Remember all those raw land purchase of the bottom of the market ?

Comments »Monthly Archives: February 2013

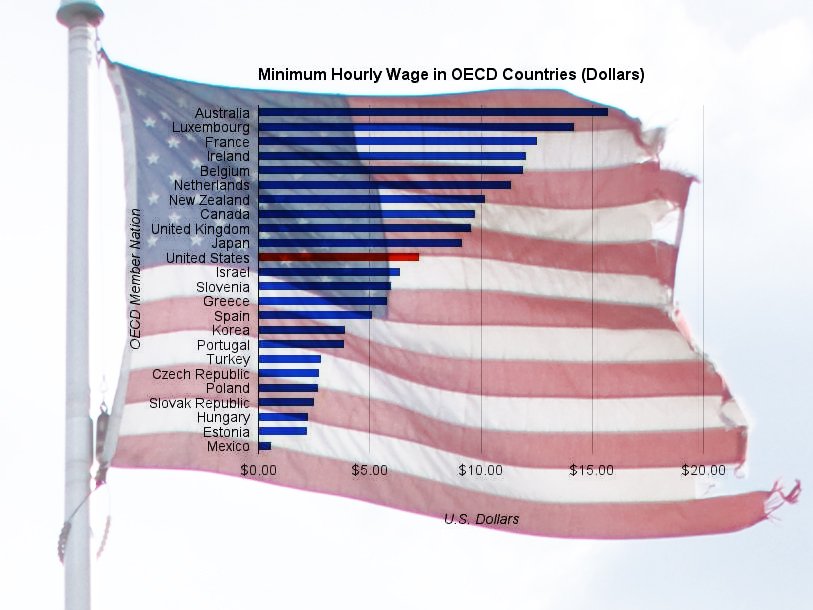

How a $9 Minimum Wage Compares to the Rest of the World

$MON Staff Canteen Memo: We Have Made the Decision to “Remove As Much as Possible All GM Soya and Maize From All Food Products in our Restaurants”

The Most Prolific Sniper in US History, Chris Kyle, Has Been Buried

AUSTIN — Surrounded by the graves of heroes, soldiers and legends, the body of decorated military sniper Chris Kyle was laid to rest Tuesday in the Texas State Cemetery.

The 38-year-old known as the deadliest sniper in U.S. military history was honored with bagpipes, a funeral salute and taps at a private ceremony in the sunshine near a small waterfall on the cemetery grounds.

With a giant Texas flag at half-staff overhead, Texas first lady Anita Perry presented Kyle’s widow, Taya Kyle, the American flag from his casket.

The services, attended by about 150 mourners, took place after a 180-mile funeral procession down Interstate 35 from Kyle’s hometown of Midlothian.

“For me, it’s a way of saying thank you to a true hero,” said Chris Dion, an Air Force active duty dog trainer at Lackland AFB who rode into town from San Antonio with about 100 Patriot Guard Riders, motorcyclists who volunteer to escort military funerals.

Kyle and his friend, Chad Littlefield, were shot and killed Feb. 2 at a gun range southwest of Glen Rose in Erath County. Eddie Ray Routh, 25, has been charged with two counts of capital murder.

Remembered by his family as a softhearted father and husband, by his friends as “the legend” and by his wartime enemies in Iraq as the Devil of Ramadi, Kyle was widely known for his book, American Sniper: The Autobiography of the Most Lethal Sniper in U.S. Military History.

He was buried in a section of the cemetery known as Statesman’s Meadow, at the center of 21 acres of gently rolling hills, waterfalls and a stream. He was laid to rest near the grave of former University of Texas football coach Darrell Royal and close to the 9/11 monument.

Mourners waved flags from overpasses up and down the interstate as the procession, escorted by an estimated 200 Patriot Guard Riders, began from Midlothian in the rain at 8:45 a.m. and arrived to sunshine in Austin three hours later.

The hourlong burial service included the tradition of Navy SEALS “pinning” the casket with Trident pins before it was lowered into the ground.

Leather-clad Patriot Guard Riders, many of them with military backgrounds, ringed the cemetery in a flag line, standing frozen in silent tribute. Mourners shook their hands, hugged and thanked them as they left the cemetery.

Lt. Gov. David Dewhurst attended the service, but Gov. Rick Perry was out of state.

