” “Although low inflation is generally good, inflation that is too low can pose risks to the economy – especially when the economy is struggling.” – Ben Bernanke

“The true measure of a career is to be able to be content, even proud, that you succeeded through your own endeavors without leaving a trail of casualties in your wake.” – Alan Greenspan

There you have it – the wisdom of two Ivy League educated economists who are primarily liable for the death of the American middle class. They now receive $250,000 per speaking engagement from the crooked financial parties their monetary policies benefited; write books to try and whitewash their legacies of failure, fraud, and hubris; and bask in the glow of the corporate mainstream media propaganda storyline of them saving the world from financial Armageddon. Never have two men done so much damage to so many people, so quickly, and are not in a prison cell or swinging from a lamppost. Their crimes make Madoff look like a two bit marijuana dealer.

The self-proclaimed Great Depression “expert” Ben Bernanke peddles pabulum about inflation being too low and posing dire risk to the economy, but is blasé that swelling the Federal Reserve balance sheet debt from $900 billion in 2008 to $4.4 trillion today with his digital printing press poses any systematic risk to the country and its citizens. Either his years in academia have blinded him to the reality of his actions upon the lives of real people living in the real world, or his real constituents have not been the American people, but the Wall Street bankers that pulled his puppet strings over the last eight years.

Now that he has passed the Control-P button to Yellen, he is reaping the rewards of bailing out Wall Street and further enriching them with QEfinity. Ben earned a whopping $200,000 per year as Federal Reserve chairman. He now rakes in $250,000 per speech from the very financial interests who benefited from his traitorous monetary machinations. I don’t think he will be invited to speak at any little league banquets by formerly middle class parents whose standard of living has been declining since the 1980s. Is it a requirement that every Federal Reserve chairperson lie, obfuscate, misinform, hide the truth, and do the exact opposite of what they say they will do?

“It is not the responsibility of the Federal Reserve – nor would it be appropriate – to protect lenders and investors from the consequences of their financial decisions.” – Ben Bernanke – October 2007

Greenspan, Bernanke and Yellen have always been worried about deflation, while even the government suppressed CPI calculation reveals that inflation has risen by 108% since the day Greenspan assumed office in August 1987. The dollar has lost 52% of its purchasing power in the last 27 years of Fed induced bubbles and busts. And these scholarly academic bozos have been worried about deflation the entire time. Since Nixon closed the gold window in 1971 and unleashed the two headed inflation loving gargoyle of debt issuing bankers and feckless self-serving politicians upon the American people, the dollar has lost 83% of its purchasing power (even using the bastardized BLS figures).

Any critical thinking person with their eyes open knows the official inflation figures have been systematically understated since the 1980’s by at least 3% per year. Should the average American be more worried about deflation or inflation, based upon what has occurred during the 100 years of the Federal Reserve controlling our currency?

I’m sure Greenspan is content and proud, as he succeeded through his own endeavors in rewarding, encouraging and propagating excessive risk taking by the Wall Street cabal during his 19 year reign of error. He exited stage left as the biggest bubble in history, created by his excessively low interest rate policy, blew up and destroyed the 401ks and home values of the middle class. This was the second bubble under his monetary guidance to burst. The third bubble created by these Keynesian acolytes of easy money will burst in the near future, further impoverishing what remains of the middle class and hopefully igniting a long overdue revolution.

Greenspan’s pathetic excuse for a career has benefitted those who owned him, while leaving a trail of casualties that circles the globe. His inflationary dogma, Wall Street enriching doctrine and Keynesian motivated schemes have drained the savings and confiscated the wealth of the middle class through persistent and devastating inflation. And it was done by a man who knew exactly what he was doing.

“Under the gold standard, a free banking system stands as the protector of an economy’s stability and balanced growth… The abandonment of the gold standard made it possible for the welfare statists to use the banking system as a means to an unlimited expansion of credit… In the absence of the gold standard, there is no way to protect savings from confiscation through inflation” – Alan Greenspan – 1966

The abandonment of the gold standard in 1971 set in motion four decades of consumer debt accumulation on an epic scale, currency debauchment, and real wage stagnation. The consumer debt accumulation was a consequence of the American middle class being lured into debt by the Too Big To Trust Wall Street banks and their corporate media propaganda machine, as a fallacious response to stagnating real wages when their jobs were shipped to China by mega-corporations using wage arbitrage to boost quarterly profits, their stock prices, and executive bonuses.

