_______________________

Listen up kids, I don’t do drugs.

No, really.

No, I get high on… silver highs. New one’s especially. ‘Fact, I might even OD on breaking all-time highs, but I am doing wind sprints and having my sons jump out of random closets at me— “Cato-Clouseau-style” — in order to get my adrenaline glands in good condition for the eventuality.

Cause I’m pretty sure it’s coming. Tonight we have new 31-year highs at $33.12, which is making me very happy. Mind you I started buying physical silver at about $4.50 an ounce, and have never sold any of it. That’s over 630% since 2002. I wish I could say the same for my silver stocks, which I’ve traded perhaps with over-zealous vigour (sic). In truth, they’ve been even more volatile than the commodity price itself.

My favorite silver play continues to be the royalty play Silver Wheaton — SLW— which does not dirty its fingernails with crude dirt-scratching but instead secures royalty payment in silver at a certain price in exchange for financing miners. Would you screech out loud if I told you that SLW had arranged to be paid in silver at the equivalent of less than $5.00 an ounce? That’s like taking a time machine back to 2002 and rifling the unsuspecting corner numismatic storedfront for less than appreciated 100 oz. ingots, only to return to February 2011 and have them assayed for over $33… and counting.

Can you see why I’m so excited about royalty plays? They are, in fact, leverage for the leveraged price of the precious metal, as that is what the miners do — they allow one leverage on an increasing precious metal price. The royalty play is one step higher up the chain of amped return. Is there risk of default and other mining related problems? Of course, but like a bank, a diversified portfolio will absorb some of that volatility.

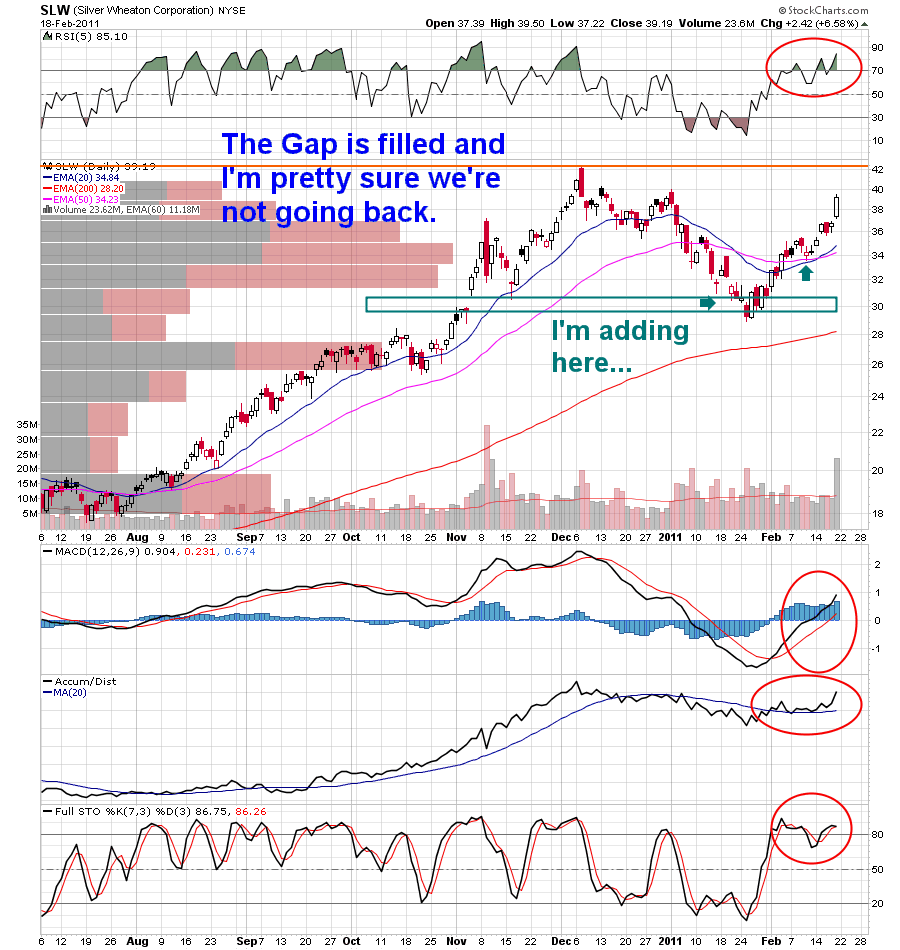

Remember this SLW chart from a couple of weeks ago? The two arrows are the places where I’ve made recent buys. We’re still not back to our old December highs, but I think we’ll be there, maybe as soon as this week.

Royal Gold — RGLD — is another royalty play, this time on the gold side, and with an even more diversified portfolio than SLW. That’s another Jacksonian you want to own.

I also like EXK, AGQ (be careful with this one), PAAS, MVG, SVM, AG, CDE (small), and SSRI. Another great catch all for all of these (or most) is SIL, the silver miner ETF.

For gold, the old standards, ANV, EGO, RGLD, IAG, GDX, GDXJ, NGD are recommended, and newcomers IVN and AAU to taste. I continue to believe also that the rare earth metals will resume their volatile climbs, and I like AVL and QSURD best.

Nothing going on in the U.S. stock markets tomorrow, but the precious metal, U.S. dollar and futures markets should be fun. Ciao for now.

_______________________

Comments »