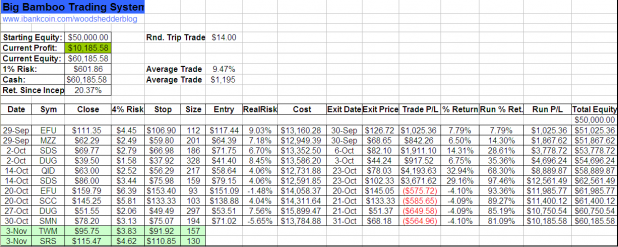

[[SMN]] was stopped out on Friday at $68.18; This was the fourth loss in a row for the Big Bamboo.

I went back and reviewed over 2 years worth of trades from this system. It has never stopped out more than 5 times in a row before hitting a winner. There was one instance of it stopping out 5 times, hitting two winners, and then stopping out 5 more times in a row.

I do expect that it will soon hit another winning streak, but I could be wrong. It could hit 20 losers in a row. But that is why we are position sizing using 1% risk. For the sake of argument, let’s assume it does hit 16 more stop-outs, in a row. Because with every loss, each new position will be smaller, we would still show a slight gain for the year, even after 20 losses in a row.

However, what if the system were all in, with 4 positions, and a large overnight gap causes each position to move past its stop more than 4%? That is certainly possible. So lets imagine that scenario happens twice in a row, with all 4 positions losing 8%, instead of 4%. The system would still show a profit for the year.

Running through hypotheticals like this is beneficial for the system trader as it can create a mentality that is strong and resolute. The system trader should be able to withstand the inevitable losing streaks without quitting the system, or signficantly altering it. Identifying some worst-case or just pretty-bad-case scenarios, and then calculating how the system would handle those, is a must.

While all of this sounds scientific and fool-proof, it really is not. Some of you may remember that I started tracking this system during a winning streak because I wanted it to start off with gains. What if I would have started tracking it from its first loser? Right now the system would be down around 4%, and the Big Bamboo may not be known by such a favorable appellation. If we were then imagining 20 losers in a row, we would be looking at a drawdown of greater than 20% from starting equity.

New Entry Signals

Highlighted in a pleasing green hue are the new entries for Monday: [[TWM]] and [[SRS]] .

Another system I trade (which is tracked on Covestor but is not disclosed on iBC) has also generated an entry for TWM. This system, which I call the Power Double Dip, has made 42 trades with an 85% win rate during 2008, and an ROI of 157%.

But wait, it gets better. As the Big Bamboo will only take 2 new signals a day, I didn’t list the number 3 signal, which is [[MZZ]] . The Power Double Dip strategy is also choosing MZZ to take along with TWM.

I will be entering these diETFs on Monday, but I will be using a different stop strategy from the Big Bamboo. I want to give them some room to move, so I will use a stop distance of greater than 10%.

Good stuff… FYI SRS triggered my limit order at 115 yesterday at the close.

If TWM gaps down I might have to buy some.

if your probability is 2 wins and 5 losses out of 7 picks. It sounds too good to be true to not play the opposite. lol

Might as well roll the dice on this one. Big Bamboo needs a new pair of shoes!!

Carey, huh? I’m not sure I understand what point you’re trying to make.

Right now, win percentage is 60%. This is where it has hovered, across all the data backtested. I am guessing that it is due to win again, although the win percentage could certainly get depressed, on its way to a long term average of 60%.

Wood, do you ever short stocks at the 200 day?

UNP is very close to 69.5 = 200 day.

I think it’s too early in the bear market to give UNP a green light and put it in the bull column. ( above the 200 is bullish)__

I think it’s at least good for an overnight trade at the 200 day, because I think it will fail it’s first attempt to get above the 200 day.

Woodshedder:

Thanks for the posts over the past week. I continue to follow your work.

Your graphs on dia, spy, and qqqq from the 28th seemed to indicate a bit of bullishness. On the other hand, the bamboo keeps signalling entries on the short ETFs. Am I off base on this?

Any additional thoughts and insights on this will be appreciated.

Zee, I love to short at the 200 day. That UNP looks like a great short setup! Thanks!

Pinball, I am feeling fairly bullish. Do not forget the fractal nature of markets. A bullish trend can contain a smaller bearish few days. The systems I trade are very short-term, designed to catch 1 swing. What the systems are saying is that we are due for a retracement of the previous week’s move. I look at it as two opportunities: 1 to get short and catch the retracement, and 2. as a buying opportunity near the bottom.

The Big Bamboo will continue taking short positions until it is confident that the downtrend is over. Because of that, it will be on the wrong side of the trade, until it is not any more. Hence, use stops and conservative position sizes.

Maybe it’s me, but I’d take a 60% win rate any day of the millennium.

Thanks for another great post, Wood – it sounds like great odds if the signal appeared in both systems!

You mentioned a stop of greater than 10% – would you mind being a little more specific?

Thanks!

Beware, Wood.

I’ve stress-tested Big Bamboo against several chart formations and found one that leads to disastrous losses.

When the Big Panda formation shows up in the charts, Big Bamboo gets eated.

Michael, I entered both positions using an 1.25ATR stop, which in percentage terms equals about 20%.

I am still using 1% risk, so that equates to a small position.

Great, thanks!