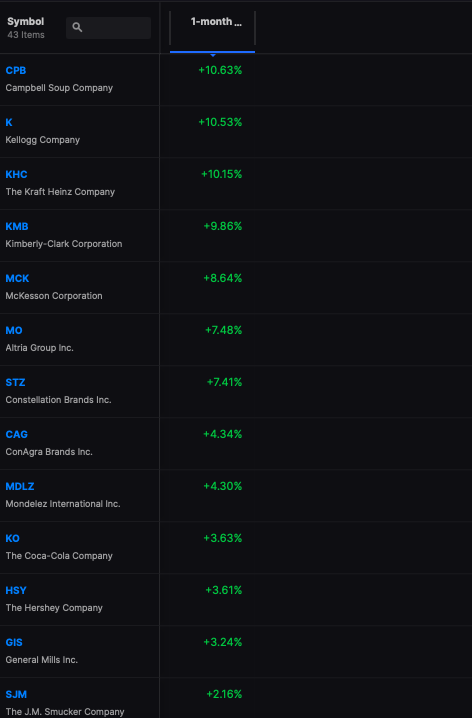

Secondly I wanted to show you an alternative market happening during this bear run. Those returns you see above all happened during the very worst of times — this terrible market. Some call them consumer staples. I call them “old man stocks.” Whatever they are called, they’re making people money — because their businesses sustain bad times and managers flock to them during times of duress. If you sold 30-40% of your tech shit and bought some defensive stocks — would it be the end of the world for you?

The money you once had in the market isn’t yours anymore. Accept the fact the market took it and it’s never coming back. You invest for the now and for tomorrow, not for yesterday. Your present account value is all that matters and your investment approach must be refreshed all the time to conform with the tape.

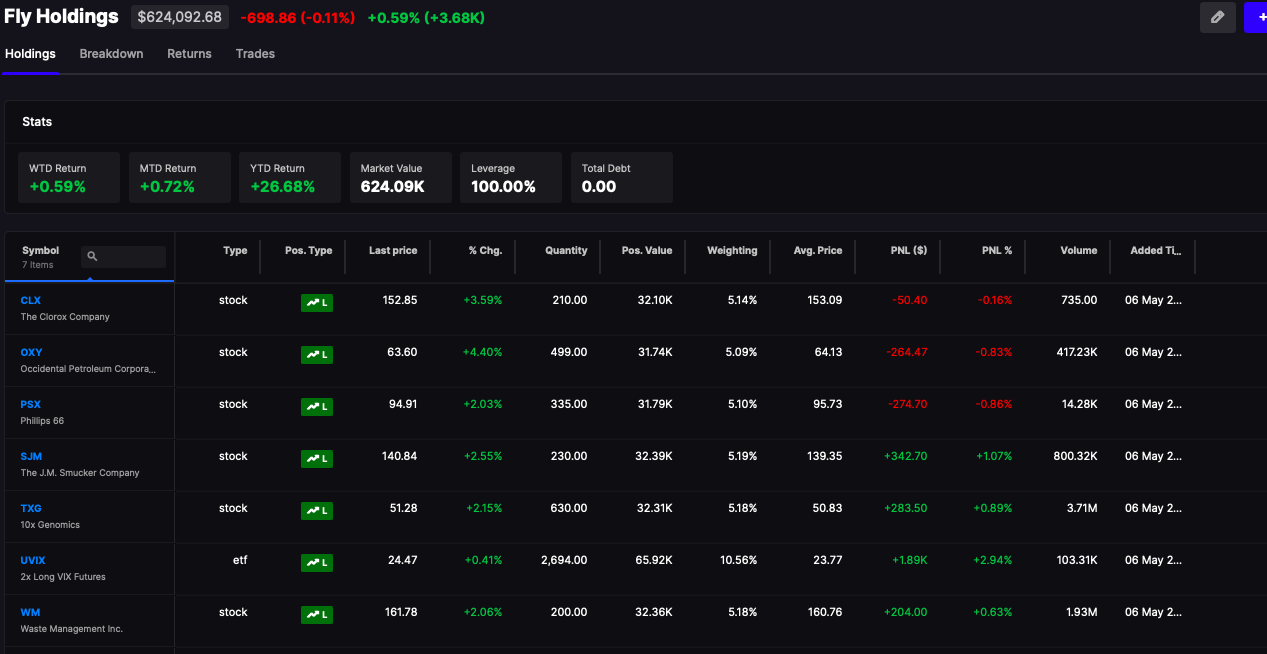

Here is my portfolio heading into today. I do not post this to boast of my +26% YTD gains, but instead show you how defensive I am now into a tape I was afraid of touching on Friday.

I am not likely to keep many of those stocks after today — because I prefer to reset all the time. If you do not have time to constantly manage your account, consider cash as an option until things get better. Or, structure your portfolios in a way that is defensive and can withstand recession. You need to start thinking ahead and understand that although markets bounce during periods of oversold, if we are heading into recession — none of those bounces will stick.

I really hate to see people suffer in the market and the reason why I started this blog many years ago was to offer some insight into how to navigate markets. I suck at many things, but have always been proficient at this.

It is never too late to sell and you can and will make your money back. You just need a plan.

If you enjoy the content at iBankCoin, please follow us on Twitter

Great post.

Energy and Ag

You’re welcome, ala “Maui”

This article is a Master’s Level course in stock portfolio management. Well done. I agree, disagree and need more information on various ideas listed in here.

This is why Buffett is at least part right. This is a hard market. Hard markets either require daily care or no care at all, depending upon your timeframe.

Fly deserves a pulitzer for his coverage of the Russian offensive on Twitter. You’ve been promoted to my front page. kudos