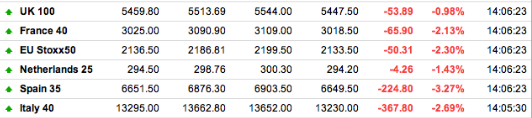

Italy was a close second at -4.3%

Comments »Market Update

Today’s Heat Map and A/D Lines

The Dallas Fed is Out With the June Manufacturing Report

“The Federal Reserve Bank of Dallas has released its report for manufacturing activity in the month of June. Some regions are seeing continued slowing growth, but the Dallas Fed district went up back into positive territory in June from a contraction in May. The general activity index rose to 5.8 in June from -5.1 in May.”

Comments »European Markets Shit the Bed Into the Closing Bell

Spain is down 3.4% after Merkel gave some commentary that makes it appear they will be less than helpful to resolve the debt crisis.

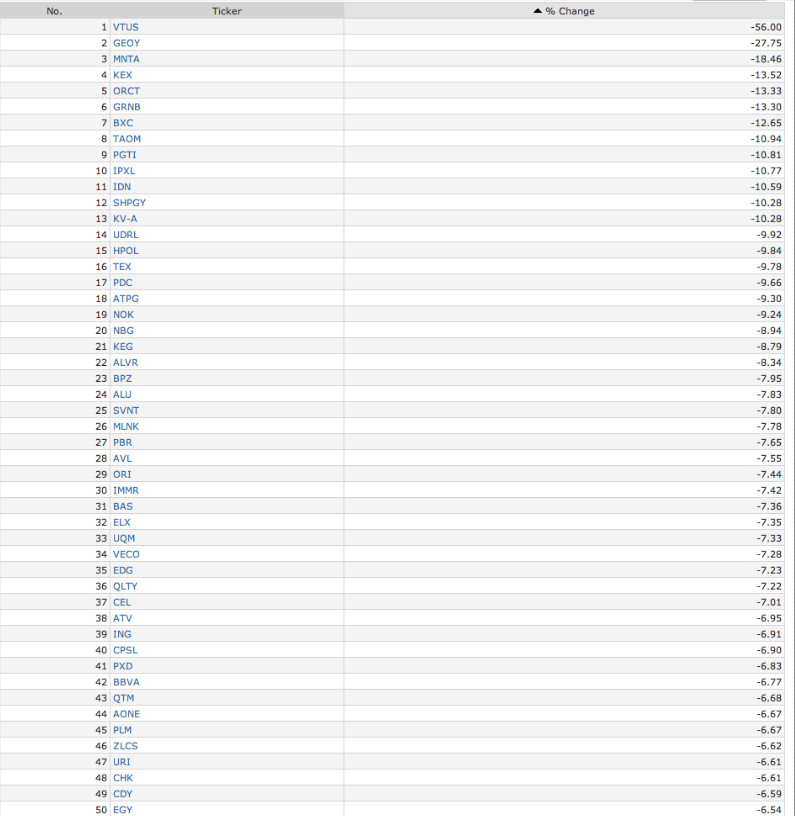

Comments »Today’s Biggest Losers

FLASH: EUROPEAN INDICES ARE GETTING FUCKED UP

Risk of Very Off This Morning

Gapping Up and Down This Morning

Gapping up

LXRX +8.9%, TEVA +7.9%, SNDK +1.8% , NVDA +0.4%, BA +0.1%, RMBS +0.9%,

STZ +1.2% , BUD +1%, WPI +1.7% , NPSP +2.3%,

Gapping down

CEL -5.1%, NOK -5%, BBVA -4.3%, DB -4%, ING -3.9%, FTE -2.8%, TOT -2.3%,

CS -2.1%, BBL -2%, STO -1.7%, RIO -1.6%, E -1.4%, ABB -1.3%, RIMM -1.2%, SD -1%

Comments »In Play and On the Wires

Global Markets Start the Week Off to the Downside; U.S. Futures Follow Suit

US/European Futures Lower in Early Asian Trade

Today’s Heat Map and A/D Lines

European Markets Fall on Weak German Business Confidence and Continued Political Folly

“European (SXXP) stocks fell for a second day as German business confidence declined to its lowest level in more than two years. U.S. index futures advanced, while Asian shares dropped.

