Info-Graphic: A Natural Gas Bounty is Hurting Producers

See the graphic here.

Comments »Greed is Good, but Derivatives are Better

“The mysteries of complexity for exotic financial instruments disguise the pure simplicity of their shared origin; namely, gambling games where the house always wins. Who exactly is the casino host? Is it the exchange, the brokerage firm or the government regulators? What about the credit rating agencies, the insurance bookie companies like AIG or the too big to fail banksters? Surely, the Federal Reserve, foreign central banks or the infamous Bank of International Settlements, must be the bottom line keeper of the cage.

Each play their role and share or lose according to the screenplay script written for all those speculators. Money is the medium to buy in. Volatility is required to maximize percentages. Risk is predetermined when the wheel of fortune is rigged. The HOUSE never loses in the end when the public is the last resort to cover foolish bets.

Sovereign wealth funds are governments in drag. The chorus line in this elaborate production entertains only the backers of the show. The audience is the butt of jokes as they pay top dollar to enter the arena. Greed keeps the doors open as the barkers create the allure of easy money. What is wrong with this financial model and how long can this play on the great Green Way of Wall Street?

That is where derivatives come to the rescue. Wikipedia says, “a derivative is an agreement or contract that is not based on a real, or true, exchange, i.e.: There is nothing tangible like money, or a product, that is being exchanged.” Roy Daviesrefines the definition accordingly, “Derivatives are financial instruments that have no intrinsic value, but derive their value from something else.” Since the common denominator is that there is no inherent, natural or real value changing hands, any swap of an intangible, but imaginatively designed financial instrument, could qualify in the broadest sense as a derivative. Does this make any sense? Well, only addictive confidence thieves, who masquerade as respectable traders of markets that do not exist in the real world, would see this as the new normal.

Futures and options have a long record of pork belly slaughter that brings home the bacon for the stage-managers of this theater of the absurd. Credit default swaps CDS, collateralized loan obligations CLO, collateralized debt obligation CDO, collateralized mortgage obligations CMO, and collateralized bond obligations CBO are relatively new in comparison. The Commodities Futures Modernization Act of 2000 falls short from meaningful regulation. “There are a set of defined rules that govern stocks, bonds, options and futures. Now that the 2000 Act was in place, the derivatives which encompass: CDSs, CLOs, CDOs and CMOs, do not have to abide by any of the standard guidelines.”

Shifting risk to anybody else is the beauty of these derivative devises. “Anybody else” was AIG, temporally, before the U.S. Treasury was left holding the bag when the game of musical chairs stopped. Hedge funds are in the business of playing a catchy tune and duck for the exit before the melody ends. Naked short selling is immoral at face value, but deceptive derivative instruments give legal cover for outlaw behavior.

Now that the banking collapse has been papered over with mountains of additional debt, just how can these bond obligations be serviced? Sensible questions are no longer significant and are certainly ignored by governments. The answer is obvious, forget about a VAT to make the payments and rule out that growing the economy is the solution. The apparent response needs to be more derivatives . . .”

Comments »David Einhorn Wins Again

Chipotle Mexican Grill prelim $2.27 vs $2.30 Capital IQ Consensus Estimate; revs $700.5 mln vs $702.26 mln Capital IQ Consensus Estimate

CMG crushed in after-hours.

Comments »$VZ Tips Investors Off on $AAPL Supply Constraints

“SAN FRANCISCO (MarketWatch) — Apple Inc.AAPL -1.07% saw its shares fall 1.1% to $637.51 in early trades on Thursday after wireless carrier Verizon VZ +1.27% disclosed “supply constraints” for the iPhone 5 in the September quarter. Verizon reported its own third-quarter results on Thursday morning, noting that it activated a total of 3.1 million iPhones — including about 651,000 units of the iPhone 5. “We had a supply constraints,” Verizon CFO Fran Shammo said on a conference call about the new smartphone, which went on sale on Sept. 21. He added that “we’re not sure where we are going to stand in the fourth quarter with those constraints,” but also said a large portion of customers are also coming to the carrier for the iPhone 4S, the price of which was cut to $99 with a two-year contract upon the launch of the newer iPhone. “

Comments »Initial Claims: Prior 339k, Market Expects 360k, Actual 388k

Liz Ann Sonders: We’ve Missed the Recession Entirely, Approaching a Bullish Inflection Point”

“Liz Ann Sonders of Schwab says we’re at an inflection point in the US economy. That’s right. She says we’ve missed the recession entirely, diverged from Europe and are now in an environment that reminds here of 1998. She offers 6 supporting points for her bullish thesis:

