Well, the hubris post did it, and pointing out that when I crossed 20% YTD gains timed the top with almost cruel exactness. Just as we all knew it would.

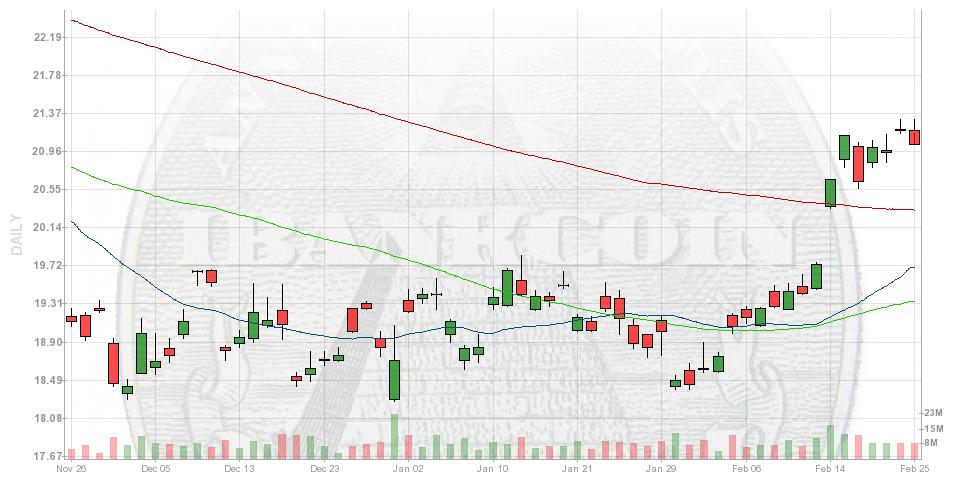

BAS is taking the session the hardest for me, down almost 7%. They started a correction after earnings, and it looks to be picking up speed. My guess is a retest of the 200 day, putting them just over $20 a share, at which time I will be a buyer.

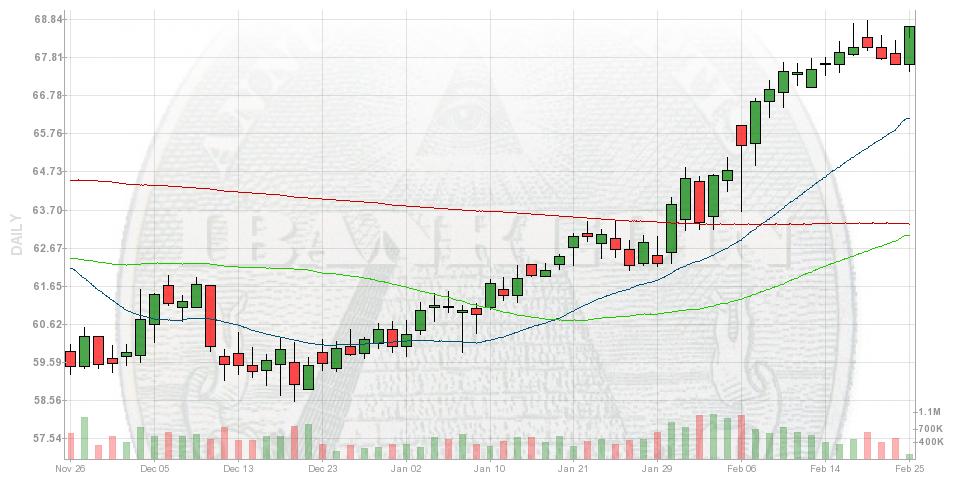

MAA is second worst, down over 5% on a disappointing…Core FFO number? FFO is very important in the real estate market, because it prices out depreciation of construction (which so long as your structure is sound is irrelevant). But they also just doubled their operation by acquiring my old position CLP, and seem to be continuing the spirit of development and expansion. They have sound debt levels making the process easier, with plenty of room to add leverage. And a strong wind at their backs in the form of a rising rent environment. I’m holding here because a 4% dividend and steady growth make MAA a sound enough investment once this passes.

Following next is a roughly four way tie between BTU, NRP, HCLP, and ETP. There seems to be a theme today of energy names being punished a little worse than the indices. Then again, people have hated coal for years and half the energy sector has huge gains unrealized with ample volume to round about escape losses elsewhere, so maybe this makes perfect sense.

CCJ had a good earnings report, continuing to kick the uranium market doldrums by personally doing just fine. Their long term contracts persist in rewarding them with a price well above the dismal spot market, and sales volumes have increased. So the market has rewarded them by only selling off 1.5%.

(Actually, I need to be honest. I am concerned that CCJ has managed to perform this well in this environment. Particularly because despite the better sales and earnings, they continued to lose cash – the only thing that really matters – and in light of the recent revelations of overseas corporations acting to enable financial games with their taxes. I’m going to be sniffing around very closely here, because I will not become prey to some corporate Enron nonsense)

AEC and silver are my “best” positions, each down “only” less than 1%.

Okay, so the market is getting clubbed. What do we do about it?

Well, if you’re in my position – and if you’ve been following me, that is quite possible – up still over 15% for the year, then the answer is pretty clear. You do nothing.

I can afford to do nothing here, to see if this hard drop doesn’t stabilize quickly and lead us higher through August. We should hit a bottom pretty quick. I don’t yet see a good catalyst for a major drop, outside of the regular bank failings and global “World War” heckling that usually bogs us down. For the moment, that’s no excuse to panic.

China, Europe, and most the rest of the world haven’t exactly been doing awesome before now. This isn’t news.

So there’s no rush here. 13% YTD gains is my floor. When I hit that point, I go to cash fast, because my year will be at least +13%. 13% because I was stuck between 10% and 15%, so let’s take the black prime number in the middle (scientific, right?).

Comments »