+0.5% to $29.33

Comments »Chinese Yuan Hits New Highs Versus Dollar

6.4988 to the dollar

Comments »Silver on the Way Up Again

Passing $36 now, on its way towards lighting silver bears’ faces aflame.

Comments »Earnings This Week

Monday

- A123 Systems Inc AONE

- Activision Blizzard Inc ATVI

- Beacon Roofing Supply Inc BECN

- Blackboard Inc BBBB

- BPZ Resources Inc BPZ

- Broadwind Energy Inc BWEN

- Callon Petroleum Co CPE

- Clean Energy Fuels Corp CLNE

- Dillards Inc DDS

- Diodes Inc DIOD

- Emcore Corp EMKR

- Evergreen Energy Inc EEE

- Georesources Inc GEOI

- GMX Resources Inc GMXR

- Grand Canyon Education Inc LOPE

- Jack In The Box Inc JACK

- Magnum Hunter Resources Corp MHR

- Rosetta Stone Inc RST

- Webmediabrands Inc WEBM

Tuesday:

- Acadia Pharmaceuticals Inc ACAD

- Arena Pharmaceuticals Inc ARNA

- Atp Oil & Gas Corp ATPG

- Energy Conversion Devices Inc ENER

- Harbin Electric Inc HRBN

- Ja Solar Holdings Co Ltd JASO

- James River Coal Co JRCC

- Molycorp Inc MCP

- Rovi Corp ROVI

- STEC Inc STEC

- Zagg Inc ZAGG

Wednesday:

- 8×8 Inc EGHT

- Canadian Solar Inc CSIQ

- CISCO Systems Inc CSCO

- Macy’s Inc M

- SINA Corp SINA

- Sky mobi Ltd MOBI

Thursday:

(Note: Please double check earnings date, dates are subject to change)

Comments »Osama Bin Laden’s Home Videos

[youtube:http://www.youtube.com/watch?v=779OY7IgCfE 616 500]

Comments »Flash: WATG Halted

Another Chinese burrito scam?

Comments »Flash: Lenny Dykstra Indicted on 13-counts of Bankruptcy Fraud

Mess with the banks; lose your freedom.

Classic Lenny:

[youtube:http://www.youtube.com/watch?v=floHSil9P58 616 500] Comments »Week in Review: Biggest Large Cap Winners and Losers

market cap over 5 bill

No. Ticker 1-week Return Market Cap

1 HLF 16.90 6,110,000,000

2 DISH 16.69 12,980,000,000

3 MGM 14.14 7,000,000,000

4 KEP 13.68 16,000,000,000

5 GMCR 13.31 10,430,000,000

6 UAL 12.40 8,520,000,000

7 SIRI 12.06 8,340,000,000

8 M 9.12 11,170,000,000

9 DAL 8.09 9,370,000,000

10 ERTS 7.78 7,250,000,000

11 OI 7.25 5,120,000,000

12 BAP 6.25 7,860,000,000

13 ROST 6.11 9,240,000,000

14 VMED 5.85 9,990,000,000

15 LCAPA 5.63 6,890,000,000

16 CCL 5.62 32,420,000,000

17 GILD 5.61 32,150,000,000

18 HNP 5.50 6,450,000,000

19 FE 5.43 12,570,000,000

20 YHOO 5.42 24,130,000,000

21 MHS 5.41 24,790,000,000

22 CUK 5.40 33,620,000,000

23 CBS 5.35 17,950,000,000

24 LINTA 4.98 10,510,000,000

25 CCK 4.47 6,070,000,000

——————————–

1 CSC -14.65 6,740,000,000

2 EGO -14.44 8,830,000,000

3 XEC -13.82 8,360,000,000

4 HP -13.02 6,220,000,000

5 PXD -12.88 10,330,000,000

6 LYG -12.53 59,230,000,000

7 GG -12.38 38,900,000,000

8 ANR -11.95 6,800,000,000

9 SLW -11.92 12,420,000,000

10 CXO -11.71 9,680,000,000

11 MUR -11.41 13,220,000,000

12 JOYG -11.36 9,410,000,000

13 STO -11.29 83,010,000,000

14 GGB -11.22 15,840,000,000

15 HMY -10.73 5,880,000,000

16 GFI -10.71 11,460,000,000

17 CLR -10.70 10,270,000,000

18 NBR -10.54 7,910,000,000

19 NOV -10.51 28,930,000,000

20 AU -10.40 18,460,000,000

21 BHI -10.34 30,290,000,000

22 CCH -10.30 9,470,000,000

23 WLL -10.24 7,320,000,000

24 AEM -9.97 11,450,000,000

25 MEE -9.96 6,400,000,000

CRACK SPREADS HAVE GONE FULL RETARD TO THE UPSIDE

A larger than life move in the 321 crack spreads is taking place right now, now up a staggering 6.9% to $29. We are now approaching 5 year highs.