Comments »Here Are the Richest 24 Men Over the Past 1,000 Years

1. Mansa Musa I, (Ruler of Malian Empire, 1280-1331) $400 billion

2. Rothschild Family (banking dynasty, 1740- ) $350 billion

3. John D Rockefeller (industrialist, 1839-1937) $340 billion

4. Andrew Carnegie (industrialist, 1835-1919) $310 billion

5. Tsar Nicholas II of Russia (last Emperor of Russia, 1868-1918) $300 billion

6. Osman Ali Khan, Asaf Jah VII (last ruler of Hyderabad, 1886-1967) $236 billion

7. William the Conqueror (King of England, 1028-1087) $229.5 billion

8. Muammar Gaddafi (former Libyan leader, 1942-2011) $200 billion

9. Henry Ford (Ford Motor Company founder, 1863-1947) $199 billion

10. Cornelius Vanderbilt (industrialist, 1794-1877) $185 billion

11. Alan Rufus (Fighting companion of William the Conqueror, 1040-1093) $178.65

12. Bill Gates (Founder of Microsoft, 1955- ) $136 billion

13. William de Warenne, 1st Earl of Surrey (Norman nobleman, ??-1088) $146.13 billion

14. John Jacob Astor (businessman, 1864-1912) $121 billion

15. Richard Fitzalan, 10th Earl of Arundel (English nobleman, 1306-1376) £118.6 billion

16. John of Gaunt (son of Edward III, 1330-1399) £110 billion

17. Stephen Girard (shipping and banking mogul, 1750-1831) $105 billion

18. Alexander Turney Stewart (entrepreneur, 1803-1876) $90 billion

19. Henry, 1st Duke of Lancaster (English noble, 1310-1361) $85.1 billion

20. Friedrich Weyerhaeuser (timber mogul, 1834-1914) $80 billion

21. Jay Gould (railroad tycoon, 1836-1892) $71 billion

20. Carlos Slim (business magnate, 1940- ) $68 billion

21. Stephen Van Rensselaer (land owner, 1764- 1839) $68 billion

22. Marshall Field (Marshall Field & Company founder, 1834-1906) $66 billion

23. Sam Walton (Walmart founder, 1918-1992) $65billion

24. Warren Buffett (investor, 1930- ) $64billion

Comments »Empire Manufacturing: Prior -10.4, Market Expects -2.8, Actual -6.6

PPI: Prior 1.7%, Market Expects 0.8%, Actual 1.1%

Live Blogging the Ryan / Biden VP Debate

10:11 I’m done. Ryan is an awful debater.

10:10 DAMMIT. BIDEN JUST NAILED RYAN ABOUT ANSWERING THE QUESTION. RYAN SHOULD HAVE NAILED HIM WITH THAT AN HOUR AGO.

10:04 Jesus. Ryan says he is going to clear things up for us.

9:58 I could not tell you what Ryan said about Afghanistan. He needs to learn bullet points, and how to slow the fuck down when speaking. Own your space, son!

MOVING ON TO AFGHANISTAN

9:54 I don’t know how much longer I can stand this. Biden is so fucking annoying and Ryan is fucking terrible. Pussy.

9:52 “VP Biden, what do you suggest we do besides raising taxes on the wealthy?” Biden has no answer. Ryan is just fucking terrible.

9:51 Raddatz: Is Biden wrong about that? When Ryan tries to respond, Biden continues to interrupt.

9:49 Biden: “Let me have a chance to translate.”

9:49 Biden is so annoying.

9:48 Raddatz: Let’s talk about this 20% tax cut. Do you actually have the specifics? Do you know exactly what you are doing?”

9:47 Ryan: “There aren’t enough small business people to tax to pay for all their spending.”

Dammit Ryan, you better kill it here.

“Our entire premise is to grow the economy and create jobs.”

MOVING ON TO TAXES

Will Raddatz stop the interrupting Biden?

When Biden starts interrupting it is a clear sign that he is losing.

Biden’s only recourse during the Medicare section is to interrupt.

Biden continues to interrupt Ryan. “Biden I know you’re under duress and needing to make up lost ground, but I think we’d be better off if we didn’t interrupt each other.”

“They got caught with their hands in the cookie jar turning medicare into a piggy bank for Obamacare.”

Biden looks exactly like the actor that plays him on Saturday Night Live.

9:35 “I heard that death care argument from Sarah Palin.”

9:34 Ryan might see some traction on Medicare. He blew it on the economy.

MOVING ON TO MEDICARE

9:32 Ryan made a mistake asking Biden if green stimulus was a “good idea.”

Ryan hitting Biden on his overseeing the Green Stimulus snafus.

9:30 Ryan: “Let’s not forget they had 1 party control. They could have had whatever they want.”

9:30 BLAME BUSH!