Volkswagen AG (VOW) slid 2.2 percent, Bayerische Motoren Werke AG (BMW) slipped 1.6 percent and Porsche Automobil Holding SE (PAH3) lost 2.2 percent as Handelsblatt newspaper reported rebates on new cars rose in June. Michael Page International Plc, Solvay SA and Royal Vopak (VPK) NV dropped after analysts downgraded the stocks. Bankia SA led gains among Spanish lenders.”

Comments »Asian Markets Fall on U.S. Data, Downgrades, and Continued Weakness in Commodities

“Asian stocks fell, with the regional benchmark index headed for a one-week low, as raw-material suppliers dropped after commodities entered a bear market and reports on U.S. home sales and manufacturing missed estimates.

BHP Billiton Ltd. (BHP), the world’s biggest mining company, slipped 2.1 percent in Sydney. Samsung Electronics Co., the largest mobile-phone maker by sales, fell 3.7 percent in Seoul. Mitsubishi UFJ Financial Group Inc., Japan’s No. 1 lender, lost 1.1 percent in Tokyo after 15 global banks were downgraded by Moody’s Investors Service.

The MSCI Asia Pacific Index (MXAP) fell 1.2 percent to 114.18 as of 7:21 p.m. in Tokyo, heading for its lowest close since June 15. About three shares declined for each that rose in the gauge, which is erasing this week’s advance. More than $5 trillion has been wiped from global equities since a March peak amid slowing economic growth in the U.S. and China, and a spreadingEuropean debt crisis that pushed Spain’s borrowing costs to a record.”

Comments »Global Markets Sell Off While U.S. Futures Reach for Aspirin

FLASH: $MS ONLY GETS TWO LUMPS

Morgan Stanley issues statement on Moody’s two-notch downgrade, ‘the ratings still do not fully reflect the key strategic actions we have taken’ (13.96 -0.24)

Co issued the following statement in reaction the Moody’s two-notch downgrade:

“While Moody’s revised ratings are better than its initial guidance of up to three notches, we believe the ratings still do not fully reflect the key strategic actions we have taken in recent years. However, their acknowledgment of our long-term partnership with MUFG as well as our industry-leading capital and liquidity highlight some of the transformative steps we have taken. With our de-risked balance sheet, stable sources of funding, diverse business mix and strong leadership team, we are well positioned to deliver for clients and shareholders.”

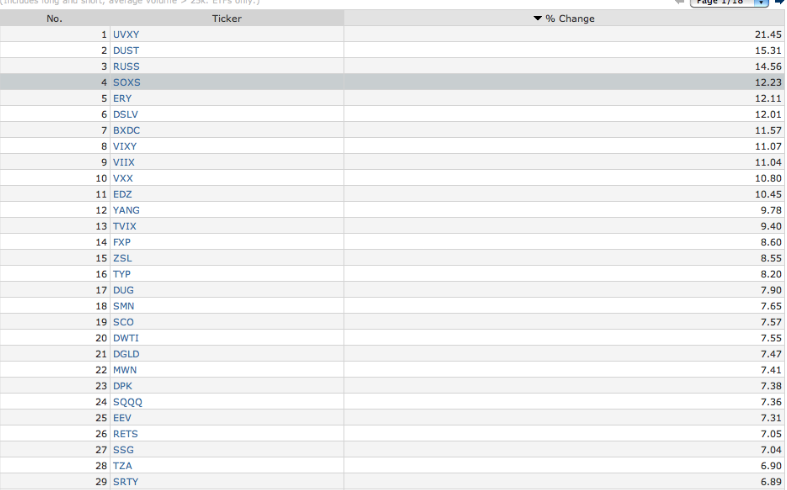

Comments »Today’s Biggest Inverse ETF Winners

Today’s Heat Map and A/D Lines

Asian Markets Sink on Poor China Manufacturing Data

“Stocks dropped and commodities declined to the lowest level since November 2010 as reports on manufacturing in Europe and China signaled output is shrinking and the Federal Reserve cut growth estimates. U.S. index futures erased declines, while Spanish bonds rose after an auction.

The MSCI All-Country World Index fell 0.2 percent at 7:33 a.m. in New York. Standard & Poor’s 500 Index futures rose less than 0.1 percent, after dropping as much as 0.6 percent. Chinese stocks sank to the lowest level since March. Spain’s two-year yield slipped 24 basis points to 4.78 percent. The euro depreciated 0.1 percent to $1.2691. The S&P GSCI gauge of 24 commodities is down more than 20 percent from the closing high in February, the common definition of a bear market. Oil earlier fell below $80 a barrel for the first time in eight months.”

Comments »