The flavor of the minute in financial news seems to be the gaining traction of sentiment that China is set to surpass the US as the master elite of the planet. Not just in the news, either; why just recently a family discussion turned to the Chinese domination of resource rights in Africa.

It’s amusing, but I don’t put much stock or fret in it.

Every 30 years or so, America fears it’s about to be unseated from the top dog spot on this planet by some emergent group. We had a thing about the European Socialists for a while there in the 20’s and 30’s before we were forced into the second World War.

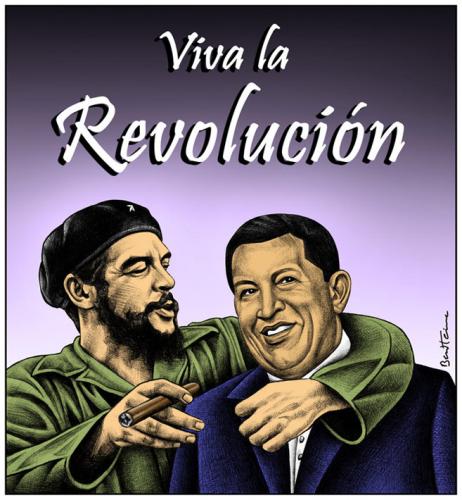

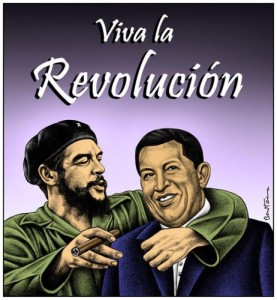

In the 60’s it was the newly stable, successful and exciting Soviet Union, ushering in utopian communism and equality for all. The press had our eulogy written and published.

Then it was the Japanese, who were going to dominate the planet with their superior corporate structures and buy us all out, one automotive sale at a time. Japanese land at one point was valued at (I believe) greater than all the land in the United States. Commercial land was going for $45,000 per square meter.

This has ceded to a sort of more general Asian thing – where we are obsessed that the East is going to clean our clocks.

America is a very paranoid country. It keeps us on our toes. Where would we be if we didn’t have the next guy to think about killing?

The truth is, China’s economy should be bigger than ours. They have three times as many people. But China also has some deep structural problems, including no trustworthy corporate or personal legal protections to speak of. Their government houses nearly all of the country’s millionaires and billionaires, raising red flags of plutocracy and government corruption. Their decision making process is even worse than the US Congress, if you can imagine such a thing. Take a look at their most recent high speed train fiasco – everything about its construction was politicized, to the point that it became more of a burden on the country than a boon.

And the biggest problem of all is the one child policy.

(Update: There is evidently an exemption for parents who were single children themselves. They may have two children. I had no idea; thank you Berserker for pointing that out. Population will still likely contract, but in a more controlled way, if everyone follows the policy)

By forcing a one child policy, China set itself on the path of contracting the population. That’s an issue; remember that most forms of entitlement use increasing contributions from expanding enrollment to pay benefits. It also enables politicians to overpay benefits to important voting special interest groups, writing off the bad decision against future increases to budgets. If China’s population gets smaller, what do you think the odds are that they’ve successfully managed that process?

And the population getting reduced by half is probably optimistic. Chinese culture has encouraged selection and preference of male offspring. That leaves China sitting with a skewed distribution of more males to females. Even if China reverses the policy, that leaves quite a few disaffected young men, sitting on the sidelines watching all the country’s growth and prosperity fall in the laps of a handful of elected officials, and a pressure bubble working its way through the entitlement system that would normally keep them docile.

Over all, I’m not that worried as I find fears that China is in imminent position to dominate our leadership as premature. Let’s see them pull it off first.

Comments »