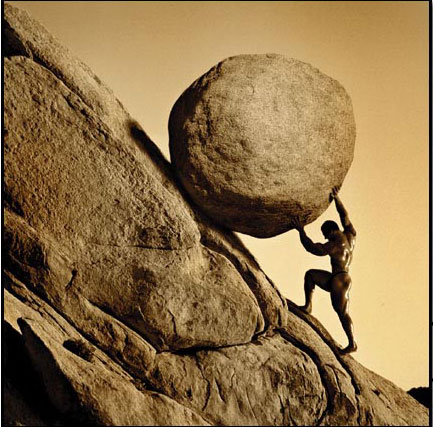

Imagine a bunch of guys rolling up a huge 20 foot tall and 1-ton metal ball up a hill (stay with me here.)… the higher and higher they get, the harder it is for them to roll the ball up. What they need is more people to jump in and push that ball up. So they scream for help. However, everyone decides to watch from the side instead. The guys pushing the ball up eventually get tired… the ball slowly rolls back down as its force is greater than the men. Finally, the men notice the ball has reached back at the point of the hill that they started pushing it. Psychological they feel they have lost. And suddenly, majority of the men let go of the ball… now the ball is too heavy for whatever men remain left there to hold it up, and everyone pushing that ball gets runned over. Flattened. Squashed.

… that my fellow traders, is what is happening in the past 3 days in the market. We haven’t quite got to the “runned over” point, but I highlighted two points on this chart that shows where the ball will effectively roll over all the men. In my not so eloquent story, I was trying to illustrate that in order to get a real rally, we need some volume. Sure, Thursday had a lot of “men” pushing the ball up, but they’re calling for help folks. They’re calling for more men who have been watching from the sidelines to jump in and help push this ball (“volume”), but so far, they’re just watching. Again, this illustrates another important fact… major rallies are not engendered from one big up day. Thursday’s “miracle rally” was only the first attempt at a strong rally. It was a great day for the bulls, but they need at least 2 more follow throughs BEFORE getting back under Thursday’s lows.

You bulls that bid everything up during Thursday’s “Miracle Rally” better do something quick and bring this market back up. Last Thursday was only day 1 of a rally attempt (the best one all year)… but the Dow, at one point was down -200 points, which would effectively puts the Dow back in the red on Thursday’s numbers.

The bull trap will be in effect if the Dow falls -300 points… which would effectively wipe out all of Thursday’s upside from the bottom.

If you are short, I strongly suggest you short FXP as a day trade hedge if the Dow gains back 8400. It is the worst performing inverse ETF right now. For example, it is red when the Dow was down -170 this morning… nonsense. One thing that tells me… the bears are a little scared here. Odd no? They have a good chance to damage the tape. But, that just shows the bears still own this tape, and we probably will see another selloff later today, so it would not be a good idea to enter new longs here.

Two stocks that look nice right now are Almost Family, Inc. [[AFAM]] and Fuel Systems Solutions, Inc. [[fsys]] . But I won’t even buy those today.

Oh yeah, I haven’t mentioned the Vix in a while… that too does not look good as it looks like we could breakout of 70.

Aloha to my new twitter friends!…

| vishal7

|

||

| fufufnik | ||

| talcumboy | ||

| gensu85 / Scott K | ||

| bennettcheung | ||

| superjones | ||

| pbsurf | ||

| yamnuska |

||

| hammerx | ||

| WeeklyTA | ||

| agmao | ||

| tradermike_1999 |

“One must imagine Sisyphus happy” -Albert Camus

Rally attempt #2… looks great so far.

Dow gained back +300

I’ll just watch for the rest of the day. Shorting FXP for a hedge would have been a great trade as the Dow moved 300 points from the bottom. end of the day should be random and interesting.

The short term pattern I am watching is indeterminate, but today’s upswing looks corrective. I can see it going higher after a little dip, but I think we see new lows soon. I am looking to add to my short positions, but as always I will let the situation dictate. If we break this morning’s lows then I am all aboard the express elevator to hell.

I’m not a big fan of the DJI in the first place.

Why not look at the $SPX or the $RUT? Or barring that, the Cubes?

___________

Going long more OXY here, and looking at DEO at a break of $56.40.

________

The ball is rolled on the bulls intraday again.

Sisyphus pushing the boulder in hell for screwing Zeus’s wife or daughter. How fitting.

A tinfoil ball? I like tin.

k Jake, i’ll use more of the SPX and NDX…. NDX is quite oversold though. SPX is close to Dow, except Dow allows for a closer snapshot, no? Dow has more psychological effect too (matches Vix very well).

Nice catch DownTick. I only understood your post once Rag commented on it. anyway, i added a picture of Sisyphus and its my post for tonight.

GIO — just not sure the Dow is reflective enough of the true market, y’know?

SPX is Dow plus the other 470 biggest stocks, soooo….

More reflective, no?

_____

yea, i know what u mean. but more from a ticker point of view was what i’m trying to say. watching the Dow intraday works better for me because it is a larger number, and therefore moves over more increments versus the SPX. Therefore I can get real critical on my points… ie, today I used 8,393 as a short-sell point.

I guess I could extrapolate the SPX to get a number easier to trace. but, Dow and SPX correlate well enough to just skip that step.

But yeah, hands down, the SPX right now is a better barometer on the long term charts… but I read somewhere in Investors Business Daily that even the SPX is becoming a bad index. Or was it WSJ? shoot, i forget.

I say we induct “Sisyphus rally” into iBC’s dictionary.