The bottom four quintiles have made no progress over the last four decades on an inflation adjusted basis. The middle quintile, representing the middle class, has seen their real household income grow by less than 20% over the last 43 years. And this is using the understated CPI. In reality, even with two spouses working today versus one in 1971, real household income is lower today than it was in 1971.

The more recent data, during the Greenspan/Bernanke inflationary era, is even more disconcerting and destructive. Real median household income has grown at an annualized rate of less than 0.5% over the last thirty years. During the bubblicious years from 2000 through 2014, while Wall Street used control fraud and virtually free money provided by the Fed to siphon off hundreds of billions of ill-gotten profits from the economy, the average middle class family saw their income drop and their debt load soar. This is crony capitalism success at its finest.

The oligarchs count on the fact math challenged, iGadget distracted, Facebook focused, public school educated morons will never understand the impact of inflation on their daily lives…..”

Full article

Comments »

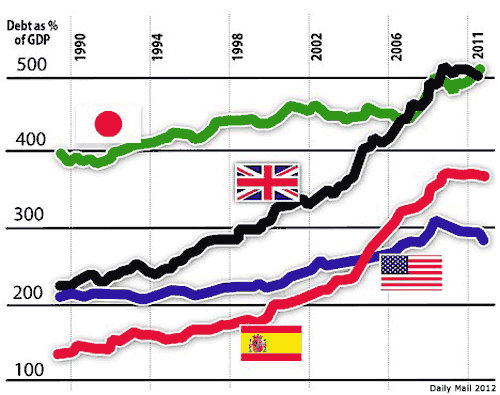

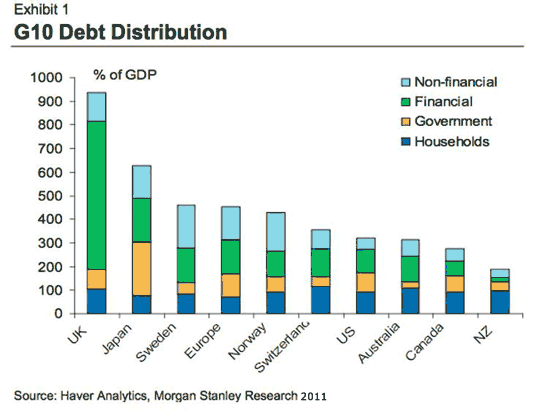

And if you think that looks bad (not that it doesn’t, mind you), there’s this 2011 Haver/Morgan Stanley one we’ve seen before here:

And if you think that looks bad (not that it doesn’t, mind you), there’s this 2011 Haver/Morgan Stanley one we’ve seen before here: In which total debt for the US, but even more for Japan and especially the UK, are much higher than in the first graph. This may largely be due to underestimating debts in the financial sector, though it’s hard to say. And for the argument I’m trying to make, it doesn’t even matter all that much. Though I would like to say that it’s crazy that we have no better insight in bank debt than we have. We’re asked to recognize that some of our banks are so big they could bring down our entire economies, but we’re not supposed to know how close they are to doing just that. Honesty would kill us, apparently. The 2nd graph shows a huge, 600% of GDP, debt for the UK, but only perhaps 100% for the US. Oh, really? Let’s see the books.

In which total debt for the US, but even more for Japan and especially the UK, are much higher than in the first graph. This may largely be due to underestimating debts in the financial sector, though it’s hard to say. And for the argument I’m trying to make, it doesn’t even matter all that much. Though I would like to say that it’s crazy that we have no better insight in bank debt than we have. We’re asked to recognize that some of our banks are so big they could bring down our entire economies, but we’re not supposed to know how close they are to doing just that. Honesty would kill us, apparently. The 2nd graph shows a huge, 600% of GDP, debt for the UK, but only perhaps 100% for the US. Oh, really? Let’s see the books. Let’s take the US as an example. There are 300 million Americans, so about 100 million families…..”

Let’s take the US as an example. There are 300 million Americans, so about 100 million families…..”