Let’s be clear, oil is for losers. The idea of being long crude is contrarian. To be a contrarian, you have to think differently. You think differently because you are inherently unhappy and ergo feel the need to do something that no one else is doing. The delusion is thinking you’re a leader or ‘early’ when in fact you’re not — you’re just a rebel. Being a rebel without power makes you a loser. George Washington was a rebel, but he had power. Had his power failed him, he’s be considered a loser today — moron who fell against the British Crown. You are not George Washington.

Healthcare stocks, of which I am long, are lower today. I am still heavily in cash, heavily in biotech — not participating in today’s rally. In order to prevent being a loser tomorrow, I might have to conform to the current strokes of the market. I can let my stocks go another day to see if biotech bounces tomorrow, but nothing more than a single day.

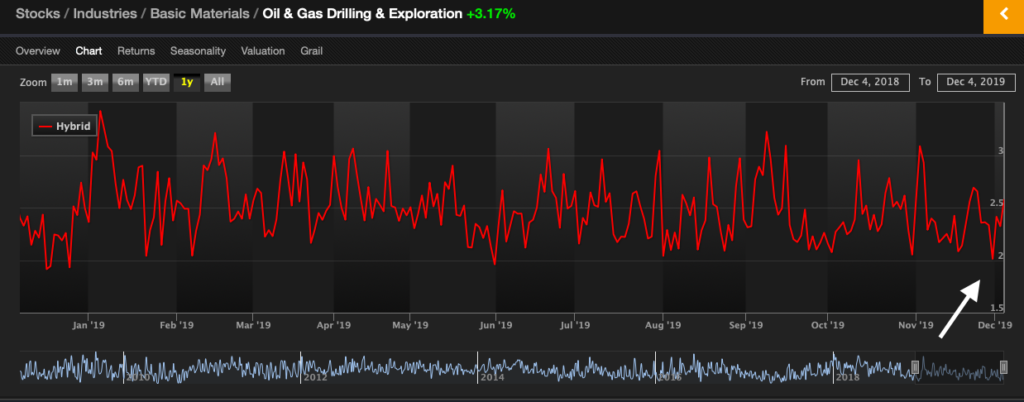

Exodus had oil stocks are extreme oversold levels as of late last week.

Today’s bounce is nothing more than mean reversion.

If you enjoy the content at iBankCoin, please follow us on Twitter

Surprised that you’ve not talked about bonds …about junk braking down out of a six month wedge yesterday …about what the masters of the universe must now be doing in order to keep things calmly bumping higher. Oil schmoil.

Nice call on TBT (although I’m still heavily bullish on long term)

Hopium is a very serious drug. The surprising thing is, the ‘big guys’ have ingested it. The Russians won’t play the deepen production cuts already agreed to. No doubt the Saudis want their IPO to go well. It’s just cool that the Saudis don’t own all the oil like in 1970s.

I was thinking about ARAMCO as well. The Saudis certainly want the IPO to go well, but more significantly, so does the *market*, as evident by the mass media’s ignoring of the Saudi’s overstatement of their oil reserves.

I was thinking about ARAMCO as well. The Saudis certainly want the IPO to go well, but more significantly, so does the *market*, as evident by the mass media’s ignoring of the Saudi’s overstatement of their oil reserves.

Given this state, I wouldn’t short oil ahead of the IPO

Noobs love ROKU, so traders love ROKU.

Yesterday’s big move on a down day should give bears caution, but this is still priced on fantasy. ROKU has no moat: TV manufactures can easily integrate their own software/hardware, while NFLX, DIS (Hulu & Disney+), AMZN, AAPL, etc compete on streming content.

I’ll have to short this one again, but I’m not looking to board the train early like last time as their is a lot of profit (on the downside) already built-in.

I’ve been accumulating XLE. With all the bankruptcies and energy companies now focusing on cash flow as opposed to production growth-at-all-costs, supply growth won’t be anywhere near as great as it has been in recent years. I think we will see the start of a sustained up move in oil prices within the next 6 months.