Officials said Kyle’s brother requested permission from an overseeing committee for Kyle to be buried in the cemetery that is the final resting place for Texas politicians, honored members of the military and other public figures.

A two-hour memorial service on Monday drew 7,000 to Cowboys Stadium in Arlington.

Comments »Rare Media Articles Expose How the Mass Media Manipulate Public Opinion

” “Media manipulation currently shapes everything you read, hear and watch online. Everything.”

— Forbes magazine article on mass media influence, 7/16/2012

The influence of the mass media on public perception is widely acknowledged, yet few know the incredible degree to which this occurs. Key excerpts from the rare, revealing mass media news articles below show how blatantly the media sometimes distort critical facts, omit vital stories, and work hand in hand with the military-industrial complex to keep their secrets safe and promote greedy and manipulative corporate agendas.

Once acclaimed as the watchdog of democracy and the political process, these riveting articles clearly show that the major media can no longer be trusted to side with the people over business and military interests. For ideas on how you can further educate yourself and what you can do to change all this, see the “What you can do” section below the article summaries. Together, we can make a difference….”

Comments »Fact Checking the State of the Union Address

“President Obama put a rosy spin on several accomplishments of his administration in his 2013 State of the Union address.

- The president claimed that “both parties have worked together to reduce the deficit by more than $2.5 trillion.” But that’s only an estimate of deficit reduction through fiscal year 2022, and it would be lower if the White House used a different starting point.

- Obama touted the growth of 500,000 manufacturing jobs over the past three years, but there has been a net loss of 600,000 manufacturing jobs since he took office. The recent growth also has stalled since July 2012.

- He claimed that “we have doubled the distance our cars will go on a gallon of gas.” Actual mileage is improving, but Obama’s “doubled” claim refers to a desired miles-per-gallon average for model year 2025.

- Obama said the Affordable Care Act “is helping to slow the growth of health care costs.” It may be helping, but the slower growth for health care spending began in 2009, before the law was enacted, and is due at least partly to the down economy.

The president also made an exaggerated claim of bipartisanship. He said that Republican presidential candidate Mitt Romney agreed with him that the minimum wage should be tied to the cost of living. But Romney backed off that view during the campaign.

Analysis

President Barack Obama gave his State of the Union address to Congress Feb. 12, laying out his legislative agenda for the coming year and achievements of his time in office. But Obama puffed up his record.

Deficit Reduction

Obama said the administration and Congress “have worked together to reduce the deficit by more than $2.5 trillion.” A bipartisan group called the estimate “very reasonable.” But it is only an estimate — and a debatable one at that — for deficit reduction from budgets through fiscal year 2022. Exactly how much will be cut will be up to future Congresses.

And, even if Congress meets those deficit-reduction goals, deficit spending will continue and the federal debt will grow larger — unless much more is done.

Obama: Over the last few years, both parties have worked together to reduce the deficit by more than $2.5 trillion — mostly through spending cuts, but also by raising tax rates on the wealthiest 1 percent of Americans. As a result, we are more than halfway towards the goal of $4 trillion in deficit reduction that economists say we need to stabilize our finances.

Obama has cited the $2.5 trillion figure on numerous occasions, including at a Jan. 14 news conference. It is based largely on two pieces of legislation: the Budget Control Act of 2011, which placed caps on discretionary spending beginning in 2012, and the American Taxpayer Relief Act of 2012, which prevented tax hikes on most Americans in 2013 but allowed rates to go up on the top 1 percent of taxpayers. There was some additional savings from reductions in discretionary spending in the fiscal 2011 appropriations bills.

Republicans challenge the $2.5 trillion figure with some justification, because the amount of savings depends heavily on the baseline — that is, the starting point of comparison. The White House told us it used the Office of Management and Budget’s January 2011 baseline…..”

Comments »Dangerous Liaisons: The Revolving Door Between The SEC and The Industry they ‘Police’

“A revolving door blurs the lines between one of the nation’s most important regulatory agencies and the interests it regulates. Former employees of the Securities and Exchange Commission (SEC) routinely help corporations try to influence SEC rulemaking, counter the agency’s investigations of suspected wrongdoing, soften the blow of SEC enforcement actions, block shareholder proposals, and win exemptions from federal law. POGO’s report examines many manifestations of the revolving door, analyzes how the revolving door can influence the SEC, and explores how to mitigate the most harmful effects….”

