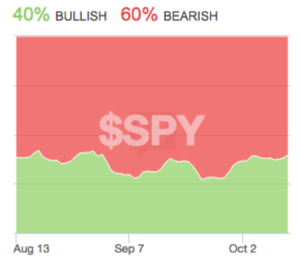

Trying to be objective. Here’s the days action in SPY. Mind you the majority view this move as bearish.

Trader’s were given a gap down to engage. They took action. The current drifted lower until any longs at the open were stopped, or changed their mind. Late buyers that engaged here were given the negative feedback loop.

I didn’t take a trade today. First time in 2 weeks.

I was intrigued by the number of traders wanting to engage the market on the downside here. Who wouldn’t after such a winning streak?

Anyway, what’s the pain trade?

Speed was my #1 signal I wanted to watch this week. In my opinion the market was walked down. No speed.

Should the speed change, I’ll adjust. This action confirms my opinion of range bound week this week, especially when we gap up tomorrow.

OA

If you enjoy the content at iBankCoin, please follow us on Twitter

The current resistance level was pounded 3 times, and finally gave up today There will not be a 4th try. There is no gap up tomorrow. Is it a sell-off? Maybe not, but we’re not moving any higher right now.

At all? Promise?

oh wee!!! OA guaranteeing a gap up tomorrow 😛

No one I know likes this market. Whatever that means.

Agree Mr. Addict, big pain trade is up

Why up? Chop seems most painful. Don’t reward bears, don’t reward bulls. Yen not pointing to any big move higher either… high yield tame… some nice stock leaders traded well under the surface today, like GOOG, but risk was clearly off (see IWM, XBI, etc.)

Longs stopped out, Shorts left short.

Interesting. Sounds great to me…

If I’m going to bleed, I want to bleed slowly…. at least that’s what I overheard bchu saying.

i actually bled fast today with LABU and UWTI

How about another gap down tomorrow, sell off, close on the highs.

Remember tomorrow is supposed to be a Red day, so what ever the open we are supposed to reverse it

why is tomorrow a red day?

Added a few more FIT NOV 50s

OA – any opinion on crude?

FWIW I was shopping at local Dicks Sporting Goods and at checkout was display for both GoPro and Fitbit. I asked the sales gal how they were each selling. Said she sells tons of Fitbits and has not sold one GoPro. Thinking GPRO shares are trading consistent with sales trend. Not all gadgets are created equally…

VMW and GPRO getting slugged in the guts, investment banks in a downgrade war.

Healthcare and energy continuing the downward spiral.

Oil below 50 Bbl will happen. There are too many wells pumping too much oil.

OA- any concern re: yen? Didn’t really confirm/support equity move higher and is flirting with danger here…

Flirting with danger? How so?

Trading at edge of range; looks like a breakdown (i.e. Dollar strength relative to yen) is happening. Also, closer to middle of range while the s$p at top.

Breaking? It’s down .03%.

Wasn’t it at these same prices with the S&P at 1860? Not sure why this is danger.

Yes @ 1860, which is also why I thought that equities overshot lower though… Just seems to me equities are getting ahead of themselves relative to yen.

It might be best to wait for a yen signal then. Thus far equities are comfortable with this range.

if you align a chart of usd/jpy against SPY, technically equities are pretty far removed from where the yen is. We should be much closer to the beginning of the year range.

Thanks. Always appreciate your perspective.

Was thinking an alternate high pain scenario would be to retest lows again. Lots of chatter about a W-bottom in equities and bears have pretty much capitulated.

That said, still think the chop scenario is the higher probability pain scenario.

All I read today were people stroking the inverse ETFs. I don’t think they’ve capitulated. Plus a move lower let’s longs in.

Respectfully…no way.

Yeh I never like seeing the internet pumping the same position I have. Always makes me nervous.

closed shorts. Going to wait on this one.

Gap up would be nice. I have a stable of ponies I need to set free. (Oct $105 QQQ calls)

Liking location of NQ here…you still trading futures?

Long NQ, NKD and CL right now.

Tomorrow will be a pivotal day with oil inventory. I’m holding several commodity plays long hoping for the best. We’ll see what happens.

Sethster,

A.P.I. numbers come out after market close tomorrow. E.I.A. inventory at 10:30 on Thursday. This was due to Columbus Day.

Have any steel? I almost bought X calls yesterday.

Yesterday /NQ (regular hours) broke below its uptrend from 9/29 (30 minute chart) and printed a perfect shooting star (daily chart) after tagging a flat 200 day SMA. Also stoch and RSI are in overbought territory. I doesn’t get any cleaner for short entries than this. If the market wants to punish shorts, it may lure more in with a confirmation of this set-up before going higher.

There was a perfect shooting star pattern in my 1998 analogue that took place roughly in the same location.

If we gap up tomorrow you’re the man behind the curtain

No doubt

The 30 yr is now getting scared. A weekly close below 2.85% does not bode well. Will be watching the 10 – 30 spread. The fact that the spread hasn’t been closing has kept me in some long equity trades. So far the entire yield curve is just being walked down. It has not significantly inverted from the one year to the thirty year.

Wow. 10 – 30 spread up to 86 bp this morning. Peeps want 10yr paper, but don’t trust the gubmint for 30 yr paper.

That PYPL – I am loving it!

hi bro, good morning .

are you still sure gold lacks one leg lower still ..or else..

Yep.

Lol.

Looked up max option pain for TWTR this week – as of yesterday it is 30 FWIW Banks and Twitter seem to be battling at that level pretty hard this week.

Long SSO w pretty tight stop.

Stopped out already hmmm