What?

We’re not supposed to see BAC higher on a day when spreads are collapsing, but we are nonetheless.

US yield curve now 64 bps, the flattest in over a decade. Inversion is still a long way off, right? Not really – it has flattened 64 bps in less than a year. pic.twitter.com/SzWfwiuiKS

— Jamie McGeever (@ReutersJamie) November 15, 2017

Financials are strong on an otherwise weak day, in spite of high yield getting killed once again. More on that in a minute.

JNK and all of PIMCOs high yield bond funds are getting crushed, some down more than 5% over the past 2 weeks.

Juxtapose that against treasuries and you can clearly see not all bonds are created equal. TLT is rising and hasn’t been hit like JNK.

I know this is all very data-dumpish, but bear with me as I attempt to scare you. Volatility is busting loose.

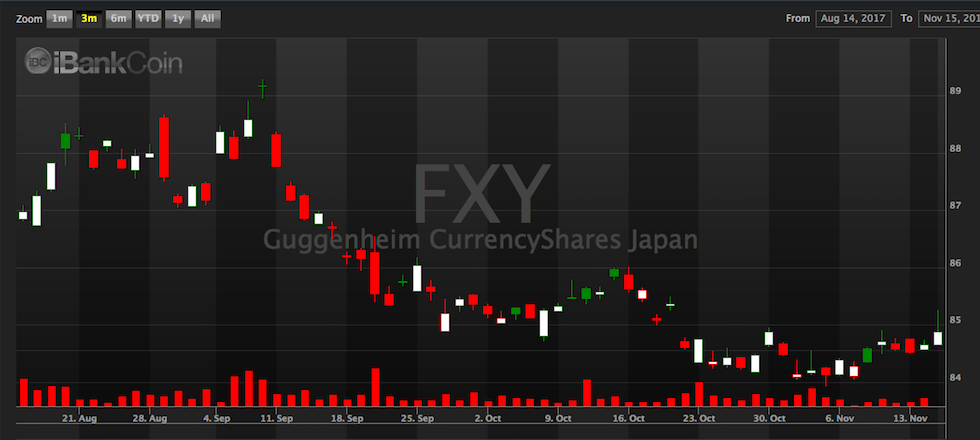

The only thing missing from the puzzle is the sharp rise in the Yen to officially spark worries of a carry trade unwind. What do you think, yen about to break higher or not?

Personally, I’d like to see a rout in NVDA, which is pretty much the poster boy of high valuation tech now, in order to confirm a true break in the market. The fact that banks are strong today suggests there is a bid in this tape, which might lead to a late date rally. Nevertheless, there are still numerous factors to be worried about, especially the breakdown in high yield credit and oil.

The only position I’d consider buying today is long Yen, but I think it’s rather redundant for me, considering my other bearish positions.

Top picks: short NVDA, RUSS, DRIP, UVXY for the laughs.

If you enjoy the content at iBankCoin, please follow us on Twitter

VIX volatility is busting loose? For how long? Oh, I forgot. My bad. That’s conspiracy theory. The rigging of VIX via VIX ETF is no longer in play here the way it used to be the front-and-center day-after-day in the casino called US equity ‘mawket’ since the introduction of VIX ETFs. Amirite?

Retail = Fucked.

BBY = ???

Add to the above a herd of wild millennial dip buyers. Going to take awhile to beat the dips into submission.

$VIX is a fraud.

It’s possible that the flattening of the yield curve is due to anticipation of a Fed rate hike coupled with foreign buyers searching for yield., and not a looming recession. Judging by how strong global PMI’s are, the global synch recovery is still on.

That’s a ridiculous idea. Yield curve flattens when economy contracts.

Debatable. Interest rate differentials in 10y govt bonds could be distorting the yield curve when our 10y is 2.33% vs .02%, .38% and 1.26% for JGB’s, Bunds and Gilts. What is interesting is how long term rates have com down while economic growth has picked up and the GOP is working on tax reform that is advertised as an expediter for more growth. Something is amiss in the spread relationship. The spread should be widening as higher growth in the economy invited higher inflation expectations. That isn’t happening—just yet.

No doubt long term treasury yields are distorted by increased demand because of historically low global yields. Regardless, the yield curve has never inverted without a recession occuring after. If it continues flattening at the same pace it could take another year until it inverts, and even then it doesn’t mean a recession is imminent, it could be another year after it inverts. But there is one coming. The output gap has also now closed, meaning the economy is running at it’s full potential and could begin to overheat. This will not reflect in inflation numbers. Low inflation is the new norm.