“The study also found numerous other concerns with the “revolving door” between the SEC and financial firms. These included agency workers trying to help corporations influence agency regulations, defending companies suspected of breaking the law, and helping them avoid tougher enforcement actions.

Perhaps the most high-profile concern in this arena is President Obama’s nomination of Mary Jo White to become the new SEC chief. During her most recent job at the firm of Debevoise & Plimpton, White’s clients included JPMorgan Chase, General Electric, Verizon Communications, former Bank of America chief executive Kenneth Lewis, and Rajat Gupta, the former Goldman Sachs board member convicted of insider trading….”

Comments »

Thousands of Florida Students Arrested Annually for Actions that Used to Merit a Trip to the Principal’s Office

“Florida continues to arrest thousands of students each year for minor violations not deemed criminal acts.

Of the 12,000 students taken from school to jail by police in 2012, 67% were accused of misdemeanors, such as disorderly conduct. Oftentimes, disorderly conduct amounts to little more than a student disobeying a teacher’s order to put away a cell phone or stop talking in class.

Wansley Walters, secretary of the Florida Department of Juvenile Justice, told theOrlando Sentinel that most arrests stemmed from “bad behavior, not criminal behavior.”

“The vast majority of children being arrested in schools are not committing criminal acts,” Walters added. He pointed out that these arrests pull students out of school and inject them into the criminal justice system, which usually results in making their behavior worse and prevents them from getting counseling.

It was also found that African-American and disabled students were arrested disproportionately in number…..”

Comments »Lateef Fund: “You Can Almost Feel the Rumbling of What They are Calling the “Great Rotation” Into Equities.”

“Stock picking, plain and simple. And successful. That’s what attracts investors — individuals, private-wealth managers, and endowments — to Lateef Investment Management, a $4.5 billion money-management firm in Greenbrae, Calif., a small Marin County town just north of San Francisco. Three portfolio managers, Quoc Tran, James Tarkenton, and Matthew Sauer, scour and sift for underappreciated and mispriced blue-chip companies with strong balance sheets, strong business models, high free-cash flows, and attractive returns on capital. The trio is steeped in the art of value investing, having learned it from some of the best in the business, including Wally Weitz of Weitz Funds and John Rogers of Ariel Investments. Their flagship offering, the Lateef Fund (ticker: LIMAX), celebrated its fifth anniversary at year end by doing what it’s usually done: beating its benchmark.

Barron’s: Are you more bullish or bearish about the U.S. equity market after the run-up in the S&P 500 and Dow Jones industrials?

Sauer: You can almost feel the rumbling of what they are calling the “great rotation” into equities. We’re seeing it in fund flows. Corporate risk spreads are obviously tight. Junk-bond yields are low. That is positive for the market….”

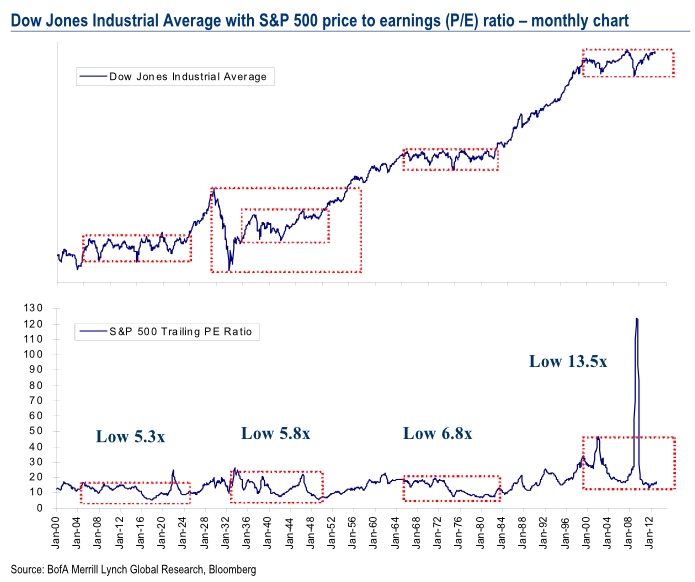

Comments »A Look at P/E For the DOW vs The S&P

Leon Cooperman Kicks Out $AAPL and Buys $FB

“Shares of Facebook (NASDAQ: FB [FREE Stock Trend Analysis]) surged to a session high Wednesday after a 13F filing revealed that Leon Cooperman’s Omega Advisors had purchased 3.16 million shares in the last quarter.

