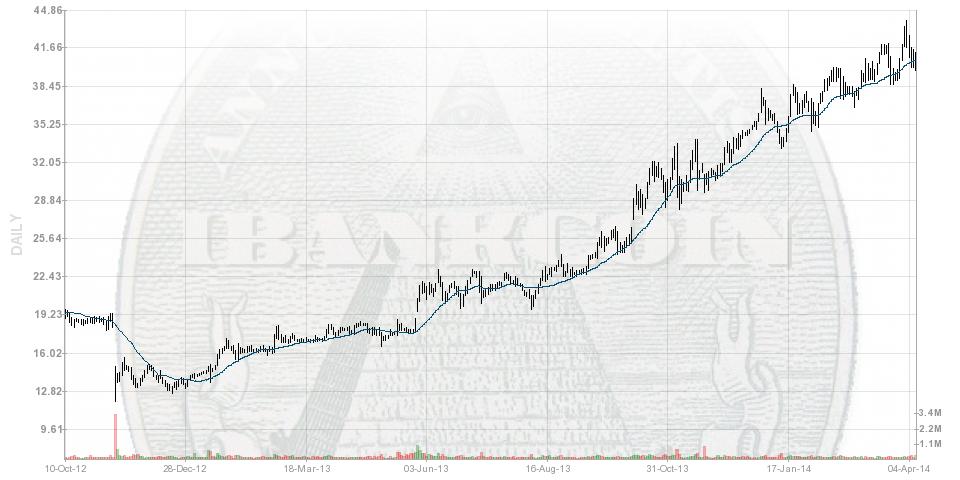

If not for Basic Energy Services turning on a dime and sprinting away from the rest of the trash that comprises this trading session, I would be having a pretty bad day.

UEC is down over 50% since I bought it. Mind you, as I have stated repeatedly, it is a small position. At its peak, it was under 5% of my account. So I’m not panicked here. But damn it, that was my 5%.

Give me my money back.

The trouble with the uranium miners (and the reason I’ve been very adamant up until now to just keep it simple and avoid the smaller businesses) is pretty forwardly summed up in UEC’s latest filing. They sold $0.00 in revenue in the first three months of 2014.

That’s $0.00.

The 2014 YEAR OF URANIUM BLISS (or whatever the hell I called it) …has been cancelled. Uranium spot just nosedived this week and, even though I suspect this flash crash is nearer the end of the turmoil, that kind of godless price action can only portend one thing.

Somebody is about to get liquidated.

I just pray it isn’t UEC.

CCJ is treading water daily. It’s all she can do to hold the line, but one false move and it’s a quick list to the side and down she goes.

The rest of my positions are holding up fairly well, actually. The multifamily theme remains tantalizing, particularly now that the primary argument against them – a resurgence in homeownership rates and a drop in occupancy for rentals – is such obvious bunk. AEC and MAA should continue to perform.

NRP has held up decent enough, following the 25% washout it took this year. That’s probably been my worst idea so far in 2014. But they are getting things under control, I have a hunch coal may be a terrific investment here, and I get to collect 8% annually while I wait.

I’m definitely not +10% for the year anymore, but there’s another 8 months to make something happen yet. My fear isn’t my positions, it’s what consequence an entire index of investors getting their combined comeuppance will have on me.

The NASDAQ traders got stupid. Real stupid. Will that spill over to me? It’s looking likely.

Like it or not, the stock market tends to take on a real flare of the vineyard effect. You pop up five vineyards next to each other, they all do well. Plenty of room to visit each, for the patrons. In fact, it draws in more business.

But if one of those bastards let’s an infestation go unattended; suddenly you have nothing but tears and reek wine.

Tesla earnings are out after the bell. Let’s see what happens there.

Comments »