Yours truly. 😉

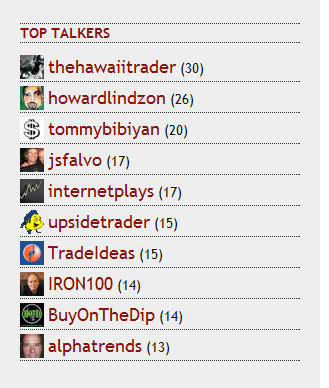

I used to hang out over at WallStreak, now I post my intraday moves on Twitter through StockTwits. Whenever I see a good setup for trading, I usually take the top spot on the “top talkers” list… I think out loud a lot! Hope yall caught some good shorts today! We started off shorting at the open, and never looked back. Top picks were to short $SPWRA and long $SKF. I really warned you about these Sisyphean Type rallies last week… they ALWAYS end in the boulder coming smashing down! And once again, I used the Vix to pinpoint an almost exact area for shorting aggressively…

“The Vix is near the mid-50s, which I targeted as a point to short the market as traders become blinded by complacency.” –http://ibankcoin.com/gioblog/?p=2397

Always pay attention to a rally if it is legit or not! Stocks moving up + Volume moving down + Vix moving down = horrible rally.

More importantly, it was critical that you cover as many short positions as you could into this sell-off. The Vix spiked an incredible 23% today, so do not overlook that. This is only the first “spike”, so you can take a chance, but when the market drops -670 points, please don’t be greedy, take a profit while you can, it is like once in every 20 years you get a day like this.

Today’s tape deserves this video again..

Check out the rest of iBankCoin’s posse over at StockTwits: