Big Mac putting a dent in your wallet? Hmmmm.

There’s a nice triangle wedge forming in the Gold ETF, [[gld]] , signalling an explosive move in the future (months out), either up or down. I know many gold traders are frustrated with the price action of gold right now, because in their minds they are thinking that printing money out of thin air would make the price of gold rise… they’re right! It should work that way. In other words, from an economic perspective: more dollars chasing a finite number of gold, means gold should go up.

But recently, many gold-related stocks have been battered and are trading near their 52-lows:

Goldcorp Inc. (USA) [[gg]]

Eldorado Gold Corporation (USA) [[ego]]

Yamana Gold Inc. (USA) [[auy]]

Silver Wheaton Corp. (USA) [[slw]]

[[gdx]]

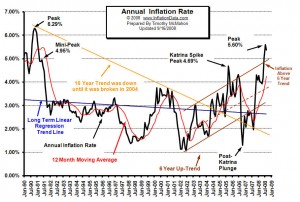

If we are living in epic times, and I know a lot of you agree we are, then it wouldn’t surprise me to see another “epic” move in the commodities market, in particular gold. Take a look at this U.S. historical inflation chart until 2007…

… perhaps the best way to play this “breakout” on inflation numbers is to average in gold. I think we were fortunate enough to have the recent financial hurricane blow the door off of gold stocks, because now I think we can afford to sneak in a steal a few blocks.

As with any stock, commodity or sector, wait for a reversal before you start averaging in. I’m not sure how much lower gold can go, but I’ll be happy waiting on the sides for it to get lower before buying. Right now, I think buying gold is a good hedge against our current market and the Government’s plan to inject money into the market… I have come to terms that we are entering into uncertain territory, so its good to hedge. If you’re skeptical about the gold trade, then I would at least recommend you look into playing a “timed-biased-call-strangle” on Gold ETFs like [[gld]] or [[gdx]] . For example, I would buy the Jan 10 GDX calls @ 60 at 80% position right now, then pair it by buying the Jan 10 GDX puts @ 20 at 20% when gold moves higher. Come back in a year, and you’ll be up 300% on your trade without logging in and out your account every day. Lately I’ve been re-visiting Murphy’s theories (from GATA) on the Fed manipulating the gold and silver market… and looking back at it now, it certainly seems that way. I mean, originally I thought he was an idiot, but now I think he’s a smart idiot.

Anyway, it’s is just something to consider. Murphy claims that “the U.S. enters world markets without public disclosure to prop up the dollar and depress the price of gold.” He thinks gold could get to $5,000 / ounce. Wait up, $5k?… he’s still an idiot.

Man, what a ridiculous target. Still, he’s got the right direction. From what I’ve seen and what has happened in the past two months, and what will happen in the coming ones, I will be one who rushes for gold. Maybe GLD will finally break the $100 spot, then I’ll be fully invested.

In the meantime, I still can’t recommend any longs to invest in equities because I still haven’t seen any new leaders emerge from our recent aftermath.

How’d you like to be a quintillionaire? Inflation can help!

Golden Aloha!

-gio-

I’ve been saying for weeks now that the only two things that make sense to me are shiny metals and the Japanese yen.

Yesterday’s market hallucination doesn’t change my stance one iota.

that’s __long-term__ interesting that ___.longffteerm___ of gold.

aapl can’t figure this site out

safari _long term_ ass.

if they bring in the amero gold will be worth 5k

easily.

unfortunately 5k will barely be enough to buy a happy meal

Yeah, the Treasury throwing a bunch of funny money at our money center banks (from which to continue their fractional lending) can’t be a good sign for the already fatigued money supply.

Click on my name for further reading….

_____

Time to get in SIL?

SLW, better management wise, imo.

__________

GLD up!

GG up!

RGLD up!

__

so, you didnt buy that TL from my co-worker huh? She said that you said, “I didnt think girls drive this kind of a car…”

i have kept my AUY for the very reason you mentioned here. unfortunately, it got whacked from my buy point of $10 and change. but i have no doubt this has to go up.

my puts remain in place… it took the economy this long to get everything out in the open… there are no quick fixes here.

and man are those canadian energy trusts cheap… nice dividends on cheap stocks.

everythings destined to go down again come earnings..

Geo,North Shore is going off.Looks like winter is here.

How will gold trading behave in a deflationary environment where all asset classes are selling, particularly commodities?

in a deflationary environment, gold should go down. is that your stand on the dollar? gold has been trading very suspiciously, which I can only attribute to it as telling us that a huge story is unfolding.

my concern is, we have a lot of paper money, but we also have a lot of “electronic money,” which probably adds complexity to the inflation issue.

Tim Morge used to be the world’s largest gold trader. He’s been adamant that China will buy a large supply of gold and push the price to $2,500 instantly. It’s possible this could happen when the Yuan is floated.

My hunch is we stay in a deflationary environment which will repress the price of gold. When liquidity is washed out of the system I imagine hyperinflation will ensue. That might also push gold above $2k.

That being said, I do not understand gold. There was a large supply from the Comex vaults that disappeared on 9/11. I’m sure that is part of the puzzle.