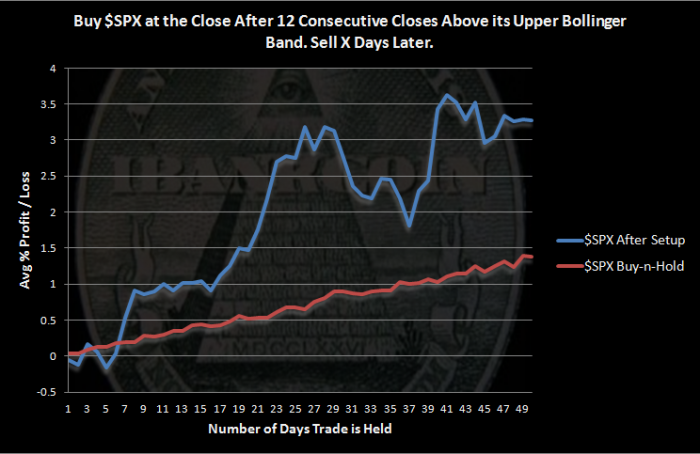

We are entering historic territory with the S&P 500 closing for the 12th consecutive day above its upper Bollinger Band (50,2). This has only happened 25 times since 1928. When the market reaches historic extremes, it is ordinary to wonder what it all means. Let’s take a look.

The Rules:

- Buy $SPX at the close after 12 consecutive closes above its upper Bollinger Band (50,2).

- Sell $SPX at the close X days later.

- No commissions or slippage included.

- $SPX history starts in 1928.

The Results:

With only 25 samples, we should be careful about drawing conclusions from these results.

If we ignore the amount of time this rally has persisted and only consider the number of consecutive closes above the upper Bollinger Band, we see that in the past the rally has been able to continue.

The $SPX buy-n-hold results were created by cutting the history into 50 day segments and then averaging those segments together.

For those who might be interested in digging a little deeper into this setup, I’ve posted below all the previous instances.

Just off the top of my head, each of those dates had at least six months to a year of good times ahead. But I expected to see a pattern relating to “valuations” or something like that, but I don’t. I guess we go up for a while longer.

Interesting study.

I plotted the DJIA against the dates of these occurrences (I know you used the S&P; the Dow is what I had at hand). A bit better than I thought: Looking out a year or so on the chart by eye, 13 times were bullish, 8 neutral, and only 3 bearish, and one of those 3 bears made new highs fairly quickly.

The odds of us going down anytime soon are not high, although as you state it’s not a large sample.

Pretty good catch about the 12 in a row, Wood.

Thanks! Its nice to have you doing some side work and confirming the studies I do!

wood,

o/t, but do you have back test results for the fidelity system 2007-09 annual basis?

Sure do. What can I tell you about it?

just wondering how defensive it did get and what the annual returns were for the periods. thanks