Monthly Archives: June 2012

Baucus: US on ‘Dangerous Path’ to European-Style Fiscal Crisis

“The United States is on a “dangerous path” that could lead to a European-style fiscal crisis, the Senate’s top tax legislator warned on Monday, while calling for more tax revenue and ending corporate incentives to shift profits and jobs overseas.

Democrat Max Baucus urged fellow lawmakers to resolve by the end of 2012 a host of “crucial spending and tax decisions” that will arise immediately after the Nov. 6 presidential and congressional elections.

The remarks by the chairman of the Senate Finance Committee were short on specifics and did not lay out a clear working agenda, but they reflected growing urgency on Capitol Hill.”

Comments »BAILOUT FOR BROTHELS: Spain To Allow Prostitutes To Advertise Again

“This weekend, the Spanish Parliament reversed a 2010 ban on advertising by Spanish prostitutes and brothels “‘because of the recession,” according to local media.

Prior to the ban, the sex industry spent €40 million annually on classified advertising.”

Comments »FITCH SLASHES LONG-TERM RATINGS ON 18 SPANISH BANKS

“Fitch just announced that it cut the long-term issuer default ratings on 18 Spanish banks.

From Fitch: “In particular, Spain is expected to remain in recession through the remainder of this year and 2013 compared to the previous expectation that the economy would benefit from a mild recovery in 2013. The institutions affected by today’s rating actions are purely domestic banks. Thus, their revenue generation capacity, risk profile, funding access and cost of funding are highly sensitive to the evolution of Spain’s economy and its housing market.”

Here’s an excerpt from the press release.”

Comments »Analyst Defends $FB Social Platform

“SAN FRANCISCO (Reuters) – Marketing on Facebook influences consumer behavior and leads to increased purchases for the brands that leverage the social-networking site, consulting companycomScore said in a report released Tuesday.

“The Power of Like 2: How Social Media Works,” looks at paid advertising on Facebook as well as earned media exposure– meaning mentions of the brand made by Facebook users in status updates and the like. It is based on the experiences of large brands such as Best Buy, Starbucks and Target.

The report follows up on a July 2011 paper, “The Power of Like: How Brands Reach and Influence Fans Through Social Media Marketing.”

Comments »BP Starts Production From a New Deep Water Project

“LONDON (Reuters) – Oil major BP said oil had started pumping from a new project in deepwater in the Gulf of Mexico, its first newdevelopment to come onstream since the Macondo disaster in 2010 caused the largest offshore spill in U.S. history.

BP said on Tuesday the Galapagos development started initial production earlier in June, with oil flowing to a nearby platform 140 miles south east of New Orleans in water depths of 6,500 feet.

The Galapagos project was named by BP as one of a handful of major projects which will help demonstrate its return to work in the Gulf of Mexico, where it is the largest producer of oil and gas in a region which is key to its future, despite the oil spill at its deepwater Macondo well two years ago.”

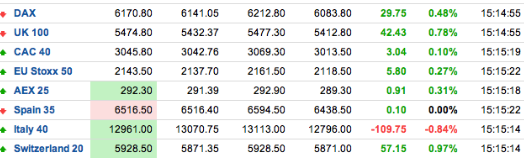

Comments »FLASH: European Shares are in Plunge Mode, As Yields Rise, Across the Board

CAC is now negative for the day.

It’s not just Spain and Italy. German, French, Austrian and other sovereign yields are spiking sharply, pan-europe.

Comments »Hedge Fund Managers Turn Bearish as Outflows Rise

“TrimTabs and BarclayHedge report each month about hedge fund inflows and outflows, and if you have been watching the tape you shouldn’t be surprised that the trend is toward ‘outflows’ of late. What is interesting is that there is a one-month lag and that means that the current report covers the month of April. If stocks were still holding up in April and the outflows were large then, imagine how bad the outflows were in May”

Comments »JP MORGAN: QE3 IS NOT A BULLISH CATALYST

“JP Morgan has some good comments on the markets and the effect of potential future government actions. For now, they’re saying the markets will likely have trouble finding their footing without a robust policy response or stabilization in the macro data. Interestingly, they do NOT believe QE3 will be a positive catalyst going forward:

Comments »“For a sustainable rally we would need the following: either a stabilisation in macro momentum or, more importantly, a robust policy response. Restart of the SMP programme,short selling bans nor the IMF rescue of Spain fit the bill. Markets tended to quickly rollover post these types of actions historically. Eurobonds remain as distant as ever.”

