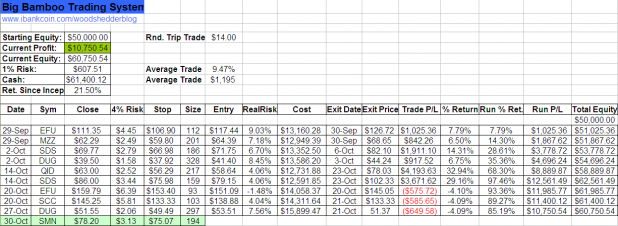

The signal for tomorrow is highlighted in a pleasing green hue.

The 4% stop on this one seems ridiculously tight. Keep in mind that when the system was first being developed, volatility was high, but nothing like it has been in October. Since this exercise of tracking a system on my blog has several purposes, I’ll continue to have the Big Bamboo keep the 4% stop level. I did put up a post with statistics which show how the system performed using wider stops.

Since stops seem to be a hot topic, I have put up a chart of [[SMN]] with the Average True Range (10) stop levels. I want to talk briefly about the pros and cons of using ATR stops.

As evident from the lower pane of the chart, ATR has gone through the roof. In one month, it has tripled. On average, SMN is moving 16.12 points a day. That is a huge spread and makes risk management a real challenge.

The 4% stop being used is .2 ATR, or roughly only 1/5 of the average daily range of SMN. This means that if SMN stalls out, or even moves slightly against this position, the stop will likely be hit.

A stop of 1*ATR can be used, while 1.5*ATR is often optimum, in my experience. However, in the case of SMN, a stop of 1.5*ATR means a stop 24 points lower than today’s close. Using such a large stop will mean buying a very very small position. For the Big Bamboo, were the system to use a 1.5*ATR(10) stop, it would be buying only 25 shares. A 1*ATR(10) would have the system buy 38 shares. Seems almost too small to be worth it.

Of course the benefits to using ATR stops is that there is much less likelihood of getting stopped out, which can increase the win percentage of a system. However, it also can decrease performance due to smaller position sizes. As volatility decreases and gets back to a more normal level, ATR will reach a sweet spot where it can keep trades from being stopped out while still allowing for decent position sizes.

For this trade, it might be worthwhile to determine another stop placement, to allow for a wide swing, but also allow for a larger position.

As I write this, S&P futures are up 2.25%. A large gap up tomorrow would be optimum, as SMN will be purchased at a discount to today’s close.

seems to be working nicely.

The 4% stop is sort of ridiculous with 200% inverses though.

Yeah, volatility is easily 2x what it was during testing of this system.

It might be that the outsized profits, larger than what was expected, might mean that the stops should also be widened.

While widening the stops will raise the w/l ratio, it will also decrease the avg. gain. But since the avg. gain has been so large, that might be okay.

hmmm, seeing how i went long XLB today, this doesn’t bode well…

Wood,

In this current gay market, don’t see how you avoid being whipsawed and slammed against an iron post with such tight stops. Just an observation.

B-rad, I wouldn’t worry too much. The system tends to win and lose in streaks. If the markets continue to melt up, it will take the BB some time to catch up, so to speak.

Alpha, got to be on the right side of the trade, from the very beginning.

Other than that, we’ll just keep it trading and let the results speak for themselves.

The only other alternative would be to switch to an 8% stop, right away, for reasons mentioned above. The danger there is that the day I adjust the stops is likely the volatility top. It’ll be trading larger stops than it needs to be as volatility decreases.

Its still in paper trading phase, so I think it’ll be more fun to keep the system running full speed ahead, to see what happens.

Let that dog run, Wood. It’s more than interesting to see the results.

Yes thanks for the time you’ve spent on this. Great stuff! It gives me something to do while my husband sticks cigars up the anal canals of animals he traps in the backyard.

Wood,

Love the system you’re using. From an engineer’s perspective, it looks like a thing of beauty. I have a few questions about the general function of the system.

– I’ve been looking for a good backtesting software package. Any that you recommend?

– Traditionally, the RSI’s done with a 14 or 28 period calculation. Was the RSI(2) the optimal value you all found when backtesting?

– I’m a little more of an options trader, but of course options are out the window right now. Out of curiosity, have you or the co-creator backtested this system using solely options? I would imagine it’d be a little more complex having to deal with liquidity in the options market, strike selection, etc. Just more out of curiosity than anything else.

Thanks!

Thanks Jorge.

So far so good this morning with SMN.

I’ll try and take some time today over lunch to answer your questions.

YOU JUST GOT WHACKED, WITH THE BIG BAMBOO

okay, okay, so that was ghey.

Thanks, Wood. The only thing this post was missing was a fractal.

flys comment on 200% inverse ( or non-inverse for that matter) is good.

I have been paper trading a simple system that tries to capture volatility; it takes both sides of the market (10,000 long and 10,000 short) and currently uses an initial 10% stop on all initial positions and also a 10% initial profit target is established. When a position hits the target the stop turns into trailing 10%.

I started about a month ago, its been very profitable.

But anyway about stops! I have been tinkering with the idea of using a formula with the VIX to automatically set the stop percentage, wondering if you have considered any such attempt to automatically adjust stops in light of volatility.

Jorge, sorry it has taken me so long to answer your questions.

As for backtesting, I find Stockfetcher to be very good for testing simple proof of concepts.

My co-developer uses TRaders Studio and swears by it.

I use Tradestation too, but it is only good really for testing strategies across a single equity or index. It will not do portfolio level backtesting.

For RSI2, I’ve yet to read a study on RSI that shows any period setting other than (2) having an edge. To be clear, I’m not sure that there is any edge to using RSI unless using a 2 period setting. Certainly our testing for RSI(2) shows that it works to help catch short swings.

Re: Options…Another gentleman did do some preliminary testing with options. The results were good, but I think for an EOD trader, it adds a level of headache that I’m not willing to take on. I would like to do more testing, but unfortunately they are really really hard to backtest. Much more work needs to be done with options strategies. I think one easy way to use the options would be to split the position in half between the ETF and the options. That would keep the risk the same, but allow for some juiced returns. Although right now, options are out due to the ridiculous spreads (volatility).

Thanks for reading Jorge. I look forward to answering more questions.

Bobbie, I like the idea of adjusting stops for volatility. Using ATR stop does just that. However, it is harder to backtest.