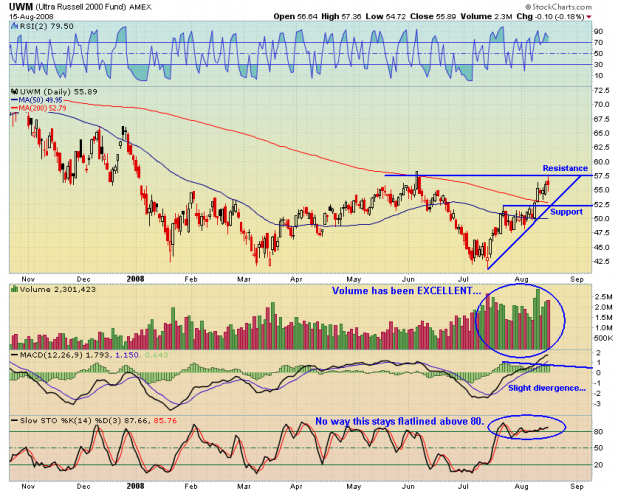

The Russell 2000 has been ripping higher, but has now reached a rather obvious point of resistance at the June high. The current trajectory is unsustainable and will be checked again soon. I’m looking for a pullback to at least $52.50

Some things to note about the [[UWM]] : Volume on the move off the bottom has been absolutely awesome. There has been some serious accumulation going on.

MACD is still strong, but is showing a slight divergence. I expect it to start rolling over. Along the same lines, the Stochastics are due to spend some time beneath 80.

What I am watching for is a break of the uptrend line, which started from the July low. A break of the line will mean the trajectory is slowing.

I ran a test tonight on the IUX, going back to 1994. A buy signal was generated when the Russell closed above the 200 day, and a sell was generated when it closed beneath the 200 day average. The average losing trade lasted 7.65 days. As this system would have had you in the Russell for 5 days now, if the index does not reverse back beneath the average, sometime this week, it is likely that it will remain above it for the next 4 months, on average.

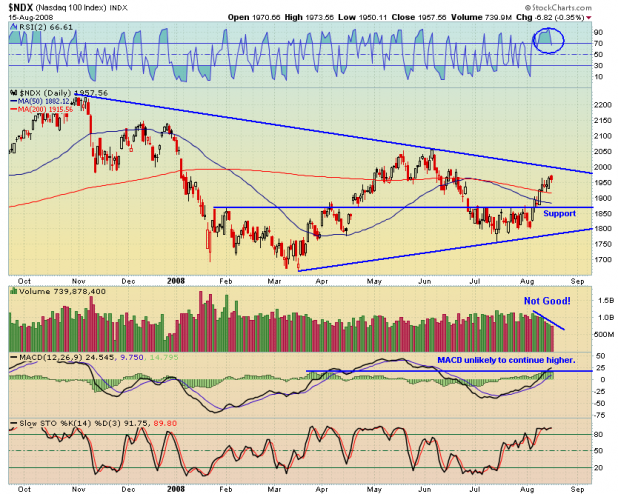

Up next is the NDX, which is the Nadaq 100 index. This one has also been strong, although it is showing signs that momentum may soon slow.

The NDX is approaching primary resistance, extending from the October 2007 high. As a contrast to UWM, volume has been slowing on the move up, which is never good.

The MACD is at a level where a reversal typically occurs, and RSI(2) has carved out an extended, albeit short-term, top.

I ran another test tonight, on the NDX, going back to 1985. The buy signal was a close above the 200 day moving average and the sell signal was a close below the average. The average losing trade lasted 10 days, while the average winner lasted 147 days. As the NDX has closed above the 200 day average for 5 days, we should watch closely to see what happens over the next week. Should the index remain above the average, I will consider the possibility of a multi-month bottom being in place.

I am still leaning long, and will continue to buy both breakouts and weakness in strong stocks. However, I will enter some double inverses tomorrow to play the downside that I am expecting.

The $RUT is in a downtrend. If you bought when over the 200 day during this downtrend you would have got panced.

Of course it is in a downtrend. We are in a bear market.

However, there is the perception that a close above the 200 day average means everything is OK.

Actually, buying the Russell when it closes above 200 day average makes you wrong 4 out of every 5 trades.

I meant to say this earlier, you were spot on today.

Thanks for the hard work.

I didn’t think anyone was paying attention, or reading. Thanks Gwar.

Hey Sheddy…

Good chartin’. You know what, I never ever ever used MACDs or Stochastics in my trading. But its all good. What’s your next move on this pullback? I sold out of ALL my inverse ETFs today. I want to step back for now and get back in when the oil-to-market/commodity-to-equity inverse relationship gets back on track.

-gio

I’m always reading.

reading but should have commented……..

looking for a bounce tomorrow and will hope for a lower high since i did not sell today. 🙁

Thanks for the charting

richard

Thanks folks…

I’m not ready to give up on the bulls yet. I’m thinking some more downside tomorrow, but then, the bulls must make a strong showing, or we will drift lower.

If the indexes weren’t up against strong resistance, I’d say this was just a normal pullback. However, this seems like a critical inflection point.

The NDX is still above its 200 day average. The COMPX once again closed beneath the 200 day average. In order for this rally to work, both indexes must stay above the 200 day, and the Russell must as well.

This week should determine which way things are going to drift.

For this call, you have earned your way out of the ghetto.

Congrats.

WooHoo! Thanks bossman. I’ll be on my best behavior.

you better fucking be. lol.

The sycophantism is sometimes galling. Can we tone it down a bit?

______

btw — I’ve been watching the Russell like a hawk for the last three weeks. Today was it’s worst day in a while.

__

THE WOODSHEDDER TOP

good call wood. I don’t always read during the day… but I always read.