GOLDMAN: 75% CHANCE FED EASES AT NEXT MEETING

“Goldman’s latest research suggests that the Fed is likely to ease at the next meeting this month. This assesment is primarily based on their proprietary indicator called the GSFinancials![]() Conditions Index (GSFCI). As a backdrop, they point out that the US economy has slowed, as shown in the chart below. Both the nonfarm payroll growth and the CAI index (Goldman’s index of broad economic activity) have declined sharply.”

Conditions Index (GSFCI). As a backdrop, they point out that the US economy has slowed, as shown in the chart below. Both the nonfarm payroll growth and the CAI index (Goldman’s index of broad economic activity) have declined sharply.”

Rosenberg Turns Bullish

Perma bear Rosenberg is actually providing hope lifting commentary lately. Here is another piece with ‘light at the end of the tunnel.’

Comments »The Private Sector is Not Well When Middle Class Counties Collect Food Stamps

“MORRIS COUNTY, N.J. (CNNMoney) — Since the recession, persistent unemployment has left middle-class life out of reach for millions of Americans.

But few residents of Morris County, N.J., could have ever imagined they would end up on government assistance.

Morris County is known for its wealth and million-dollar homes. Median household income there is over $91,000. Yet, the number of people receiving food stamps in the area has nearly tripled in the past five years.”

Comments »Wall Street Shuffles Out Short Term Risk for Longer Term Risk in Europe

While U.S. banks have been trying to unload debt exposure to Greece, Ireland, and Protugal they have been increasing risk to Italy, France, and other EU countries.

What impact will this have on risk exposure ?

Comments »Oddity: ALL EUROPEAN YIELDS ARE CLIMBING

Earnings Preview: $FDS, $PIR, $SFD, $WGO, $CASY, $KORS

"It's another quiet week on the earnings front, but there are a few reports to take note of this week. Overall, traders have another three or four weeks of sluggishness on the earnings front to contend before the second-quarter earnings parade really kicks into high gear. For this week, traders that are looking to take a break from Europe can opt to focus on the following earnings reports."Comments »

Pimco’s Gross Boosts Treasurys for First Time in Four Months as QE3 Looms

“Bill Gross, who runs the world’s biggest bond fund at Pacific Investment Management Co., increased its holdings of Treasurys to 35 percent in May as yields on U.S. government securities approached record lows.

Gross raised the proportion of U.S. government and Treasury debt in the $260 billion Total Return Fund, bringing it up from 31 percent of its record asset holdings in April, Newport Beach, California-based Pimco said on its website. Holdings of mortgages dropped to 52 percent from 53 percent.

Investors should focus on debt of nations such as the U.S. and Brazil and avoid Europe until credit begins flowing again from the private sector as government solutions aren’t enough to stem the region’s debt crisis, Gross said two weeks ago. The yield on the benchmark 10-year note fell to a record low of 1.44 percent on June 1.

“We would suggest at Pimco avoiding the entire eurozone until they can come up with some type of solution which involves the private sector,” Gross said in a radio interview on “Bloomberg Surveillance” with Tom Keene on June 1. ”

Comments »Loophole May Allow MF Global Executives to Walk

Tax Revolt: N. Dakota Votes to Get Rid of Property Tax

If the property tax is eliminated, it would be the first time since 1980 — when oil-rich Alaska got rid of its income tax — that a state has discontinued a major tax, reports the Tax Foundation, a non-partisan research group. North Dakota would become the only state not to have a property tax, a levy the state has had since before it joined the union in 1889.

Comments »Roubini Tells Europe to Stop ‘the Savings Madness’

“Governments in Europe should lower taxes and increase salaries to boost growth rather than insisting on austerity and continued saving, famous economist Nouriel Roubini told a German newspaper in an interview on Tuesday.”

Comments »