Although Cooperman could’ve exited his stake within the last few weeks, he was in Facebook as of December 31.

Facebook shares traded up nearly three percent after news of Cooperman’s filing broke, trading back above $28 per share.

(c) 2013 Benzinga.com. Benzinga does not provide investment advice. All rights reserved.

Comments »Market Update

U.S. equities fell after a early morning attempt to seek higher ground by the bulls. Currently the DOW is off 38 bones which is roughly 30 points off the lows.

Gold, silver, and copper are flat. Oil has swung from positive to negative territory sitting flat right now near multi month highs.

The Yen and Euro lead against the dollar. The dollar is still holding above 80.

Profit takers have capped the markets from grinding higher, but selling is light and with 7 year intraday highs on the S&P it feels like we may be bot into the close thanks to Bearded Clam Physics.

Rule #1 Don’t fight the Fed.

Rule #2 In addition to remembering rule #1 understand that the whole planet is on the same page.

Rule # 3 Make hay while the sun shines.

[youtube://http://www.youtube.com/watch?v=eePRkP1HMYQ 450 300] Comments »Heart Attack Grill Spokesman Unfortunately Lives Up To its Name

“The second unofficial spokesman for the Heart Attack Grill in downtown Las Vegas has died from an apparent heart attack.

John Alleman suffered a heart attack last week as he waited at the bus stop in front of the restaurant, located inside the Neonopolis at Fremont Street and Las Vegas Boulevard.

Alleman was taken off life support shortly after 1 p.m. on Monday, said restaurant owner Jon Basso. He was 52.

“He lived a very full life,” said Basso, who seemed shaken when reached by phone Monday evening. “He will be missed.”

The Pennsylvania native is survived by his only family, his brother Paul. Basso said Alleman had a genetic predisposition for cardiac problems, as both of his parents died of heart attacks in their 50s….”

Comments »$DF Falls on Poor Guidance After Reporting Decent Earnings

“For the quarter, the food and beverage company posted adjusted diluted earnings per share (EPS) of $0.40 on revenues of $3.04 billion. In the same period a year ago, the company reported EPS of $0.28 on revenues of $2.93 billion. Fourth-quarter results also compare to the Thomson Reuters consensus estimates for EPS of $0.30 and $3.37 billion in revenues.

On a GAAP basis, Dean Foods posted EPS of $0.20 for the quarter. Adjustments take into account the spin-off of The WhiteWave Foods Co. (NYSE: WWAV) and the sale of the Dean Foods’ Morningstar dairy business.

For the full year, adjusted EPS totaled $1.39 on revenues of $12.9 billion. The consensus estimate called for EPS of $1.29 on revenues of $12.77 billion. On a GAAP basis, EPS totaled $0.90 for the full year.,,,”

Comments »The Relationship Between Returns and Volatility

“Do returns dictate volatility or does volatility dictate returns? It might seem like a silly question, but one that is worth spending a bit of time on. If market returns actually followed normal distributions, then we might expect that there are as many up days as down days and upside deviation equals downside deviation. Unfortunately, the distribution of returns is rather non-normal with a larger number of negative returns and a lot of small positive returns. You can read about option pricing and equity return distributions at a popular old post, “Do Black Swans Negate Option Premiums“.

The question for today is whether volatility necessarily means that returns are negative. For this little bit of analysis, we will look at the S&P 500 daily returns going back to 1928. The data is calculated into calendar month statistic sets and then the sets are grouped by realized volatility buckets (see figure 1)….”

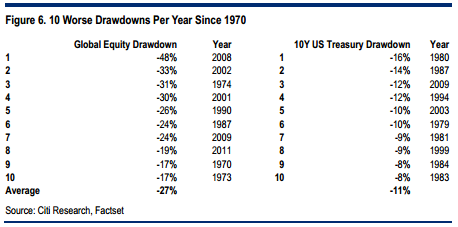

Comments »A Historical Look at Stock and Bond Drawdowns

A Look at the Best and Worst Stock Oracles

“(MoneyWatch) The financial media tends to focus most of its attention on stock market forecasts by purported investment gurus. They do so because they know that’s what gets the public’s attention. Investors must believe they have value or they wouldn’t tune in. Nor would they subscribe to investment newsletters, nor publications like Barron’s that claim to provide you with “news before the markets know.”

