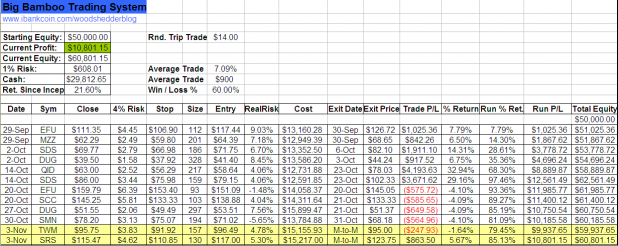

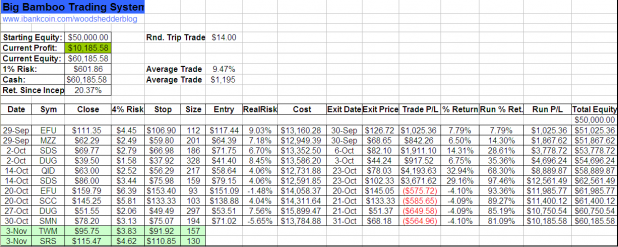

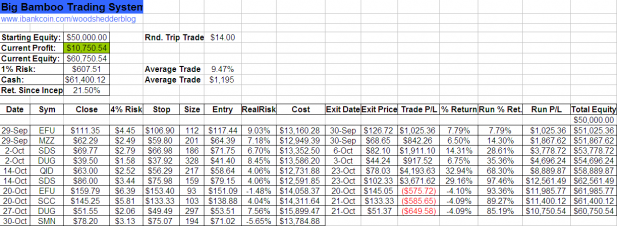

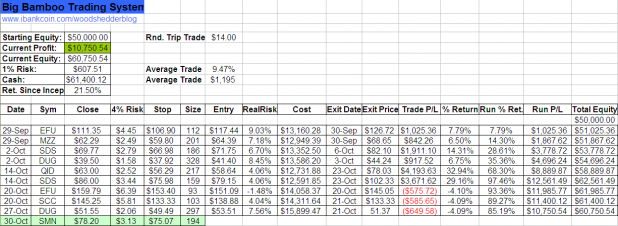

[[SMN]] was stopped out on Friday at $68.18; This was the fourth loss in a row for the Big Bamboo.

I went back and reviewed over 2 years worth of trades from this system. It has never stopped out more than 5 times in a row before hitting a winner. There was one instance of it stopping out 5 times, hitting two winners, and then stopping out 5 more times in a row.

I do expect that it will soon hit another winning streak, but I could be wrong. It could hit 20 losers in a row. But that is why we are position sizing using 1% risk. For the sake of argument, let’s assume it does hit 16 more stop-outs, in a row. Because with every loss, each new position will be smaller, we would still show a slight gain for the year, even after 20 losses in a row.

However, what if the system were all in, with 4 positions, and a large overnight gap causes each position to move past its stop more than 4%? That is certainly possible. So lets imagine that scenario happens twice in a row, with all 4 positions losing 8%, instead of 4%. The system would still show a profit for the year.

Running through hypotheticals like this is beneficial for the system trader as it can create a mentality that is strong and resolute. The system trader should be able to withstand the inevitable losing streaks without quitting the system, or signficantly altering it. Identifying some worst-case or just pretty-bad-case scenarios, and then calculating how the system would handle those, is a must.

While all of this sounds scientific and fool-proof, it really is not. Some of you may remember that I started tracking this system during a winning streak because I wanted it to start off with gains. What if I would have started tracking it from its first loser? Right now the system would be down around 4%, and the Big Bamboo may not be known by such a favorable appellation. If we were then imagining 20 losers in a row, we would be looking at a drawdown of greater than 20% from starting equity.

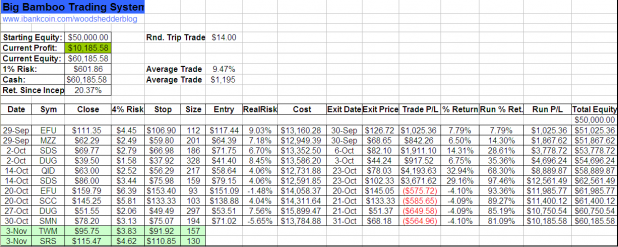

New Entry Signals

Highlighted in a pleasing green hue are the new entries for Monday: [[TWM]] and [[SRS]] .

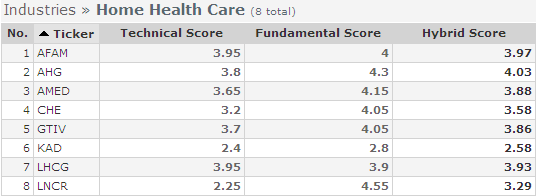

Another system I trade (which is tracked on Covestor but is not disclosed on iBC) has also generated an entry for TWM. This system, which I call the Power Double Dip, has made 42 trades with an 85% win rate during 2008, and an ROI of 157%.

But wait, it gets better. As the Big Bamboo will only take 2 new signals a day, I didn’t list the number 3 signal, which is [[MZZ]] . The Power Double Dip strategy is also choosing MZZ to take along with TWM.

I will be entering these diETFs on Monday, but I will be using a different stop strategy from the Big Bamboo. I want to give them some room to move, so I will use a stop distance of greater than 10%.

Comments »