First, before I get explaining my unpopular sentiment on tomorrow’s tape, I just want to offer a few accolades to the iBC posse for reppin’ it over on Twitter/StockTwits. We practically had a full house on the market casino. On a -670 point day:

– Woodshedder’s Big Bamboo heavy short via the inverse ETFs

– Ragin’s 3x Inverse ETF for 3x the fun

– Danny’s easy money shorting the close

– Cha’ddict shorting the banks and financials

– And me, I stuck to fading the solars (been calling the reversals, up and down, in this sector with art)

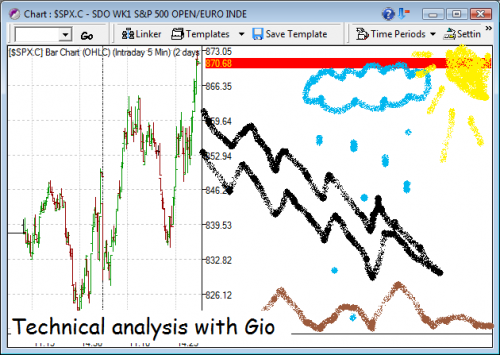

Okay, for Tuesday’s and Wednesday’s tape:

Yes I have gone mad, and once again am taking the harder road. But come on now…

Yesterday’s sell-off was a bunch of nonsense, especially that -200 drop at the close. Purely on news, on speeches, words, and thoughts of worst-case-scenarios. Whenever the Fed takes the mic, everyone decides to sell. Sure, I was expecting a -400 point day, but that close was a bit panicky.

Here’s some $Vix analysis for yah:

– studying this activity in the Vix in the past 2 weeks sheds light as to why I covered nearly all of my shorts into yesterday’s panic-attack.

– There was actually some bullish moves going on in the Vix. Notice the two wedge patterns that led to two spikes down? That’s actually medium term bullish, short term bearish (hence the “double spike” theory or the target at Vix 55 to start shorting aggressively on a healthy pullback). However, yesterday’s pullback started off with a much needed flush of about -400 points the entire day, until the Fed took the podium and it was all nonsensical. Without the Fed, the market probably would have gained back 100 points on the Dow.

– So anyway, that leads to my next theory that this Vix, whether it moves up or down tomorrow at the open, it should eventually fade back to < 64.50 — 63.00 which is a more proper reading than 68.50, which was so grossly engendered by a news item.

– Right now we have to be like Davinci when trading, using the Vix as our paintbrush. Any profits in shorts or longs should be taken immediately! The last thing you need is to get stuck in another boring Vix wedge. I say this because the Vix @ 80 is very tough to crack. If we do so, then that would be yet another new low.

– So far there is only one “Vix spike”, which is a total move of 25% from yesterday, if you count the outlier close. You can wait for a second Vix spike (try 15%-22%) to enter longs. In fact, its probably better to average in your longs by entering at this first Vix spike, and another add at the next one.

… so there you have it. I want to get long tomorrow!! Monday’s sell-off was “too easy.” I think we overshot that one, and therefore we have a good chance of gaining a lot back tomorrow or Wednesday. A great entry would be Vix > 70, and if we gap down tomorrow then that’s where I will start. As always, I am heading into tomorrow’s tape with the expectation that this setup will not show up. Therefore, there’s no need to chase anything not there. Got it?

Aloha to my new twitteracious new buddies. Let’s see who we got… Howzit UpsideTrader! If you don’t know, he’s a great contributor to stock blogging community. It seems like a lot of you twitter people here are new. I strongly suggest you get an avatar so you can build an identify. Then, when you’re done, annoy people with that avatar by tweeting your every move. Lol!

Comments »