Related: Gasoline is up more than 2%.

Comments »Greece Says it is NOT Leaving Euro

Today’s Biggest ETF Winners

1 PSLV 8.82

AGQ 8.17

2 ERX 7.28

3 EDC 6.92

4 LBJ 6.03

5 XIV 5.17

6 DIG 4.74

7 NUGT 4.70

8 GDXJ 4.67

9 UCO 4.56

10 XPP 4.36

YOKU doing a $600m Secondary less than 6 months after IPO. And why not?

05 May 2011 23:08 EDT DJ Youku.com, Investors Plan Up To $600 Mln Share Offering

BEIJING (Dow Jones)–Chinese online video company Youku.com Inc. (YOKU) said it and some of its investors plan to sell up to $600 million worth of American Depositary Shares in the company, with the majority of the offering composed of primary shares issued by Youku.

Youku said in a prospectus filed with the U.S. Securities and Exchange Commission dated Thursday the $600 million figure includes additional shares that its underwriters could choose to buy, in addition to the secondary shares to be sold by investors who invested in Youku before its initial public offering in December. It didn’t elaborate.

The firm didn’t specify the number of American Depositary Shares it and its investors will sell.

-By Owen Fletcher, Dow Jones Newswires; 8610 8400 7702; [email protected]

Comments »AIG Hits the Skids With a Fresh Billion Dollar Loss

“NEW YORK (Reuters) – Bailed-out insurer American International Group lost more than $1 billion from its ongoing operations in the first quarter, as the company took a huge charge for the termination of its credit facility with the Federal Reserve.

AIG’s Chartis unit also racked up $864 million in catastrophe losses related to the March 11 earthquake in Japan. The company, one of the top foreign insurers in Japan, had previously warned of substantial quake charges.

AIG shares, which have lost more than 30 percent of their value since late January, fell about 1 percent in after-hours trade to $30.50.

AIG reported a loss from continuing operations of $1.18 billion, or $1.41 per share, compared with a profit on the same basis a year earlier of $2.09 billion, or $2.16 per share.”

Comments »Gold and Silver Are Bouncing Higher

Gold +15.16 to 1,487.75

Silver +.20 to $34.88

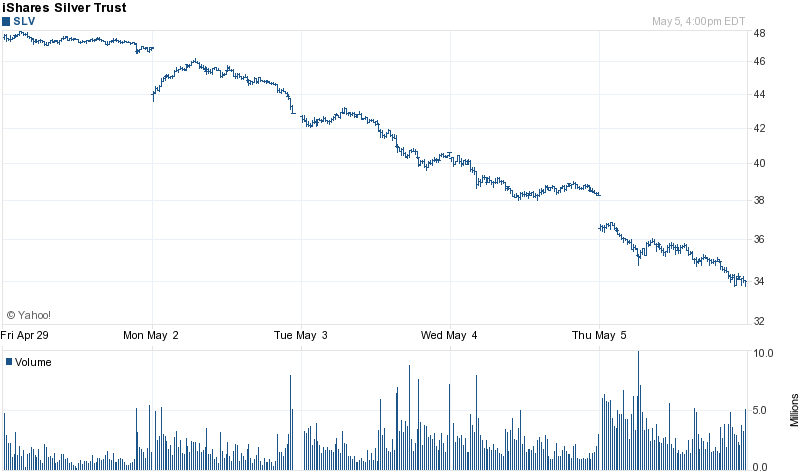

Epic Plunge in Silver Was Orchestrated

Silver has declined in value to the tune of 30% this week, the largest decline since 1983 when the Hunt brothers cornered the market. The fact of the matter is, silver was doing just fine until the CME hiked margin requirements a record 5 times over the past 2 weeks, an 84% increase in trading costs.

Comments »Oil Plunges But Crack Spreads Rise

Gasoline dropped far less than oil today. As a result, crude dropped about 10% and spreads went up 2%, nearing $28.

Comments »Silver: This is What a Margin Liquidation Looks Like

Raw Commodities Undergoing Stiff Correction

Raw commodities have been punished over the past month, following monster returns. Recently, silver has been the headline loser, due to margin requirements being lifted 4 times over the past two weeks. However, the losses were not isolated to just silver.

1 month returns:

Cotton -22%

Sugar -21%

Lead -15%

Livestock -10%

Palladium -10%

Lithium -7%

Silver -6.5%

Coal -5%

WTI/Brent Spread Tightening

Due to a sharp pullback in Brent crude, the spread is now a touch under $10, down from a high of $15 a few weeks ago.

Comments »Initial Claims:Prior 429k, Market Expects 400k, Actual 474k :(

Weather is a usual suspect, but also Japan’s crisis has been thrown into the mix for a terrible report….

Comments »