The morticians at Bank of America are so far ahead of everyone else, they’re planning for an end to a bull market that hasn’t even happened yet. This is financial cuckery at its finest. If I was running their division, I’d fire them on the spot for such shoddy analysis.

The bank is literally warning that the end of the bull market is at end, but we’re due for another 20% rip to the upside. Well, hell-fucking-oh, I don’t think anyone is planning for their divorce just before getting married.

souce: Bloomberg

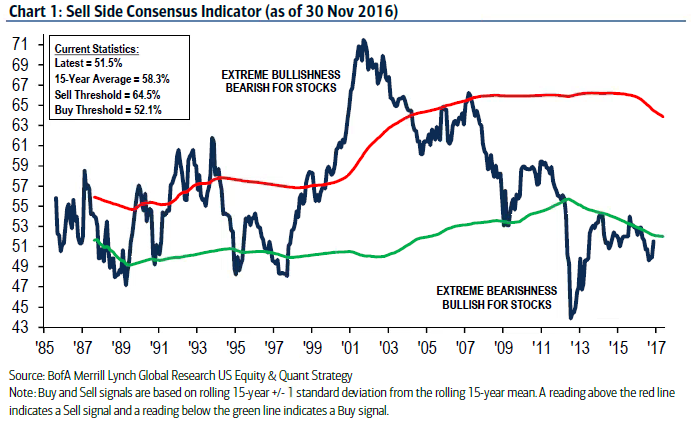

Stocks have continued to hit new highs this year despite concerns over global growth, geopolitical events, and an earnings recession. That dissonance may be coming to an end as analysts at Bank of America Corp. predict we are approaching the market’s last hurrah. The crux of the argument is that the firm’s contrarian sell side indicator, which measures Wall Street’s bullishness on equities, jumped to a six-month high in November, its biggest gain in more than a year. Right now, the index is pointing toward a rally of almost 20 percent for U.S. stocks over the next 12-months, but the analysts believe that a rally of that magnitude could mark the end of the bull run.

“[T]he post-election bounce in Wall Street sentiment could be the first step toward the market euphoria that we typically see at the end of bull markets and that has been glaringly absent so far in the cycle,” a team led by Savita Subramanian, head of U.S. equity and quantitative strategy at the firm, wrote in a note Thursday.

“The Sell Side Indicator does not catch every rally or decline in the stock market, but the indicator has historically had some predictive capability with respect to subsequent 12-month S&P 500 total returns,” the bank said.

Bank of America analysts currently have a base case call for the S&P 500 to end 2017 at 2,300, or 5 percent above today’s levels. With this indicator taken into consideration when formulating their outlook, the team’s bull case scenario represents a rapid rise in stocks. “The case for a traditional euphoria-driven end-of-bull-market rally is easy to argue for, and 20 percent or greater annual returns are the historic norm, putting the S&P 500 at 2,700 in our bull case,” they conclude, adding that their bear case calls for stocks to end the year down 27 percent at 1,600.

In other words, because sentiment was so poor, stocks will trade higher — then they will top. Gee thanks for the value add. This is something the Option Addict has been preaching the entire year, and did so with great success. If you want real analysis without cuckery, attend the last iBC boot camp of the year — scheduled to start on 12/12/16.

If you enjoy the content at iBankCoin, please follow us on Twitter

Well, there was that woman in “It’s a Wonderful Life” who donated to George Bailey the money she was saving for a divorce in case she ever got married.

The other equity division of BofA, SAVITA SUBRUMANIAN’s team, has a year end SP500 target of 2100.

They contradict each other lol

This is the quant team, not the equity strategy. Who knows what to believe haha

It’s like they’re looking for that last hurrah that will exhaust the buyers. Doesn’t surprise me they’re expecting a blowoff top. One thing I follow is margin debt levels y-o-y. We are nowhere near the levels you would expect at major tops in the market. Their scenario has some merit.

They could be right – we might have another 20% rally after the 2016 annual rate increase led 20 % sell off happens in January 2017.

The only question is will it be a V or W shaped dip/recovery?

That’s the thing, most of the time words out of analyst mouths are meaningless because they don’t provide enough context to make it actionable information.

They’re like squirrels trying to protect their nut…

It’s called a prenuptial prognostication.

Excellent Information for Bull Marketing.. Thank you.

Manshu Ydoxy

Online Marketing Consultant

http://www.ydoxy.com/