+4.4% to $35 on Hurricane Irene news.

Comments »Monthly Archives: August 2011

With Yields Through the Stratosphere Greece Accesses the Emergency Liquidity Assistance Program

Today’s Winners and Losers

No. Ticker % Change

1 PSS 19.16

2 TIVO 16.87

3 CARB 15.27

4 PANL 13.83

5 BAC 12.09

6 ALTI 11.82

7 Z 11.77

8 CYDE 10.64

9 ENER 10.61

10 CHC 10.44

11 GAME 10.33

12 SCHS 9.36

13 AHC 9.23

14 KTCC 9.04

15 III 8.80

16 GGR 8.71

17 CTHR 8.33

18 MEMS 8.11

19 MEG 7.77

20 AONE 7.67

21 PRO 7.33

22 HPOL 7.02

23 PMI 7.00

24 CAVM 6.87

25 PSTI 6.85

—————————

2 AVNW -17.51

3 BWS -15.20

4 TBUS -14.54

5 LPHI -14.03

6 CISG -13.92

7 CIS -13.41

8 RCON -13.10

9 SIGM -11.85

10 SLH -11.23

11 PDCO -9.93

12 TAOM -9.79

13 EEE -9.00

14 EDS -8.58

15 ZN -8.42

16 VIT -8.33

17 AIP -8.27

18 SINO -8.15

19 RP -7.65

20 CRWN -7.35

21 LIWA -7.30

22 GMR -7.24

23 RUE -7.19

24 MERR -7.17

25 SVBL -7.14

26 FENG -7.04

FLASH: FITCH REAFFIRMS GERMANY AAA

Ho-hum

Comments »CNBC: Germany NOT Going to Ban Short Selling

As per German officials, responding to market rumors, there will NOT be a ban on short selling.

Comments »FLASH: Shares of VHC Explode by 15% in 2 Minutes

No news, thus far.

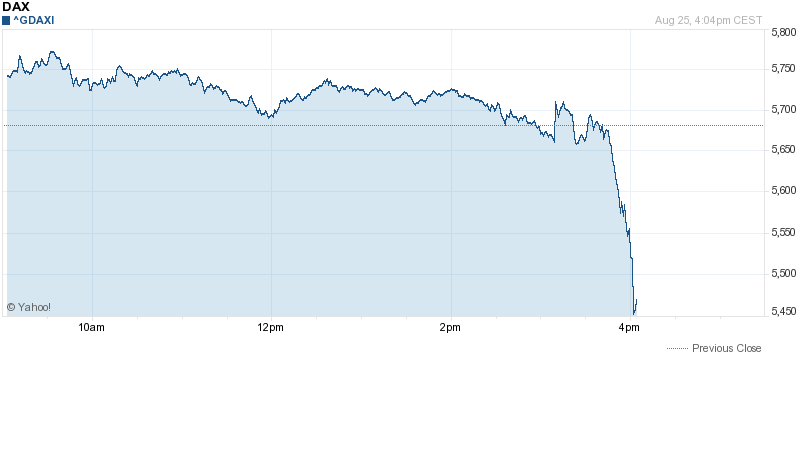

Comments »FLASH: German Markets Flash Crash

Obama Bows to Corporate Masters Again

Liquidity Reaches “Terminal Velocity”

FLASH: German Markets Plunge

Now off 1.8%. I gather someone thought Buffett was gonna buy a German bank.

UPDATE: Germany is now down 2.5%.

Comments »The Case for Not Relying on Gold To Boost Your Portfolio During Potentially Troubled Markets

Spanish 10 Year Bonds Back Under 5%

Why We Are Not Japan 2.0

Other Banks that May Need Blankfien’s High Profile Lawyer

CBO Releases a Very Upbeat Outlook for U.S. Economy

Liquidity Crunch a Big Fear As BoE Extends Swap Lines

Uranium production market remains soft

Comments »NEW YORK, NY–(Marketwire -08/25/11)- The uranium market has slowed to a halt in recent weeks amid continued uncertainty surrounding the global nuclear energy industry. Meanwhile, uranium producers are posting lackluster results as demand for the radioactive material slows. The Bedford Report examines the outlook for companies in the Uranium Sector and provides investment research on Cameco Corporation (NYSE: CCJ – News) (TSX: CCO.TO – News) and Uranium Resources, Inc. (NASDAQ: URRE – News).Access to the full company reports can be found at:

The spot price for uranium has declined 24 percent since the week before the March 11 earthquake and tsunami damaged Tokyo Electric Power Co.’s Fukushima Dai-Ichi power station. According to Ux Consulting Co., “A number of market participants have indicated that recent market activity has been very limited… This lack of activity has been described as the market looking like a ghost town.”

“Some activity still proceeds as the spot price floats near the $50 level,” Ux said. “Several spot transactions have been posted over the past week, most involving smaller quantities.”

Chinese corn import laws increasingly define agriculture trade

Comments »A legal battle between two of the world’s most powerful agribusiness companies is shedding light about the growing role of China in agricultural commodities markets.

Syngenta, the Switzerland-based agrochemicals producer, is suing New York-listed Bunge, one of the world’s largest food traders, for refusing to accept a type of its biotech corn. Bunge – the “B” of the “ABCD” group of companies that includes ADM, Cargill and Louis Dreyfus and control agriculture trading – refuses to buy from farmers growing Syngenta’s new Agrisure Viptera corn because it has not been approved for sale in China.

Syngenta said the action was illegal and that its new corn is approved for sale into “major” export destinations, including Australia, Brazil, Canada, Japan, Mexico, New Zealand, the Philippines, Korea and Taiwan. But, it acknowledged, not in China.

The lack of approval for sale into China would not have been a problem only a couple of years ago, as Beijing was self-sufficient in corn. But China has recently become a big importer. And Bunge said on Tuesday it was expecting that imports would “grow significantly this year”, one of the strongest statements yet from a trading house about the issue.

The US Department of Agriculture estimates that China imported 1.5m tonnes of corn in the 2010-11 season, which is about to end, the highest since 1994-95. For most of the 1990s and early 2000s, China’s corn imports were negligible, at just a few tonnes. For 2011-12, the USDA forecasts imports of 2m tonnes. But private sector analysts are far more bullish, predicting imports anywhere between 5m-10m tonnes, the biggest ever.

The legal battle between Syngenta and Bunge reveals that the trading house believes that imports from China would grow much more than the level suggested by the USDA. It also confirms an open secret in the industry: all the ABCD companies are battling to establish themselves as Beijing’s favourite party to carry the corn deals. Until now, Louis Dreyfus of France has been a leading seller, but Cargill and Bunge are battling to keep pace.

Trucking Industry to Face Wage Inflation Due to Shortage of Drivers

John Thain buying up CIT shares

Former Merrill Lynch CEO, engineering student, and $75,000 Persian rug connoisseur John Thain has been openly buying up shares in his new company. Unfortunately, Ken Lewis is not around to buy this one from him for an undefinable premium.

Comments »The recent woes that have troubled the market haven’t got the head executive at CIT Group worried. He’s plunking down cash and buying up shares of the commercial lender.

On Tuesday, Chairman and Chief Executive John A. Thain bought 40,000 shares of CIT (ticker: CIT) for nearly $1.2 million, an average of $29.91 each. That same day CIT stock hit a 52-week intraday low.

This is his first open buy on record since the company declared bankruptcy, restructured and resumed trading in 2009. Following this transaction, he directly holds 319,575 shares of the lending company…