Blue asks: Gio, can you explain the no long with Vix under 30 thesis a little more for us please?

Hi Blue,

Thanks for your interest in the Vix Theory. There is a lot of uncertainty out there which means the Vix will work very well. Remember, the Vix measures market volatility, and volatility is often a product of uncertainty. Here we go!…

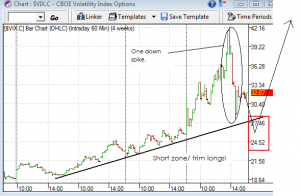

Jot down in your notes that Vix 40 was an extreme point for panic, as it was the Second-Spike in the Vix pattern that signalled a huge opportunity to get long. Inversely, I think if you get two Vix spikes down, then that presents a good opportunity to get short. So far, the Vix prints 32, which is about a 32% drop! That’s huge, and I can tell you without looking at any other indicator that we are short-term overbought. Anyway, that doesn’t matter. Just because you are overbought, doesn’t mean the buying will stop. You think that way, then you run the risk of becoming a perma-bear.

What you really should be doing is try to translatewhat the Vix numbers are saying about how people (the herd) are thinking. Let’s take a look at the 4-week Vix chart to paint us a market sentiment picture.

- The VIx above 40 signaled panic

- The Vix dropping 30% from 42 to 32 signaled huge relief. You could easily ignore the news and come up with that conclusion. Reading the news, we now see that relief came in the form of huge government intervention.

- Now two things can happen here: 1) the Vix can trickle down below 32, which signals the market (herd) is accepting the government’s proposal in the short term and viewing it a good idea. This will cause more hesitant buyers to feel more comfortable. Therefore, the Vix trickles down. 2) the Vix will melt-up/trickle up, which means there is still fear. This phenomenon is called “climbing the wall of worry.” Right now, this is a a dangerous place for bears, since a lot of perma-bears will fight the tape, wondering why stocks are moving up on low volume. They’ll keep shorting, the covering since the tape will be too boring. Again, “never short a boring market.” Meanwhile, the bulls will keep adding in increments, a little more and more, like dipping their toes in the water.

From a contrarian trader’s point of view, you do not want to get heavily long when the Vix is trickling down right now. There’s too much “dumb money” bringing stocks up, too much satisfaction and content in the government’s quick fixto the market. One blow up here, lets say Washington Mutual, Inc. [[wm]] goes under, or any slight sign that the government’s RTC plan will not work, or inflation rises to new highs, …then BOOM!!! Look out below. The Vix under 30 would be a prime spot for the market to crash. I know a lot of people start preaching crash when the Dow is printing -400 on the day, but in reality, market crashes occur when it is not expected. So, like I said before, there is a more likelihood of a crash when the Dow was up +700 in the past two days, then when the market was down -500. PLEASE PLEASE PLEASE study what happened to the Nasdaq .com bubble in 2000. You will notice the market did not tank when the Vix was at its peak. Rather, it occurred when the media was trying to tell everyone everything was okay, after an earlier panic. It was like, “bam!” ….. “bam!!” …. “yay, we’re okay!” “…… kaBoooooooM!! You’re dead.” I hate to say this, but so far, history is repeating itself. I mean, look at Cramer. Didn’t that guy lose a lot in the .com bust? Man. Cramer used to be a good trader, but now he’s trading on emotion too much.

So how will I play the Vix from here? I think the market will sort of melt-up a little from here whether the Vix moves up or down very slowly. Pay attention to which direction the Vix moves to get an idea of why stocks are moving up. I like to look at the Vix in ranges, that way I can average in and out within a range. Its better than guessing, since the Vix is just another tool to measure a possible outcome. Therefore, I am looking to re-shorting or selling longs if stocks move up as the Vix gets to that 24-28.50 range. To me that level says “the easy money on the long side is done.” Given our current economic state, I strongly suggest at least cutting all positions in half in that 24-28.50 range, or getting a strong hedge. For example, if I am holding a lot of longs during that period, and I don’t want to sell, then I will begin to buy puts when the Vix gets to that area. The best possible sign for me to short would to get a trickle down below 30, then a nice spike down to the 25-26 level… that will signal to me that there is too much euphoria in the market and its time to start shorting. WARNING: If the Vix does get back to 40 level then go to 100% cash. There’s no telling how high the Vix can spike if it breaks that high of 42, as the market can continue to fall to new lows. I would suggest going to cash above 42, then rebuying at the next double spike up.

Finally, remember that all my Vix ranges and numbers are relative and very dynamic, therefore they change a lot!

Anyway, hope this all helps with your entry and exit strategies.

Aloha!

-gio-

Gio,

I get the 30 number on the upper end. Why only 24-28.50 on the lower end? I put my lower end down around 20. Why would you say that’s too low? I trying to understand where you are coming from to incorporate into my other tools. Thanks.

Akebono

Good stuff, thanks

I noticed you bought CNQR last week. what stops you have ?

Thanks GIO. I really appreciate your new “Questions from Readers” segments. You’re the man!

Hi toronto… I have a mental stop loss to sell half around 41.50 – 42.50. Depends on volume.

thanks heckler.

I noticed the Vix is flat today. It should be moving UP when the Dow is down -200 points. Now, let me ask you… without reading the news, but using only actions in stocks/commodities/futures AND Vix… what is on the minds of the investors? in other words, translate what the Vix is saying about “the herd.”

The herd is wrong and they’re trying to figure out what it means when Oil spikes up $25 on the day. The market has to play catch up this week, because the financial trades are done. No more shorting, dead sector. Sector rotation time..

Thanks for the explanation Gio. Very much appreciated!

Oil is up because the dollar has been diluted by 700 Billion new printed bills.

I ask If you were a hot shot banker who buys/sells oil contracts OTC and open market, when would be a perfect time to ensure false signals into the market? When you least expect them, and when the oil contracts are due in the open market seem to be best. Today’s spike in oil was fundamentally real (due to lower USD), however, you must look at the Oct/Nov contracts and realize it was a normal movement.

In conclusion, if anything, consider today’s activity in oil contracts noise. Even the contracts traded above 115 were light in volume.

http://charts.barchart.com/chart.asp?sym=CLV8&data=Z30&jav=adv&vol=Y&divd=Y&evnt=adv&grid=Y&late=y%1Cy&code=BSTK&org=stk&fix=

-Overall don’t loose sight of the real market mover: paulson/congress agreement? If so details please.

Alternative energy stocks were down quite hard today. I think we have a good buying opportunity in them.

Lower $ means buy gold. Oil is rebounding because its been oversold.

More on today’s oil blast.

__