9:28 Biden goes for the sympathy play. I bet that is his ace in the hole.

9:27 This is a man who gave 30% of his money to charity. Ryan kills on the joke about Biden’s gaffes. “”I think the vice president very well knows that sometimes words don’t come out the right way.”

9:26 Ryan outlining the 5 point plan. “Let me tell you about the Mitt Romney I know.”

9:25 Ryan kills on the Scranton line.

9:25 2 minutes in and Biden still hasn’t answered the question. Ryan’s turn.

9:24 Hahaha Biden doing his best angry man. Damn, he’s so angry! Lol Nail him Ryan, right now.

9:23 HAH, Biden fits in the 47% line.

Can you get unemployment below 6%? Biden not answering the question! Nail him on it Ryan.

9:22 STATE of OUR ECONOMY

9:20 Ryan showing signs of life. Finally Raddatz causes Biden to pipe down.

9:20 Biden: “Facts matter, Martha.” Biden starting to show is ass. Good ‘ole Joe! Let Joe be Joe!

9:18 Biden: “This is a bunch of stuff.” More lying liars routine.

9:17 Has the moderator, a la, the one who looks like a mistake made in a coal mine, challenged Biden yet? (Good line, Fly)

9:16 Ryan: “Instead of meeting with Bibi, Obama went on a talk show.”

9:14 Biden chuckles, “Incredible..” He will hammer the lying liars theme all night. I’m almost 100% certain Biden will dominate Ryan tonight.

9:14 WTF is Ryan talking about?

9:11 Ryan sounds like a frightened little pussy. Man up.

9:10 Biden: “We weren’t told they wanted more security [in Benghazi].”

9:08 Biden: “That is all a bunch of malarkey.” Biden is already on the Romney Lies theme.

9:06 And Raddatz is already on the attack, asking if Romney’s statements were appropriate.

“It took the President 2 weeks to acknowledge this was a terrorist attack.” I think Ryan is going to do poorly. Just saying. His opening salvo has me worried.

9:04 Biden is 69 years old. The hairs on his head look like they may have been transplanted from an aging horse.

Raddatz starts immediately with Benghazi. I guess she’ll get the hard stuff out of the way so that no one remembers at the end of the debate the huge cover up made by Obama.

9:02 Biden has some shiny, shiny chompers.

9:00 Raddatz has a Leno chin.

Comments »Hungarian Billionaire, Thomas Peterffy, Takes Out Ad To Warn Against Socialism

Al Gore is THE GREEN BANDIT

The man who was within sight of the presidency 12 years ago has transformed himself, becoming perhaps the world’s most renowned crusader on climate change and a highly successful green-tech investor.

Just before leaving public office in 2001, Gore reported assets of less than $2 million; today, his wealth is estimated at $100 million.

Gore charted this path by returning to his longtime passion — clean energy. He benefited from a powerful resume and a constellation of friends in the investment world and in Washington. And four years ago, his portfolio aligned smoothly with the agenda of an incoming administration and its plan to spend billions in stimulus funds on alternative energy.

Comments »Strategist Dwyer: S&P 500 Will Hit 1,575 by Year-End

“The stock market might have stumbled Wednesday, but it will soon resume its 3 ½-year rally, says Tony Dwyer, chief equity strategist at Canaccord Genuity investment bank.

Indeed, he tells CNBC the Standard & Poor’s 500 will hit 1,575 by year-end. That would represent a 10 percent gain from Wednesday’s close of 1,433. The index dipped 0.6 percent Wednesday.

Dwyer sees a correction to last for a bit first, sending the S&P 500 to 1,400, “but at the end of the day, we’re in the economic sweet spot,” he maintains. ”

Comments »REMINDER: This Moron is Doing a Debate Tomorrow

Remembering Steve Jobs

“Apple has posted a video on its homepage today, with footage of Steve Jobs over the years speaking at keynotes and Apple events, showing images of him and the products he created that changed the way we think about and use computers and mobile devices. The video begins with the famous Wayne Gretzky quote that pretty much defines Jobs’ career: “I skate to where the puck is going to be, not where it has been.”

Comments »Buchanan: Romney Debate Performance Best in 52 Years

Mitt Romney on Wednesday night turned in the finest debate performance of any candidate of either party in the 52 years since Richard Nixon faced John F. Kennedy, with the possible exception of Ronald Reagan’s demolition of Jimmy Carter in 1980.

But where Reagan won with style and quips – “There you go again” – and his closing line, “Are you better off now than you were four years ago?” Romney crushed Obama on both substance and style.

Mitt was like a contender so keyed up by his title shot that, between rounds, he could not sit on his stool, but stood in his corner to rush out and re-engage the champ the instant the bell sounded for the next round.

