Too many good trades to mention!

Instead of going fishing at the beach, I went fishing into The PPT‘s notes page (picture above. click to preview) and found some great calls by The PPT Community. I’ve been a part of many trader-communities, and I can honestly say The PPT group has a very high trader IQ. Motley Fool CAPS forums is fool of fools, I mean new traders. Yahoo Message Board… well, you know how toxic and immature that place is. Scottrade Community has too many panties, or traders stuck in the year 2007 stocks. StockTwits is great for day-traders, but you can get lost in swing calls.

Here is a sample of some top calls from The PPT Community in the past few weeks. I’ll be keeping an eye out for more picks this week 😉

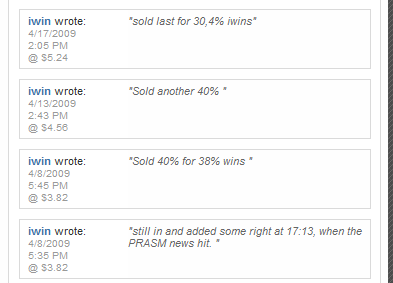

Long HA – iWin. 3/10, out 4/17

This stock was surely a winner as airline stocks took flight for an insane squeeze. Awesome play iWin.

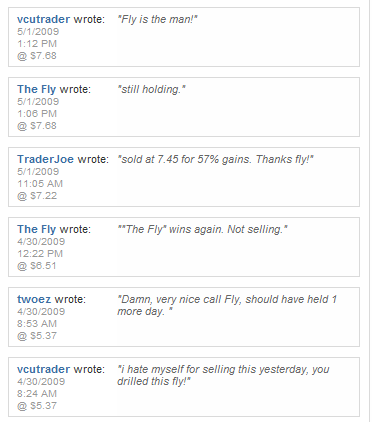

Long PCX – TheFly

What made this trade great was Fly’s sector wide call on commodities, in particular energy. I was leaning bearish on energy, but man did that squeeze prove me wrong! I know Fly’s trade on this was “market timing”, but look at the “charting” and classic technical squeezes on PCX…

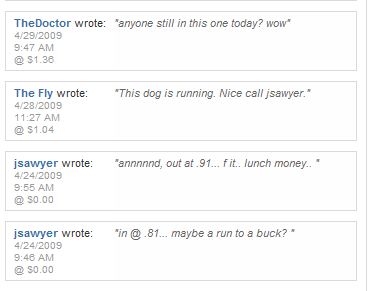

“Long COIN” – jsawyer 4/24

jsawyer made a nice call on COIN which was consolidating for an extended time under a buck. What impresses me most about this trade was his entry just before it exploded. Those lotto tickets cost him .88 cents.

Long CLF – Fly, RedFrog, Nation81, VCUTrader

Sorry no chart. But congrats to these guys for playing this commodity stock, CLF, on rising volume. Great swing play.

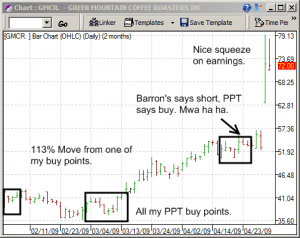

Long GMCR – Gio, jnuts

One of my most watched stock, and best trades so far this year. What I liked about the GMCR trade was that I predicted it would hit the IBD100 and it did get way up there, and I also used The PPT fundamental scores to bet againstBarrons who were very bearish heading into earnings… oops for Barrons.

Long CDNS – Fly in 4/22 @ 4.85, partial out at 5.46 5/1

What I like about Fly’s calls is that he uses fundamentals. In picking CDNS as a long, he used correlation fundamentals, observing that CDNS relationship with TSM would help them greatly.

Long RUTH – Ragin 4/23

Ragin gets the “pick of the month” award for April on his RUTH pick. Talk about a wonderful squeeze. Nothing but green bars and BOP and massive volume.

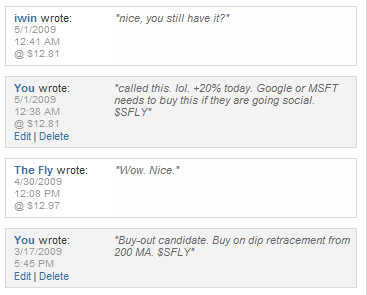

Long SFLY – 3/17

I used fundamentals to make this call. SFLY hit my radar a few years ago, so I’ve been watching its book value to determine when it would be cheap. In The PPT I mentioned it to be a buy-out candidate once the big companies start using cash.

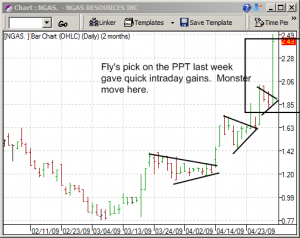

Long NGAS- TheFly

Broker A’s current pick is this fast moving energy stock. Again, although he’s not much of a chartist, look at all those bullish flag breakouts.

Most of these picks were from last week! I think having a community of real traders can really upgrade your trading performance. Even if you didn’t follow anyone into these trades, it’s nice to ask other traders what they think and to offer a stock tip yourself.

If you like StockTwits, following people’s trades, or “thinking out-loud” your trades, then The PPT‘s “Wall” is probably something you will find very useful. For those of you subscribing to The PPT, I strongly suggest you participate in this feature. You wil definitely make your money back and much more.

Basically, the Wall is the PTT’s composite brain power of all the members in The PPT. I like to think of it as the central nervous system connected to “the brain”. Those who use StockTwits will especially find using the Wall (community notes) easy to use. You simply enter a ticker, then add a note. The wall will then update notes chronologically to a public notes place and to your own notes page. So, a few days later you can check up on your call and see if you were wrong or right… kind of like StockTwits. Think of The PPT‘s Wall/Community Notes as a swing trader’s version of StockTwits (which is predominantly day trading notes).

Anyway, keep up the good work guys and girls! Now go make some money.

-gio-

If you enjoy the content at iBankCoin, please follow us on Twitter

Watching VIX 34.50. Wouldn’t mind shorting market under that.

Here, here. This is where I hang out when I’m not off helping someone with their real estate deals. CROX and DRYS picked up last week from here. Happy today. I can honestly say I haven’t lost big once when I play here. But when I stray, I have to come back to recover my losses. lol. (only once)

What do you think of the VIX today ? Mkt up 175 pts and the VIX is down .14 cents….is it broken ?

Hi GW… no it’s not broken. When the VIX is flat on a market up day (usually when market already in an uptrend) then check the volume. Right now volume is light, so to me this formula reads:

Vix(small move) + Market (big move price) + Market (low volume) = WEAK shorts cover. Too many weak bears shorting along the uptrend and covering too quick causes this pattern.

This tends to happen before big corrections, so if you’re long then you should begin selling into the rally. If you are sidelined, then do not enter longs here at full position and if you want to short, wait for a proper move: Market up + VIX down big. Doing so will improve your entry point to short.

Thanx Bro….you confirmed my inner voice….GLT