Let’s hit the bullet points here:

Speed – none.

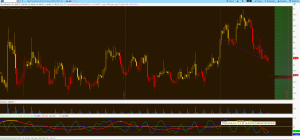

USD/JPY – at its September lows.

IBB – Likely going to close at/near $303

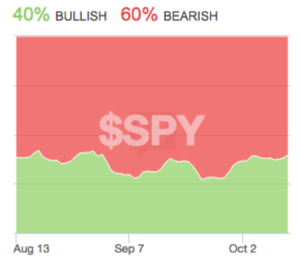

Relative strength in momo…(NQ unch)

Oil – so poised.

Semi’s, Transports, FXI, EEM – green.

In the face of some serious disaster out there ($BOFI, $WMT, etc), I’ll admit…I’m impressed. Maybe in denial, but impressed.

In other words…I’ll stay.

Comments »The opportunity to secure ourselves against defeat lies in our own hands, but the opportunity of defeating the enemy is provided by the enemy himself.