Obama was mauled, with facts, figures, anecdotes, arguments, jokes, quips. A smiling Romney was on offense all night. And the president’s performance seems inexplicable.

With the split screen showing his response to Romney’s swarm attacks, he appeared diffident, sullen, pouting, flustered, petulant.

Obama made no serious blunder. Yet, on the split screen, as Romney lectured him with a stern smile, Obama seemed a chastened schoolboy, head down, being instructed by a professor that if he did not get his grades up he would not be back next semester.

Comments »$MMM Cancels Their Planned Buyout of $AVY Division

“3M Co. (MMM)’s retreat from a $550 million office-products purchase amid regulatory pressure will let it focus on an even bigger acquisition while forcing deal partner Avery Dennison Corp. (AVY) to put the unit back on the block.

Avery fell as much as 7.8 percent in after-hours trading in New York yesterday following the announcement. Investors may be concerned that Avery will struggle to get another offer and a price that comes close to 3M’s, said Ghansham Panjabi, an analyst at Robert W. Baird & Co. in New York.

“When one of the national bidders is out of the process now, then by definition there are fewer bidders for the asset,” Panjabi said. “The likelihood of the sale is pretty high. The question is, ‘At what price does it get done?’”

3M terminated the Jan. 3 sale accord to buy Avery’s office- products business amid U.S. Justice Department opposition because of overlap between the companies. The move reversed 3M’s pledge last month to keep pursuing federal approval and came after Chief Executive Officer Inge Thulin agreed Oct. 1 to pay $860 million for ceramics maker Ceradyne Inc. (CRDN)”

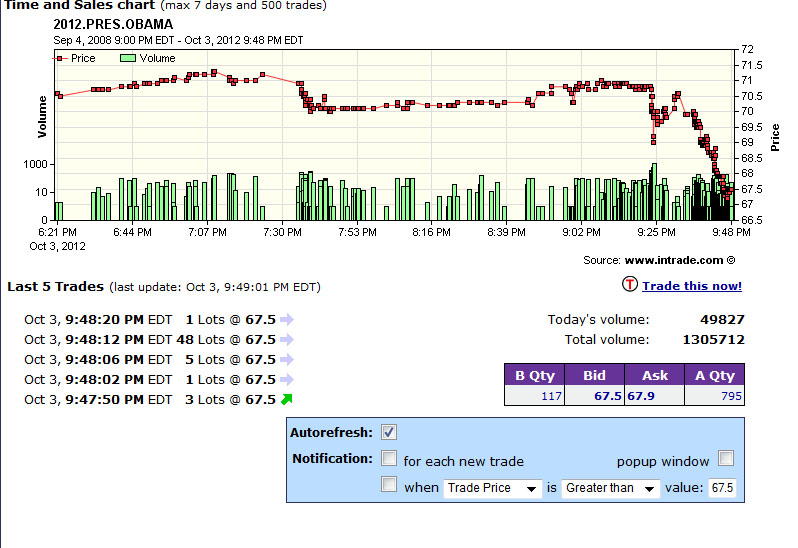

Comments »FLASH: OBAMA’S STOCK IS TANKING ON INTRADE

NEW STUDY: COFFEE KILLS

During 5,148,760 person-years of follow-up between 1995 and 2008, a total of 33,731 men and 18,784 women died. In age-adjusted models, the risk of death was increased among coffee drinkers. However, coffee drinkers were also more likely to smoke, and, after adjustment for tobacco-smoking status and other potential confounders, there was a significant inverse association between coffee consumption and mortality. Adjusted hazard ratios for death among men who drank coffee as compared with those who did not were as follows: 0.99 (95% confidence interval [CI], 0.95 to 1.04) for drinking less than 1 cup per day, 0.94 (95% CI, 0.90 to 0.99) for 1 cup, 0.90 (95% CI, 0.86 to 0.93) for 2 or 3 cups, 0.88 (95% CI, 0.84 to 0.93) for 4 or 5 cups, and 0.90 (95% CI, 0.85 to 0.96) for 6 or more cups of coffee per day (P<0.001 for trend); the respective hazard ratios among women were 1.01 (95% CI, 0.96 to 1.07), 0.95 (95% CI, 0.90 to 1.01), 0.87 (95% CI, 0.83 to 0.92), 0.84 (95% CI, 0.79 to 0.90), and 0.85 (95% CI, 0.78 to 0.93) (P<0.001 for trend). Inverse associations were observed for deaths due to heart disease, respiratory disease, stroke, injuries and accidents, diabetes, and infections, but not for deaths due to cancer. Results were similar in subgroups, including persons who had never smoked and persons who reported very good to excellent health at baseline. Full Article

Comments »