I will short SRS hard. If it falls, I will short the shippers (DRYS, TBSI, GNK etc.).

My allergies are crazy. I think my whole insides came out of my nose.

Comments »I will short SRS hard. If it falls, I will short the shippers (DRYS, TBSI, GNK etc.).

My allergies are crazy. I think my whole insides came out of my nose.

Comments »

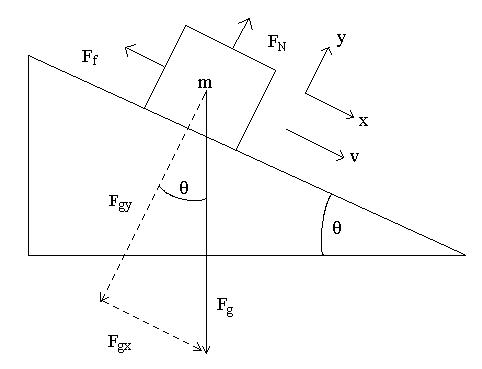

Which of Newton’s Laws does this demonstrate?

“There would be some bullish rallies in weird places.” …well, education is a spot.

Tonight I’ll be going over APOL’s numbers. If you don’t know who APOL is, you may recognize them as The University of Phoenix, you know, the one you always see advertised on TV. Funny thing, I was sitting in the doctor office today watching random stuff like Family Feud, and during the commercials, I would see a bunch of “go back to school” commercials. Have you noticed this too? They really are pressing it! Notice the air time they are picking to post these ads… during work hours. Obviously there’s an unemployed target market here.

Anyway, it was a topic that caught considerable interest in Twitter land, and in my comments section a few posts ago. And what we came up with makes sense… in a recession, people tend to change jobs and careers (thanks Dogwood), and in order to do so, you need education!

Another trend I brought out, was that there must be some kind of correlation between unemployment numbers going up with demand for education going up. And that makes sense too, because when you think about it, the higher the unemployment pool is, the more the pursuit of higher education to bolster one’s chances. Survival of the smartest. Enrollment grew 18.4% at APOL, and I would pay close attention to this type of data (source).

It will be interesting to see how the education stocks perform in the weeks to come. With APOL, a leader in the industry, beating the street I have to say that dips in the education stocks should be bought and likewise I will stop shorting them (congrats to A-Dawg btw for holding earnings).

Anyway, here’s a list of education stocks with PPT scores. I think if the hybrid scores continue to improve, you will see the IBD100 top 25 get a bunch of education stocks in there.

APEI (2.21) … I was short this stock.

APOL (4.16) …ranks #7 on The PPT Universe before earnings came out. Check out its PPT score!

Blackboard (BBBB) 1.6

Ceco (CECO) 3.4 Rated a Buy

DeVry Inc (DV) 3.24 Recently hit a buy-point range from pullback

Strayer Education (STRA) 2.95 The post-secondary education company. Nice pullback here. I sold this stock above $200.

Universal Technical Institute (UTI) 2.42 Company similar to APOL

Capella Education (CPLA) 2.8 An online secondary education company.

Grand Canyon Education (LOPE) … it’s not yet in The PPT database, but this is one recent IPO stock I want to get in.

I’ll be carefully watching The PPT scores for these education stocks. I think if more and more get above 3, then we know the technicals are improving. Let’s face it, we need education…

-gio-

Comments »

Economic news tomorrow means we could be in for some action into the final hour or so of trading in anticipation for it. The DJI is down about 100 points, and so I have exited most of my shorts because I’m concerned of a thunder pattern from the right (rally the close). Someone asked me about EDU, well, I covered a little more than half. Looking to re-enter these shorts in a few days.

It’s nice to see CSKI pullback here. So far, it’s down about -11%. Also, turns out I made a clean exit on EGO short yesterday when I got a cover signal. Today, EGO is up 8% while GG lags at 1%.

Comments »

Not much time to explain, but today (Thursday), I will be building a list of short position in health-care related stocks if AFAM cannot breakout above 50 soon. I am expecting a sector-wide correction, led down by AFAM and ISRG. We should get one checkpoint with ISRG down, but the key here is AFAM which coincidently did good on Wednesday.

I am still longterm bullish on CSKI, but will wait for a high volume selloff to enter. So this is my one spot for a hedge.

This is really tough for me to do since I’m a AFAM fan, but if we don’t get follow-through soon I can see this heading back to the 30s. Yikes!

I would be cautious shorting education stocks here, especially if STRA can hold the 189 area. There’s actually one education stock I want to get long, ***E. It’s too early to call a top in APOL, so until you see STRA and APOL both reversing, then the dips must be bought in this sector.

… I’m trying to figure out why education stocks are in their own bullish cycle? My guess is that there must be some kind of correlation between our rising unemployment with the demand for higher education. Which makes sense a little… people generally feel that if they have extra education, then their chances of getting a job will be better. I could be on to something.

-gio-

Comments »Even though only two of my shorts received cover signals with the NDX down -3%, I was able to find about 5 more great short setups. The two shorts I covered today were APEI, an education stock, and EGO, a gold stock. Actually, upon further review, EGO still looks like a good short.

Yesterday I got stopped out of my DRYS shorts, what a lame move! That’s why I usually don’t keep stop losses in low volume markets. Yeah, that was a mistake, but I did manage to add to Chinese shorts which was a great move.

Let’s do this lighting round style…

So, EEV +11% looks good for another buy with the Vix above 44. FXP +15%.

For you SRS people, it underperformed today! Yep, go for FXP or EEV and short foreign markets instead. There’s too much U.S. policy to ruin the SRS party.

EGO, should have held a little more, but don’t want to bet against gold just yet.

Ags did well today, thanks to MON’s outlook, shooting the stock up 17%.

Oil… been getting questions on oil. I’m currently short oil, but I think this dip should be bought soon. Maybe in a few weeks.

CSKI and CWT showed strength today.

AFAM up 3% on a day like this. This one is powerful.

AIPC down -13% after touching 52-high. Will buy this dip soon.

Comments »

Yesterday was an awesome day to enter shorts! Did you pay attention to the market, or were you a “paper chaser”?

1) Vix between 35-40 = start looking for shorts. (See 1/2/09 “Careful with this week’s tape” and 1/6/09 “Looking to buy EEV down here” to see how complacency in a bear market is not good)

2) Laggards leading market, leaders taking a break – this is what I call “Paper chasing”, and it increases the probability for better short entry point. (See post 1/6/09 post “Leaders pulling back, time to attack” to see how to use leadership as a gauge for the market)

How effective have these 2 flags been!

Yesterday I flipped my positions and went 100% short when the market was up +140. I even tweeted to the bears to just hang in there. 3 of my shorts from yesterday are down over 8% today. Not bad, eh? It would have been 4 stocks if I didn’t get stopped out of DRYS yesterday near the close (stop was set to 15.15. Idiot.)

HOWEVER, look at the leaders today, they haven’t really continued selling off. If they were, I would add to these shorts. And volume was actually better yesterday on the Nasdaq’s rally. So, respecting that action I will cover at least two of my shorts, APEI because STRA is green today, and EGO because it’s near my buy point (under 7). I will also cover EDU which looks a little panicky.

Laters players!

-gio

Comments »