![[sisyphus025-cr.jpg]](http://ibankcoin.com/gioblog/files/7feb3902b392f9e1a03c65902b5a69ff.jpg)

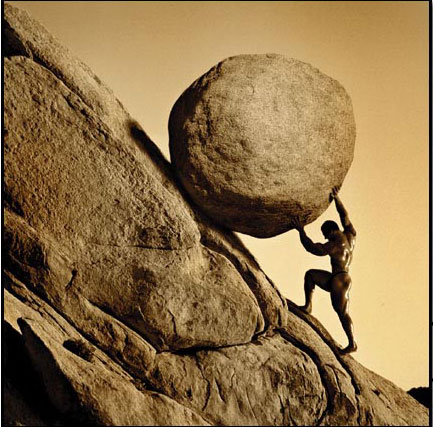

Yesterday I made a post talking about how dangerous these past couple of rallies have been. I decided to do a little more analysis of all the major rallies that occurred in 2008 so far. Anyway, many of these rallies have been “Sisyphus rallies” (hat tip to one of my readers that pointed this out). If you don’t know who Sisyphus is, then read about this mythology character here at Wikipedia (you must read about him before you understand this post). All you need to know about this mortal character is that Sisyphus overstepped his bounds by considering himself a peer of the gods who could rightfully report their indiscretions (sounds a lot like our modern fund managers). He seduced his niece, took his brother’s throne and betrayed Zeus‘s secrets. That pissed Zeus of course. As a punishment from the gods for his trickery, Sisyphus was compelled to roll a huge rock up a steep hill, but before he could reach the top of the hill, the rock would always roll back down again, forcing him to begin again. This is much like our stock market today (There is only one rally that does not fit the Sisyphus Rally component, and that happened from March to May… let’s call that the Queer Rally) . So with that in mind, you should understand what a Sisyphus Rally is…

Basically these fallacious rallies have these components:

1) “market going to hell”… in other words, first the overall market is in a severe bear market.

2) The rally comes very sudden and sharp, stabbing as many unexpecting bears in the back. As a result, we have “panic-buying” which we all know as a short-squeeze. Therefore, it’s only natural that we would be in an extreme oversold situation when the rally ignites.

3) Enter the Sisyphus Bulls (you don’t want to be one of them). Basically, these are the ones that jump in on the bear market rally, convincing themselves that the trend has turned, basing their opinions on news events, promises, and hope, when really there has been nothing fundamentally changed for the long term good.

4) These Sisyphus rallies have a very high volume day, and like Sisyphus, they push the “boulder”/”stock prices” higher and higher. But understand, that one day with high volume action does not signal a major reversal. There must be follow-through days (FTDs… see IBD), which means higher volume, which means more than the hopeful traders are participating in the rally. However, in a Sisyphus rally, the main players in the stock market remain on the side, adding no strength to the rally, and henceforth, by the next key resistance level or news item, the boulder comes rolling back down.

As you can see, the analogy is quite fitting for the sins we’ve committed… greed, deceit, presumptuousness…

The higher the Sisyphus rally pushes the “boulder”, the stronger the velocity the boulder/market comes crashing down. Just as in the myth of Sisyphus goes as his punishment from the gods for his trickery, Sisyphus was compelled to roll a huge rock up a steep hill, but before he could reach the top of the hill, the rock would always roll back down again, forcing him to begin again; such a story is quite fitting for the many players in the stock market with their incessant trickery- banks with their toxic assets, over supply in homes, credit manipulation, commodity manipulation, Government intervention… whatever trickery that has been done to prop our market up, has been revealed, and the market has punished us all for participating in this chicanery.

The trend is down until proven otherwise, and we will continue to get these Sisyphus Rallies. The question is, are you behind the boulder?

Here are this year’s Sisyphus Rallies. Study them real good, and make sure you don’t get smashed by these false rallies. Can you see why and how the bulls got tricked? Can you see the “boulder” moving from rally to rally?…

Sisyphus Rally #1: The Fly declares 2008 dead (January 2008)

The market starts the year off with heavy selling after reaching a top in November of 2007. The end of the month the bears start covering though, as bulls refuse to believe the great market rally from 2003 is not yet over. 15,000 here we come! Push… push… push!!!

Sisyphus Rally #2: The Pre Summer Meltdown

From March through July, Bear Stearns collapse begins to be felt throughout the market sending the Dow below 12k psychological level, but right when summer comes, commodities are lit on fire. This is largely in part to the Beijing Olympics hype, that maybe China’s productivity is good for the world. But is higher oil good for the market or bad for the market? We can’t figure it out, so the Sisyphus rally ends into a tug-of-war of volatility throughout August. Then in September, the commodity markets pop, completely collapse, sending the boulder right back down…

Sisyphus Rally #3: The “Epic Bounce” (after October’s historic meltdown from the bailout bill)

The major sell off in gold, oil, agriculture and other commodities was only part of the problem. The market selloff accelerated as the credit crisis starts flexing its muscles (even though we ignored the signs from Bear Stearns) as large companies like AIG, JP Morgan, and other keystone American companies fall apart. Then the rest of the world gets a rude awakening as the U.S. Government proposes a “bailout package”, that only verifies that the problem is bigger than we can handle. The market sells off hard as we get under 10,000 on the Dow, and until the Vix more then doubles. Soon enough, the Sisyphus Bulls enter and ignites the “epic rally,” sending the Dow up over 10% in one day as bears run for cover! Push that boulder! Push push push!!

Sisyphus Rally #4: The Vix @ 80 Rally

… but no, we are still going down. The boulder gets too heavy and hedge funds take advantage of the squeeze to unload. Trillions of dollars are lost. And global markets start rolling over too. But then in late October the Vix gets very high, in the 80s! With the feeling of “change” coming with the elections coming up in a few weeks, another massive 1,500+ Sisyphus rally rolls forth in a few days…

Sisyphus Rally #5??: The “One Day Miracle Rally”

… but here comes November. The elections are over, and talks are just talks. The boulder rolls over all the hopeful Sisyphus bulls until we get under 8,000 for the first time in a looooong time. Then volume gets very light in the past two weeks, leading to all kinds of mysterious actions on the tape. One being a “miracle” rally that sent the Dow from -300 to +500 in a few hours on impressive volume, perhaps on seasonality hopes. But in the past two days, that +500 has turned into -500 and the news headlines are searching for ways to explain it….

… right now we are in the middle of what could be a Sisyphus Rally. I would call it a Sisyphus Rally if we get back under 8,000 which would send the boulder right back down over the bulls that bought up Miracle Thursday. I personally would NOT want to see another Sisyphus Rally that leads to the boulder rolling right back down again. So at least I can say that we are at a very critical point, perhaps one of the most important points all year for the bulls to do something. Its tough though, because once again, nothing has changed for the good fundamentally. Even if we rally here for a few days, if we don’t get follow throughs on follow throughs, then Sisyphus will grow weak, and the boulder will come back down.

Aloha to my awesome and new twitter buddies! …

Comments »

![[sisyphus025-cr.jpg]](http://ibankcoin.com/gioblog/files/7feb3902b392f9e1a03c65902b5a69ff.jpg)