Unfortunately for investors, there’s a whole body of evidence demonstrating that market forecasts have no value (though they provide me with plenty of fodder for my blog) — the accuracy of forecasts is no better than one would randomly expect. For investors who haven’t learned that forecasts should only be considered as entertainment, or what Jane Bryant Quinn called investment porn, they actually have negative value because forecasts can cause them to stray from well-developed plans.

The latest piece of evidence illustrating the futility of forecasts comes from CXO Advisory Group. The investor research firm set out to determine if stock market experts, whether self-proclaimed or endorsed by others, provide useful guidance on how to time the stock market. To find the answer, from 2005 through 2012 they collected and investigated roughly 6,600 forecasts for the U.S. stock market offered publicly by 68 experts, bulls and bears employing technical, fundamental and sentiment indicators. Their collection included forecasts, all of which were publicly available on the Internet and which went back as far as the end of 1998. They selected experts based on Web searches for public archives with enough forecasts spanning enough market conditions to gauge their broader accuracy.

CXO’s methodology was to compare forecasts for the U.S. stock market to the S&P 500 index returns over the future intervals most relevant to the forecast horizon. They excluded forecasts that were too vague and forecasts that included conditions requiring consideration of data other than stock market returns. They matched the frequency of a guru’s commentaries (such as weekly or monthly) to the forecast horizon, unless the forecast specified some other timing. And importantly, they took into account the long-run empirical behavior of the S&P 500 index. For example, if a guru said investors should be bullish on U.S. stocks over the year, and the S&P 500 index was up by just a few percent, they judged the call incorrect (because the long-term average annual return has been much higher). Finally, they graded complex forecasts with elements proving both correct and incorrect as both right and wrong (not half right and half wrong).

The following is a summary of CXO’s findings….”

Comments »Early Morning Shakers and Movers

“SAN FRANCISCO (MarketWatch) — Shares of Comcast Corp., Groupon Inc., and Cliffs Natural Resources Inc. are making notable moves in U.S. trading on Wednesday while ExOne Co. is leading other 3D printing stocks after President Barack Obama talked up the technology.

Shares of Comcast CMCSA +6.20% rose 6.2% after the cable company said Tuesday it will gain full control of NBCUniversal from General Electric Co.GE +3.23% and also buy 30 Rockefeller Plaza and CNBC’s Englewood Cliffs, N.J., headquarters in a deal totalling $18.1 billion. Comcast also reported fourth-quarter earnings rose 18% to $1.52 billion, or 56 cents a share. Comcast to buy out GE’s stake in NBCUniversal

Groupon Inc. GRPN +5.20% gained 5.9% after analysts at Sterne Agee lifted the stock to buy from neutral. “We recognize that meaningful risks remain, the stock will be volatile and we may be a bit early. However, we believe the risks are well known and largely priced in,” the analysts said in a note.

FMC Technologies Inc. FTI +6.72% shares added 5.4% after the company reported fourth-quarter earnings rose to 50 cents a share from 41 cents a share a year ago.

Decliners

Cliffs Natural Resources CLF -19.11% shares tumbled 18%. The company was downgraded to a hold rating from buy by Deutsche Bank and cut to a neutral rating from buy by Citigroup. The mining company said Tuesday it swung to a loss in the fourth-quarter as revenue slipped. Cliffs Natural swings to a loss

Dean Foods Co. DF -9.27% shares declined 7.7%. The food and beverage company on Wednesday said it swung to a profit in the fourth quarter but it forecast first-quarter earnings of 10 cents to 15 cents a share versus analysts’ expectations of 30 cents a share.

Dr Pepper Snapple Group Inc. DPS -4.73% shares slid almost 5%. Earlier Wednesday, its reported fourth-quarter earnings of 82 cents a share, below the 85 cents a share forecast by analysts in a FactSet survey.

Top Tickers Trending

$XONE: ExOne XONE +4.09% is rallying 8% after President Obama anointed 3D printing as having “the potential to revolutionize” the way things are made in his State of the Union address Tuesday.

3D Systems Corp. DDD +3.90% climbed 3.9% and Stratasys Ltd. SSYS +1.27% gained 1.8%. “

Comments »