Yes! This is all very good to see. The cost to service our $20 trillion debt load has been soaring since election night, and the markets love it. More than that, the U.S. dollar index hasn’t been this high in decades — yet I seem to be the only crazy person reminding people that a stronger dollar is a bad thing for the economy,

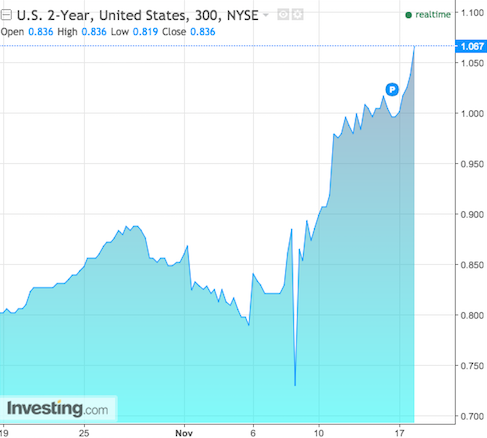

U.S. 2yr yield, fucking soaring

Dollar index, fresh new highs!

Lastly, the Chinese have decided to rig their currency more than ever. The PBOC has priced their currency lower for the 11th consecutive day.

As you were.

If you enjoy the content at iBankCoin, please follow us on Twitter

Most corporate spreads are tightening into this sell off so the pain hasn’t been that bad, even high yield. But municipal bonds on the other hand are acting like we won’t be paying any taxes at all in a few years, they are getting absolutely kicked down the stairs (current coupons have gone from 2.75% to 3.75% in just a couple of months). I haven’t looked but I bet leveraged muni closed end funds are getting crushed…I see some people calling this dollar rally the death blow to the stock market, oil may get re-priced @ 40 and gold will break $1200 if this doesn’t let up.

Moar Moar!

If the Chinese remove themselves from the RMB it shits to 10 against the dollar

If the debt is in $ and US Gov prints the $, then is the servicing of said debt an issue?

Why pray tell, is the yield curve soaring like this. Who calls this shot and makes it happen?