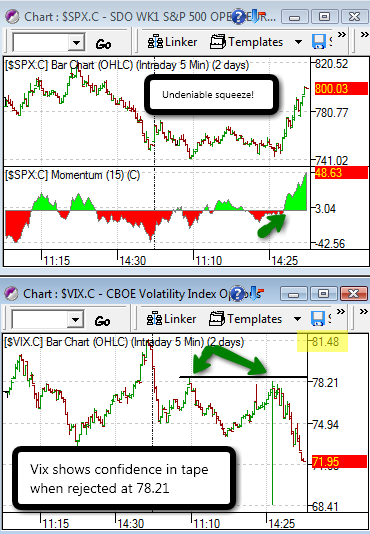

(This is for you short term traders…) You will have about 5 hours from the open before the rest of the street starts taking profits tomorrow. At least that is what I will be trying to play on Tuesday (updates on Twitter if I notice any changes). My thesis is that the short week of trading will lead to a lot of portfolio re-balancing ahead of the long weekend. Don’t even count Friday as a trading day, volume is the lowest of the year there. According to the Vix spike theory, now is not a good time to be in a fully long position. When the Vix was at 80, that is where you wanted to get a little more aggressive. However, on the flip side, worst case tomorrow for rookie bears is they will short into a dull market- that means the volume is low all day, but the market melts up.

(This is for you medium term traders… ) But let us forget about tomorrow. Tomorrow will have a series of profit-taking, followed by dip buying, so I’m expecting it to be choppy, and tough for the bears to short and fade stocks despite a vix spike down. But yes, let us forget about tomorrow for now…take a look at this 3 month pattern of the Vix, that shows the nice drop in the Vix from the 80s to the low 60s.

Basically, given the intraday action in the past two days, I expect the Vix to create a wedge-pattern from now and for the next few weeks, as traders undergo the grinding process of a Sisyphean Reversal (a counter-trend rally). This Sisyphean Rally will probably last quite long, but the strategy I’m implementing is to buy on Vix on the top range of the wedge, and sell on the bottom of the wedge. As the wedge tightens, then I will bet on the counter-trend rally getting real legs. Sorry, but I just don’t think we get an instant rally by just adding turkey sauce, especially with retail numbers coming out tomorrow. Again, this whole “wedge pattern” in the Vix is only an early discovery and could very well be nullified. Wait for the range of the tightening channel, then you’ll know how to enter and exit swing positions.

As you can see, there are many ways to play the market right now. It appears Fly is taking the medium term attack on the bears, which has a high probability here since I believe the Vix is heading for the mid 50s. But, if you’re into the volatility on the day-by-day scale, then you can get more complex and use the wedge pattern in the Vix. The other outcome may be that there is no wedge channel, and the Vix just takes the A-train straight to the mid-50s. If that is the case, then its back to the contrarian strategy by going against the trend when the Vix hits “extreme” levels.

Anyway, if you’ve noticed from the chart, I am expecting this rally to go a little higher as the Vix heads back to the mid-50s. But don’t think its an automatic trip there, but do trade accordingly.

Aloha to my new stocktwitteradical peers! Let’s see, who do we have? First and foremost, “Uncle” Howard, founder of StockTwits. I’m honored. Also check out SkyTrader and BlackDogTrader who were keeping it real intraday on twitter…

| CW_Nightman / C & W Nightman | ||

| evileggbeaterma

|

||

| jarsch501

|

||

| howardlindzon | ||

| JohnMilner / John Milner

|

||

| adamsussman

|

||

| optionmonster / Jon Najarian

|

||

| buster_french

|

||

| charlesamadeus / Charles Amadeus

|

||

| magikmsu

|

||

| danreich

|

||

| sparkycollier / Mark Collier

|

||

| SkyTrader

|

||

| thefoxmanjr

|

||

| daytrend / Vic Scherer

|

||

| BlackDogTrader / Chad Geauvreau

|

||

| whitestone

|

||

| forcevector

|

||

| jaycoje |

||

| akapaul

|

| HPHolidayCheer

|

||

| bhh_ibdindex

|

||

| mt_ppr |